Buy to Let Mortgage Broker in Exeter

Start your Exeter property investment journey off on the right foot – use our buy-to-let mortgage broker to discover the best rates and save yourself thousands in the long run.

Say goodbye to the complexities of scouring through various lenders – our partner broker simplifies the process and helps you find the ideal BTL mortgage free of charge.

Simply press the below button and complete an application form. You’ll be presented with a range of personalised buy-to-let mortgages perfectly suited for your Exeter rental property.

Why Use a Buy-to-Let Mortgage Broker?

Navigating the buy-to-let mortgage market can be complex and time-consuming, especially in a dynamic market like Exeter. A mortgage broker acts as your personal guide, helping you find the most suitable mortgage deals that align with your investment objectives.

Here’s why using a broker is beneficial:

– Access to Exclusive Deals: Mortgage brokers have access to exclusive mortgage deals not available to the general public, potentially saving you money over the term of your mortgage.

– Expertise and Insight: Brokers bring a wealth of knowledge about the mortgage market, offering advice tailored to your specific investment scenario.

– Time-Saving: A broker does the legwork in comparing various mortgage products, saving you considerable time and effort. In our case, the process only takes you 3 minutes!

The Benefits of Using Our Brokerage Service

Navigating the buy-to-let mortgage landscape can be daunting, especially when balancing investment aspirations with financial practicalities. Our brokerage service simplifies this process.

By completing a quick 3-minute form, you gain access to a wide array of mortgage products, each with its unique benefits and terms.

This service is particularly advantageous for first-time investors who might find the mortgage market overwhelming and equally valuable for seasoned investors looking to expand their portfolios efficiently.

Why Get a Buy-to-Let Mortgage in Portsmouth?

Growth Past 5 Years

23.24%

Rental Yield

6.10%

Popular areas for investment

Topsham, Heavitree, Pennsylvania

Average Price

£308,947

Exeter presents an excellent opportunity for buy-to-let investors. Its robust economy, driven by sectors like education, healthcare, and retail, creates a stable backdrop for property investments.

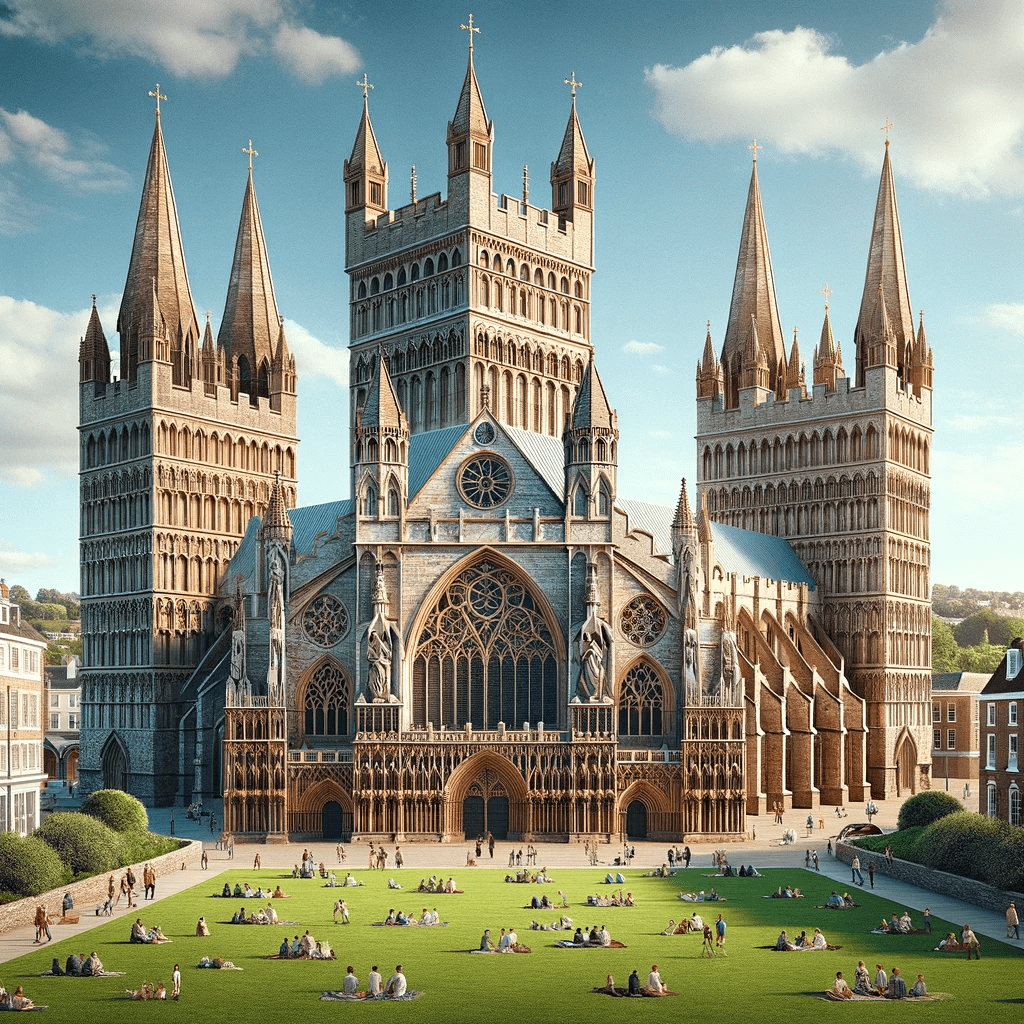

The presence of the University of Exeter adds a significant student population, ensuring a consistent demand for rental properties. The city’s rich cultural heritage, exemplified by landmarks like Exeter Cathedral and the historic Quayside, along with a lively city centre, attracts both tourists and locals, bolstering the short-term rental market.

Areas such as St. Leonards and Exwick are particularly popular for their community feel and accessibility, making them sought-after by families and professionals alike.

Furthermore, Exeter’s excellent transport links, including easy access to the M5 and a well-connected railway station, enhance its appeal to commuters. This combination of educational prominence, cultural richness, and strong connectivity positions Exeter as a lucrative location for property investors looking for growth potential and steady rental yields.

How to Find the Best BTL Mortgages?

Discovering the best buy-to-let mortgage has never been easier:

1. Access the Application Form: Use the application form provided or visit Lendlord’s website to explore their financing options.

2. Complete the Questionnaire: Fill out a brief questionnaire that captures essential details about your investment goals and property.

3. Receive Tailored Options: A sophisticated system analyses your information and presents you with a selection of mortgage products best suited for your unique situation.

4. Explore Your Options: Review the presented mortgage options and select the one that aligns with your investment strategy.

5. Soft Application Submission: Submit a “soft application” to the chosen lender. Rest assured, this step doesn’t impact your credit rating.

6. Expert Contact: The lender will contact you promptly to discuss your application and finalise the details.

See What Rates Are Available

Join your fellow property investors benefiting from market-leading rates and hassle-free applications. Fill in the questionnaire form to find out what rates are currently available for buy-to-let mortgages in Exeter.

Areas we serve: