Buy to Let Mortgage Broker Hull

Are you eager to begin your Hull property investment journey with a strong start? Our buy-to-let mortgage broker is at your service, ready to unveil the best rates and potential long-term savings.

It’s as easy as dedicating a mere 3 minutes to complete the straightforward form below, and presto! You’ll gain access to a selection of buy-to-let mortgage options meticulously tailored to your property’s unique needs.

It’s a hassle-free process, and the best part – it won’t cost you a penny. What’s more, you’ll enjoy access to some of the most competitive rates in the market. Give it a shot and seize this opportunity today!

Why Use a Buy-to-Let Mortgage Broker?

Exploring the buy-to-let mortgage landscape in a vibrant city like Hull can be a complex and time-consuming endeavour. Fortunately, enlisting the services of a mortgage broker not only eliminates the hassle but also opens doors to market-leading rates.

Here’s why partnering with a mortgage broker can be a game-changer:

– Exclusive Opportunities: Brokers possess access to unique mortgage products that remain elusive in high-street banks.

– Market Mastery: Brokers come equipped with profound insights and expertise in the mortgage market, ensuring tailored advice aligned with your individual investment circumstances.

– Time Efficiency: Brokers shoulder the responsibility of comparing diverse mortgage products, liberating you from the burden of time-consuming research. Our streamlined process is so efficient that you can complete it in just 3 minutes!

Experience the Benefits of Our Brokerage Service

Locating the perfect buy-to-let mortgage may seem like a daunting task, especially when seeking a harmonious balance between your investment aspirations and prevailing market rates. Rest assured, our brokerage service is here to simplify the journey.

All it takes is a swift 3-minute form, and presto! You’ll gain access to a curated selection of mortgages tailored precisely to your property and investment objectives.

Why Get a Buy-to-Let Mortgage in Hull?

Growth Past 5 Years

+36.77%

Rental Yield

5.23%

Popular areas for investment

Holderness Road, Anlaby & Hessle

Average Price

£209,923

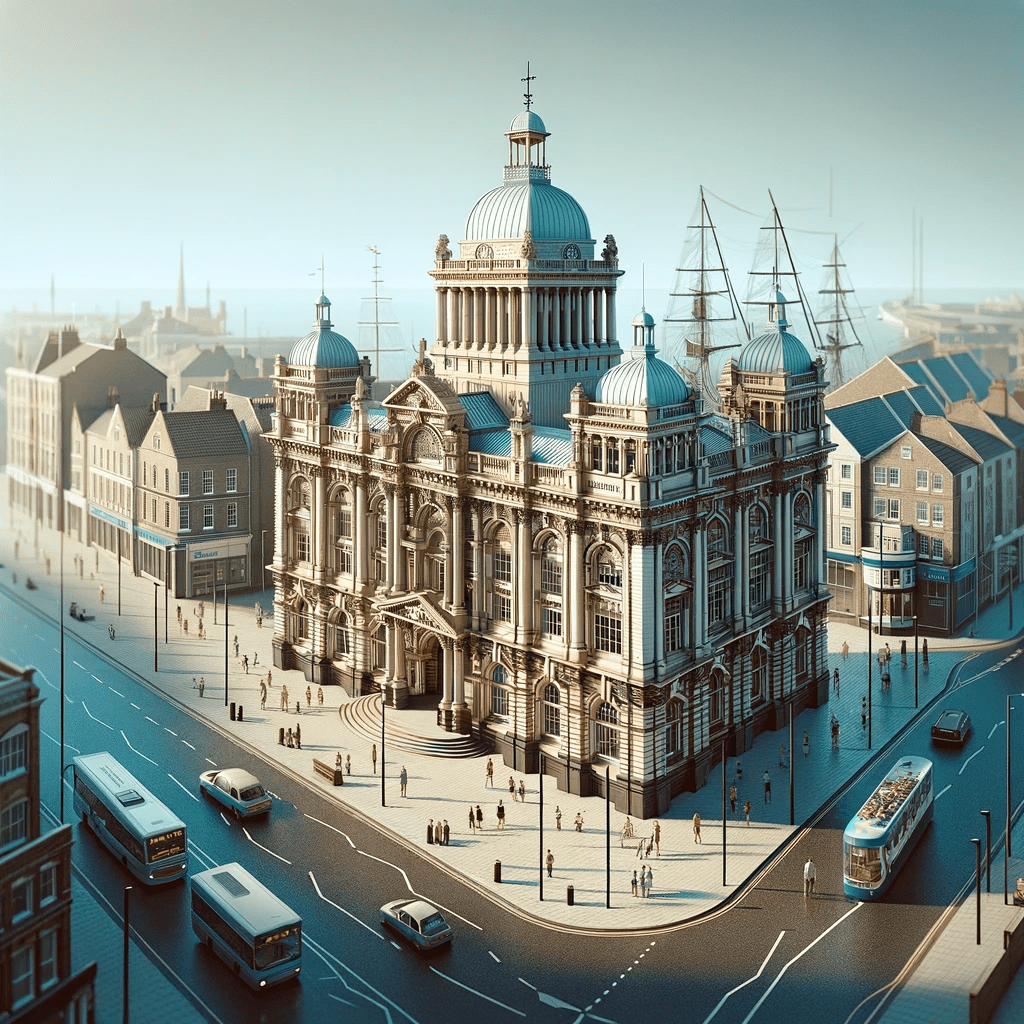

Hull, officially known as Kingston upon Hull, offers a unique and compelling opportunity for buy-to-let investors. As a city with a rich maritime history and an evolving cultural landscape, Hull’s economy is diversifying, notably in sectors like renewable energy, digital technology, and healthcare.

This economic growth supports a resilient rental market. Hull’s property market is particularly attractive due to its affordability, with average house prices lower than the national average, providing a great entry point for investors.

Areas such as the Fruit Market and Marina are undergoing significant development, becoming popular for their vibrant lifestyle offerings. With its excellent transport links, including its port and railway station, and the ongoing investment in city infrastructure, Hull presents a balanced investment opportunity, combining the potential for steady rental yields with prospects for capital appreciation in the property market.

How to Find the Best BTL Mortgages?

Step 1: Let’s Begin the Journey!

Start by completing the questionnaire above. This is your opportunity to divulge your property investment aspirations and provide details about your intended property.

Step 2: Tailored to Perfection

After you’ve submitted the questionnaire, our system springs into action. It meticulously analyses your responses to identify the ideal mortgage options for you.

Step 3: The Thrilling Choices

Now comes the exciting part – exploring your options. Consider what matters most to you, whether it’s interest rates, repayment terms, or other factors. This step allows your thoughtful decisions to shape your future investment.

Step 4: Commitment-Free Application

Found the perfect mortgage? Excellent! It’s time for a ‘soft application.’ This process is entirely commitment-free, ensuring that your credit score remains untouched.

Step 5: The Personalised Touch

Once your application is in, the lender takes over. They’ll reach out to discuss the finer points of your application. This is where everything gets finalised with a personal touch.