Buy to Let Mortgage Broker in Gloucester

Let our buy-to-let mortgage broker unlock the door to your Gloucester property investment.

Simply fill out the below questionnaire form (it only takes 3 minutes) and you’ll be shown a range of buy-to-let mortgage products personalised for your property.

It’s hassle-free, fast and allows you to access market-leading rates, all for free.

Why Use a Buy-to-Let Mortgage Broker?

When it comes to finding the best buy-to-let mortgages, our partner stands out for a range of compelling reasons:

1. Extensive Network of Lenders – With connections to 45 lenders, Lendlord has the reach to match you with the best mortgage options available on the market for your property.

2. Competitive Rates – Investment success hinges on favourable financial terms. Our broker’s ability to secure competitive interest rates and favourable mortgage terms can significantly enhance the profitability of your buy-to-let property.

3. Customised Approach – They take a personalised approach, providing you with mortgages that align with your unique needs and circumstances.

4. Super Fast Application – Gone are the days of drowning in paperwork. Lendlord offers a super-fast application process that revolutionises the way you secure a buy-to-let mortgage. Fill in an application, answer a short questionnaire, and receive a list of personalised recommendations.

5. Hassle-Free Process – This buy-to-let mortgage brokerage offers a streamlined application process that minimises administrative complexities, allowing you to dedicate more time to the bigger picture.

Why Get a Buy-to-Let Mortgage in Gloucester?

Growth Past 5 Years

27.24%

Rental Yield

6.01%

Popular areas for investment

Barnwood, Abbeymead, and Longlevens

Average Price

£259,189

Gloucester is emerging as an attractive location for buy-to-let investors. Key aspects making it a worthwhile investment include:

1. Affordable Property Market: Gloucester stands out with its relatively affordable property prices. The average property price in Gloucester is approximately £259,189, significantly lower than the national average, making it an accessible market for investors.

2. Rising Rental Demand: The city has seen a steady increase in rental demand, partly due to its growing population, which has risen by about 8.5% over the last decade.

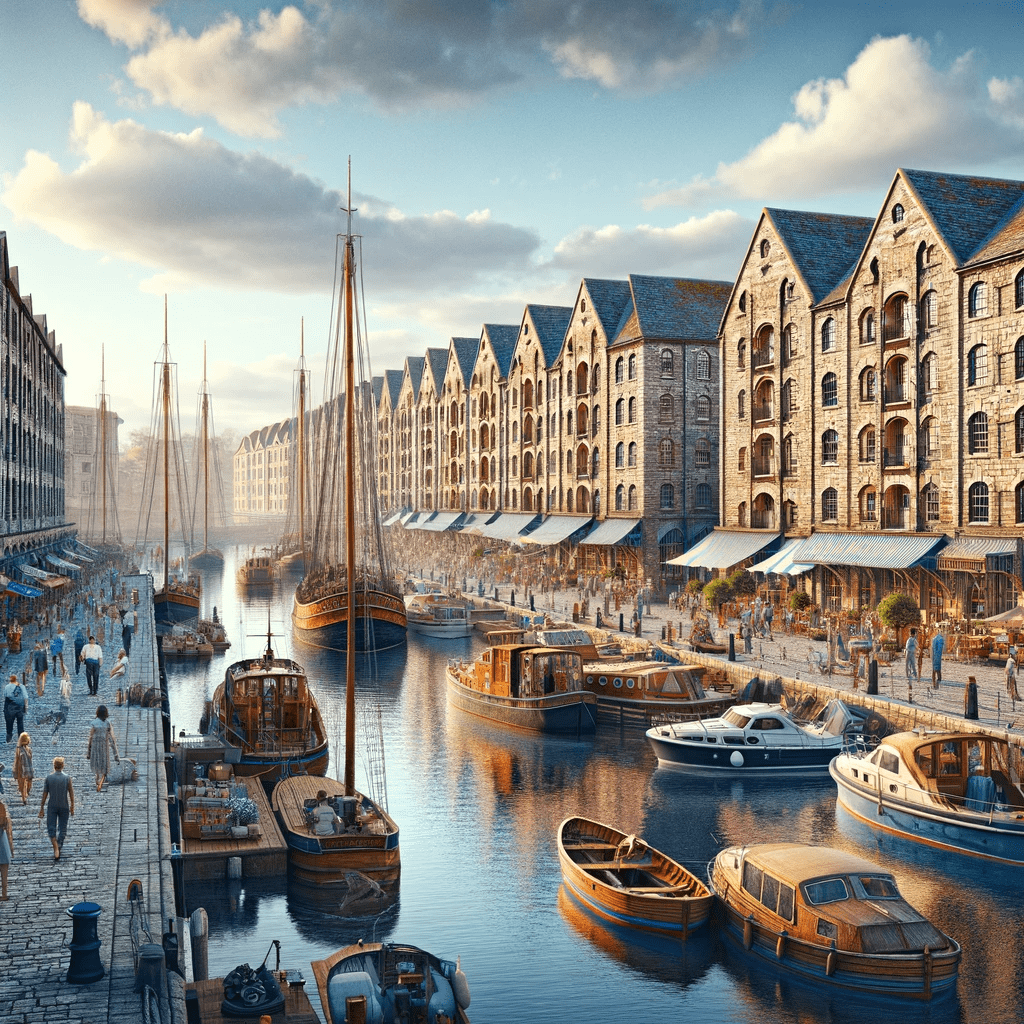

3. Economic Growth and Development: Gloucester’s economy is diversifying, with significant investments in areas like the Quays and the city centre. This economic growth is a positive sign for property value appreciation.

4. Historical and Cultural Appeal: Attractions such as Gloucester Cathedral and the historic docks add to the city’s appeal, attracting tourists and supporting a vibrant short-term rental market.

5. Connectivity: Gloucester’s connectivity, including its proximity to the M5 and direct rail links to London and Birmingham, makes it attractive to commuters and professionals.

6. Rental Yield: The city offers competitive rental yields, averaging around 6.01%, which is appealing to investors looking for steady income streams.

How Much Does a Buy-to-Let Mortgage Broker Cost?

Some mortgage brokers may charge for their services (this can either be a flat fee or a percentage of your mortgage amount). However, our partner is free of charge for you.

They make their money by receiving a small commission from the lender if a mortgage product is taken by an individual. This keeps the brokerage free of charge, allowing for the best possible customer experience.

How to Find the Best BTL Mortgages?

Discovering the best buy-to-let mortgage has never been easier:

1. Access the Application Form: Use the application form provided or visit Lendlord’s website to explore their financing options.

2. Complete the Questionnaire: Fill out a brief questionnaire that captures essential details about your investment goals and property.

3. Receive Tailored Options: A sophisticated system analyses your information and presents you with a selection of mortgage products best suited for your unique situation.

4. Explore Your Options: Review the presented mortgage options and select the one that aligns with your investment strategy.

5. Soft Application Submission: Submit a “soft application” to the chosen lender. Rest assured, this step doesn’t impact your credit rating.

6. Expert Contact: The lender will contact you promptly to discuss your application and finalise the details.

Access Market Leading Rates

Join your fellow property investors benefiting from market-leading rates and hassle-free applications. Fill in the questionnaire form to find out what rates are currently available for buy-to-let mortgages in Gloucester.

Areas we serve: