Buy to Let Mortgage Broker Bradford

Ready to launch your property investment journey in Bradford on the right note? You’re in the right place! Our buy-to-let mortgage broker is ready to assist you in discovering the best rates, potentially saving you thousands in the long term.

All it takes is a mere 3 minutes to complete the straightforward form below, and presto! You’ll gain access to a selection of customised buy-to-let mortgage options tailored specifically for your property.

It’s a hassle-free process and it’s completely cost-free. Moreover, you’ll have the opportunity to access some of the most competitive rates in the market.

Is a BTL Mortgage Broker Worth It In Bradford?

Opting for a buy-to-let mortgage broker in Bradford is a savvy decision! With expert assistance by your side, you’ll discover the ideal mortgage to align with your needs and strategy while keeping costs in check.

Our brokerage service offers a distinct advantage by granting you access to a broader array of products than what you’d typically encounter at high-street banks or through online comparison platforms. These options often feature more enticing rates and terms. The icing on the cake? Our partner broker provides this comprehensive suite of services at absolutely no cost!

Why a BTL Mortgage Broker is Essential

1) Extensive Lender Network: Our broker links you with 45 lenders, presenting a diverse range of specialised mortgage products.

2) Competitive Rates: Harness the unique market position of our broker to secure rates and terms that outshine the competition.

3) Streamlined Efficiency: Say goodbye to the hassle of paperwork. In just 3 minutes, you can breeze through our simple questionnaire and receive personalised mortgage recommendations tailored precisely to your requirements.

Why Get a Buy-to-Let Mortgage in Bradford?

Growth Past 5 Years

+45.91%

Rental Yield

4.89%

Popular areas for investment

Manningham, Frizinghall & Heaton

Average Price

£224,205

Bradford’s economy is on a growth trajectory, driven by sectors like manufacturing, digital technology, and retail, which support a stable property market. The city’s property prices are notably affordable, offering attractive investment opportunities compared to other UK cities.

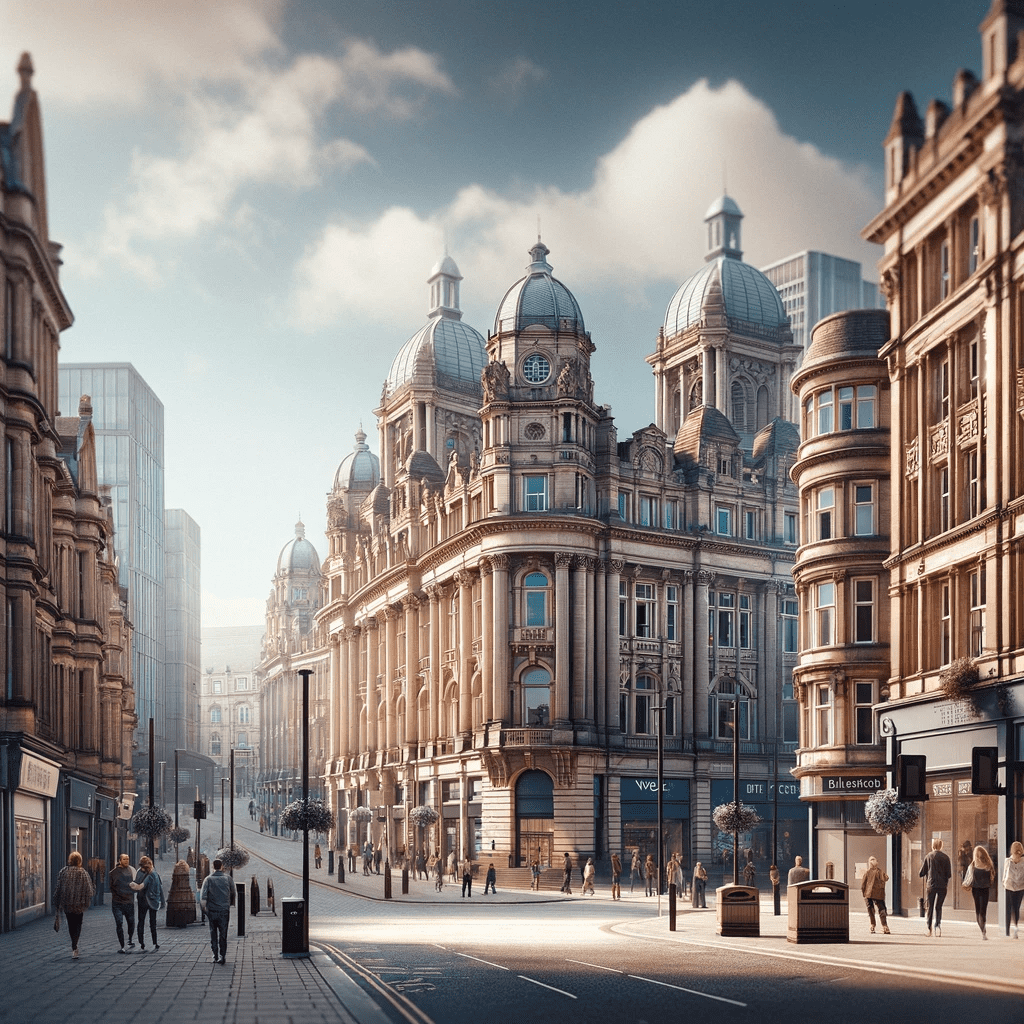

The city is known for its rich cultural scene, including attractions like the National Science and Media Museum and the Alhambra Theatre, adding to its appeal. Areas such as Little Germany and Shipley are increasingly popular, and known for their historic architecture and modern amenities.

Bradford’s location in the heart of West Yorkshire, with good transport links, including Bradford Interchange station, makes it accessible and appealing to a wide range of tenants. With ongoing urban development projects aimed at revitalising the city centre and surrounding neighbourhoods,

Bradford is poised for future growth, making it a compelling location for both rental income and capital appreciation in the property market.

Finding the Best Buy to Let Mortgages in Bradford

Here’s how our brokerage service streamlines the process, step by step:

1) Starting with the Basics: Your journey begins with the simple questionnaire form above. We’ll ask a few questions about your funding requirements, your personal information, and details about the property.

2) Tailoring to Your Needs: Once you’ve completed the questionnaire, our advanced system springs into action. It meticulously analyses your responses to match you with mortgage products perfectly suited to your unique investment situation.

3) Compare and Choose: Now comes the exciting part – comparing mortgage options. Consider factors like interest rates, loan terms, and repayment structures. This step is crucial as it helps you identify the mortgage that not only meets your immediate needs but also aligns with your long-term investment strategy.

4) Effortless Preliminary Application: Once you’ve pinpointed the mortgage that aligns with your goals, it’s time to take action. Submit your ‘soft application.’ Rest assured, this won’t impact your credit score.

5) The Final Touch: After you’ve submitted your application, the lender takes the reins. They’ll reach out to you directly to delve into the finer details of your application, ensuring everything is in order.