Buy to Let Mortgage Broker in Canterbury

Are you in search of a buy-to-let mortgage broker in Canterbury? Look no further! Our broker offers access to an extensive network of 45 lenders.

Bid farewell to the hassle of sifting through multiple lenders; our partner broker streamlines the procedure and assists you in locating the ideal buy-to-let mortgage at no cost.

All you need to do is click the button below and fill out an application form. You’ll receive a selection of tailored buy-to-let mortgage options that are a perfect fit for your Canterbury rental property.

Why Use a Buy-to-Let Mortgage Broker?

When it comes to discovering the best buy-to-let mortgages, our partner (Lendlord) distinguishes itself for several compelling reasons:

1. Vast Network of Lenders – Lendlord boasts connections with 45 lenders, ensuring that you can access the most attractive mortgage options available in the market for your property.

2. Competitive Interest Rate – The success of your investment relies on favourable financial terms. Our broker’s ability to secure competitive interest rates and favourable mortgage conditions can significantly enhance the profitability of your buy-to-let property.

3. Tailored Solutions – They adopt a personalised approach, offering mortgages that align precisely with your unique requirements and circumstances.

4.Rapid Application Process – Say goodbye to drowning in paperwork. Lendlord offers an incredibly swift application process that transforms how you secure a buy-to-let mortgage. Complete a brief questionnaire, and receive a list of customised recommendations in no time.

5. Simplified Procedure – This buy-to-let mortgage brokerage simplifies the application process, minimising administrative intricacies and allowing you to focus more on the bigger picture.

Why Get a Buy-to-Let Mortgage in Canterbury?

Growth Past 5 Years

6.09%

Rental Yield

5.97%

Popular areas for investment

St Dunstan’s, Wincheap, Thanington, Hales Place

Average Price

£335,970

Canterbury, known for its rich history and vibrant culture, is a promising location for buy-to-let investors. Here’s why:

1. Impressive Rental Yield: Canterbury boasts an attractive rental yield of 5.97%, signalling strong returns for property investors. This high yield is indicative of the healthy demand for rental properties in the area.

2. Potential for Growth: The city’s property market shows significant growth potential – with detached houses having grown by 70.2% in the last 5 years! Its historical appeal and modern developments suggest a promising future for property value appreciation.

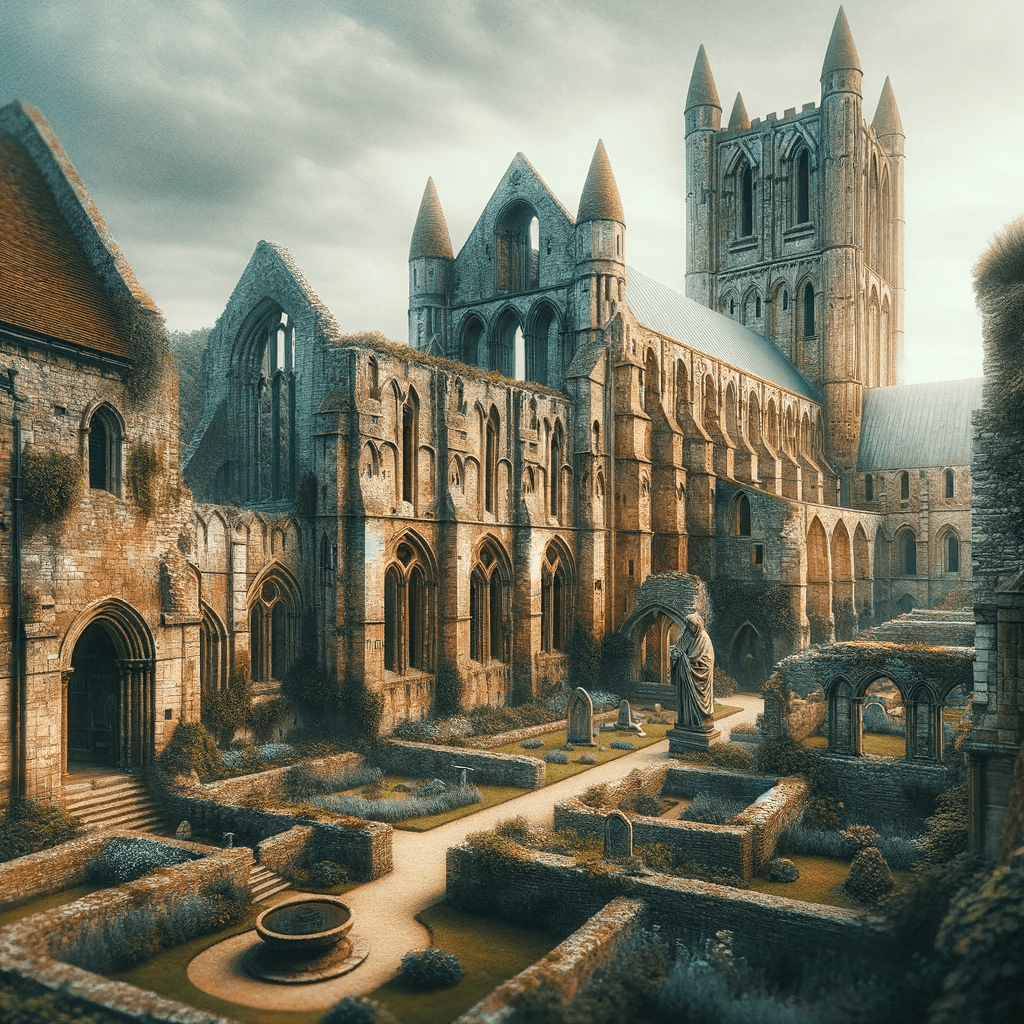

3. Tourist and Cultural Appeal: With landmarks like Canterbury Cathedral and the Marlowe Theatre, the city attracts a steady flow of tourists and culture enthusiasts, supporting a robust short-term rental market.

4. Educational Hub: Home to the University of Canterbury and several reputable schools, the city has a constant demand from students and educators for rental properties, underpinning the rental market.

5. Lifestyle and Amenities: Canterbury offers a blend of medieval charm and modern conveniences, with various shops, restaurants, and entertainment options that appeal to a wide demographic.

How Much Does a Buy-to-Let Mortgage Broker Cost?

While some mortgage brokers may impose fees (either a fixed charge or a percentage of your mortgage amount), our partner’s services come to you completely free of charge.

Their revenue is generated through a small commission from the lender if an individual opts for a mortgage product. This ensures that the brokerage remains cost-free, providing you with the best possible customer experience.

How to Find the Best BTL Mortgages?

By completing the brief questionnaire form, you will receive a selection of the best buy-to-let mortgages available in Canterbury. These products are carefully tailored to suit your unique circumstances and property.

Explore the presented options and choose the one that aligns with your investment objectives and strategy. If you decide to proceed with your application, the process would be as follows:

- Submit your application to the lender. This would constitute a “soft application,” meaning that it will NOT have any impact on your credit rating.

- The lender will get in touch with you directly to discuss your application and finalise the details.

What Are You Waiting For? Use our Buy to Let Mortgage Broker

Join the ranks of property investors who are enjoying market-leading interest rates and a seamless application process. Complete the questionnaire form to discover the current rates offered for buy-to-let mortgages in Canterbury.

Areas we serve: