Buy to let mortgage broker in Cambridge

Are you looking for a reliable buy-to-let mortgage broker in Cambridge? Our brokerage service offers a seamless and efficient solution for your property investment needs.

With a simple and fast process, taking just 3 minutes to complete our questionnaire form, you can unlock personalised buy-to-let mortgage products tailored to your investment goals.

Whether you’re a first-time investor or a seasoned property mogul, our brokerage tool is designed to streamline your mortgage journey.

Why Use a Buy-to-Let Mortgage Broker?

When it comes to finding the best buy-to-let mortgages, our partner stands out for a range of compelling reasons:

1. Extensive Network of Lenders – With connections to 45 lenders, Lendlord has the reach to match you with the best mortgage options available on the market for your property.

2. Competitive Rates – Investment success hinges on favourable financial terms. Our broker’s ability to secure competitive interest rates and favourable mortgage terms can significantly enhance the profitability of your buy-to-let property.

3. Customised Approach – They take a personalised approach, providing mortgages that align with your unique needs and circumstances.

4. Super Fast Application – Gone are the days of drowning in paperwork. Lendlord offers a super-fast application process that revolutionises the way you secure a buy-to-let mortgage. Fill in an application, answer a short questionnaire, and receive a list of personalised recommendations.

5. Hassle-Free Process –This buy-to-let mortgage brokerage offers a streamlined application process that minimises administrative complexities, allowing you to dedicate more time to the bigger picture.

Why Get a Buy-to-Let Mortgage in Cambridge?

Growth Past 5 Years

3.2%

Rental Yield

3.6%

Popular areas for investment

Chesterton, Trumpington, and Central Cambridge

Average Price

£504,213

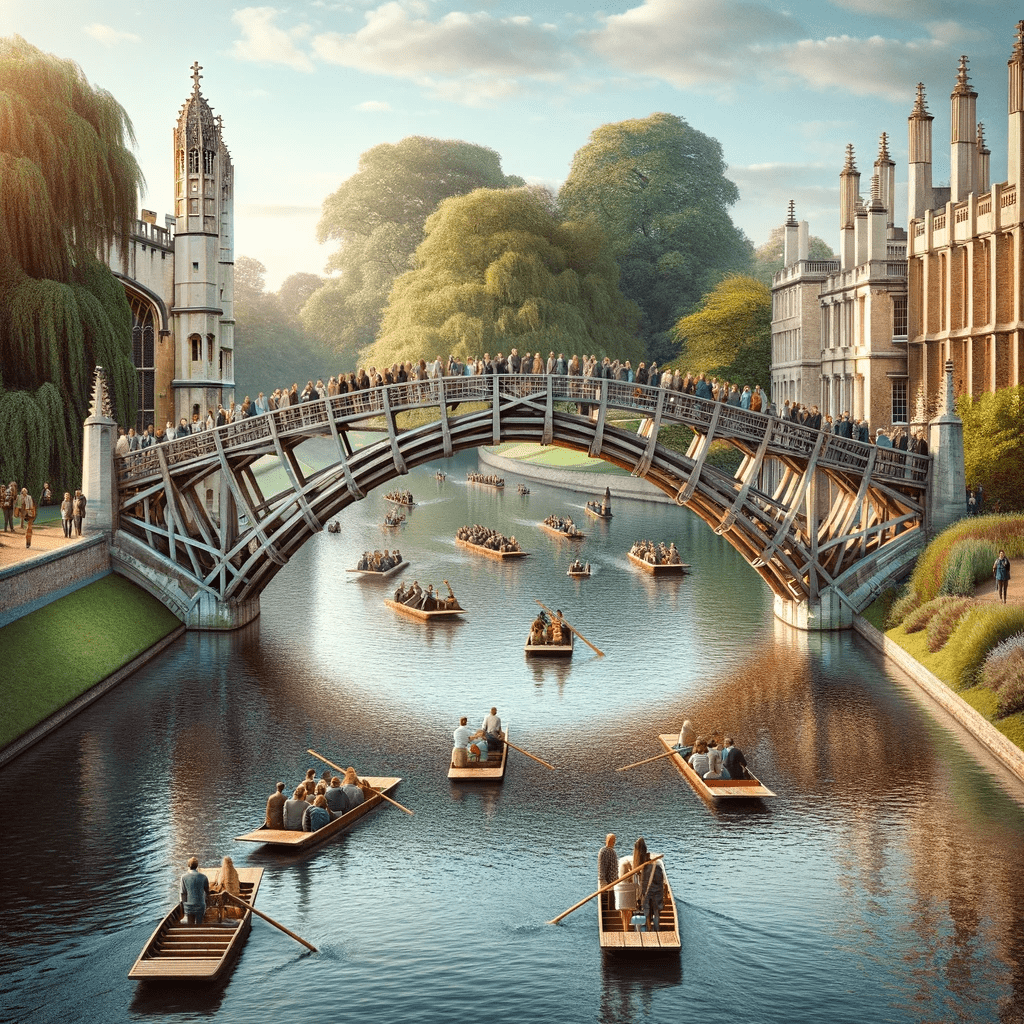

Cambridge, renowned for its prestigious university and cutting-edge technology sector, is an excellent choice for buy-to-let investors. The city’s strong economic foundation, driven by education and innovation, ensures a high demand for rental properties.

Cambridge’s property market is robust, with properties offering a mix of historic charm and modern luxury, appealing to a diverse range of tenants including students, academics, and tech professionals. The city is also a cultural and historical hub, with attractions like the Cambridge University Botanic Garden and the Fitzwilliam Museum adding to its appeal.

Additionally, Cambridge’s high standard of living, coupled with its green spaces and excellent transport links, including its proximity to London, makes it highly desirable for residents. With a vibrant rental market and potential for significant capital appreciation, Cambridge stands out as a promising investment location.

Finding the Best Buy to Let Mortgages in Cambridge

To navigate the mortgage maze, you need an expert on your side. Our brokerage service simplifies the process for you. Here’s how it works:

1. Starting with the Basics

Fill in the questionnaire form above to kickstart your journey. This form is your opportunity to share crucial information about your property investment goals and the specifics of the property in question.

2. Tailoring to Your Needs

Once you submit the questionnaire, our advanced system gets to work. It meticulously analyses your responses to align you with mortgage products that resonate with your unique investment scenario. It’s all about personalisation and ensuring the options presented are the best fit for you.

3. Compare and Contrast

Now comes the exciting part – exploring your options. Consider aspects like interest rates, loan terms, and repayment structures. This step is crucial as it helps you identify the mortgage that not only meets your needs but also complements your long-term investment strategy.

4. Soft Application

Once you’ve pinpointed the mortgage that speaks to your goals, it’s time to make a move. Submit your ‘soft application’ This means you can proceed without the worry of impacting your credit score.

5. Personalised Final Touch

After your application is in, the lender takes the baton. They will reach out to you directly to delve into the finer details of your application.

Access Market Leading Rate

Investing in a buy-to-let property in Cambridge has never been easier. With our free and fast brokerage service, you can find the perfect mortgage to suit your investment needs.

Don’t let the complexity of mortgages hold you back from your property investment dreams. Fill out our questionnaire today and take the first step towards securing your ideal buy-to-let mortgage in Cambridge.

Areas we serve: