Buy to Let Mortgage Broker in Southampton

Are you looking for a buy-to-let mortgage broker in Southampton? Our partner Lendlord is here to help with an industry-leading selection of 45 lenders.

Say goodbye to the complexities of scouring through various lenders – our partner broker simplifies the process and helps you find the ideal BTL mortgage free of charge.

Simply press the below button and complete an application form. You’ll be presented with a range of personalised buy-to-let mortgages perfectly suited for your Southampton rental property.

Why Use a Buy-to-Let Mortgage Broker?

When it comes to finding the best buy-to-let mortgages, our partner stands out for a range of compelling reasons:

1. Extensive Network of Lenders

With connections to 45 lenders, Lendlord has the reach to match you with the best mortgage options available on the market for your property.

2. Competitive Rates

Investment success hinges on favourable financial terms. Our broker’s ability to secure competitive interest rates and favourable mortgage terms can significantly enhance the profitability of your buy-to-let property.

3. Customised Approach

They take a personalised approach, providing you with mortgages that align with your unique needs and circumstances.

4. Super Fast Application

Gone are the days of drowning in paperwork. Lendlord offers a super-fast application process that revolutionises the way you secure a buy-to-let mortgage. Fill in an application, answer a short questionnaire, and receive a list of personalised recommendations.

5. Hassle-Free Process

This buy-to-let mortgage brokerage offers a streamlined application process that minimises administrative complexities, allowing you to dedicate more time to the bigger picture.

Why Get a Buy-to-Let Mortgage in Southampton?

Growth Past 5 Years

17.23%

Rental Yield

6.16%

Popular areas for investment

Portswood, Highfield, Bitterne, Woolston

Average Price

£267,753

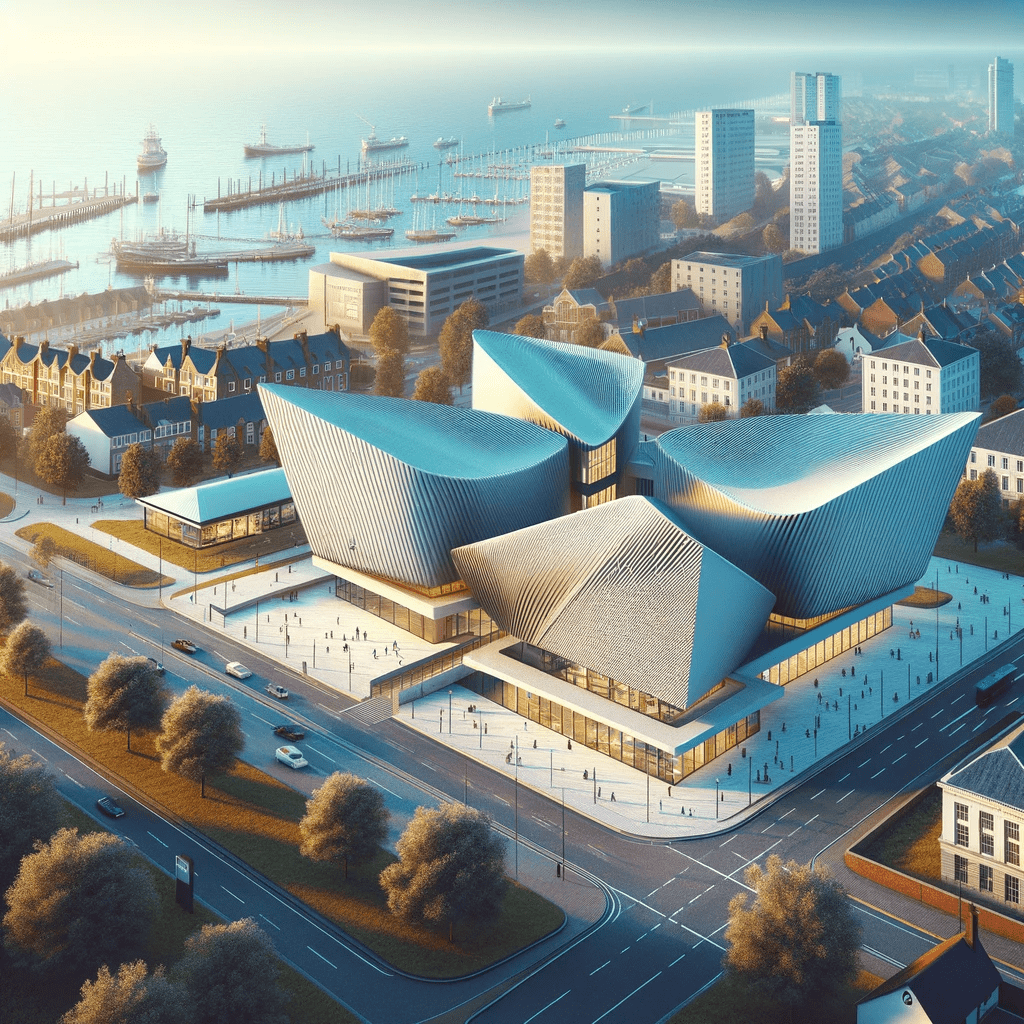

Southampton, a dynamic port city, stands out as an excellent choice for buy-to-let investors. Its robust economy is supported by sectors like maritime, education, and technology, making it a promising area for property investment.

The city’s educational institutions, notably the University of Southampton and Solent University, create a constant demand for rental properties, particularly in student-popular areas. This steady rental market is a significant draw for investors.

Property market trends in Southampton are favourable, with a steady increase in average property prices and competitive rental yields, especially in sought-after areas like Portswood, Highfield, and Ocean Village. These areas offer diverse residential options and lifestyle amenities, attracting a mix of students and professionals.

Recent statistics highlight Southampton’s growth potential, with property prices showing a significant increase over the past five years.

How to Find the Best BTL Mortgages?

Discovering the best buy-to-let mortgage has never been easier:

1) Access the Application Form: Use the application form provided or visit Lendlord’s website to explore their financing options.

2) Complete the Questionnaire: Fill out a brief questionnaire that captures essential details about your investment goals and property.

3) Receive Tailored Options: A sophisticated system analyses your information and presents you with a selection of mortgage products best suited for your unique situation.

4) Explore Your Options: Review the presented mortgage options and select the one that aligns with your investment strategy.

5) Soft Application Submission: Submit a “soft application” to the chosen lender. Rest assured, this step doesn’t impact your credit rating.

6. Expert Contact: The lender will contact you promptly to discuss your application and finalise the details.

Our Buy to Let Mortgage Broker

Are you ready to simplify your buy-to-let mortgage search and access tailored solutions personalised for your Southampton property? Complete the questionnaire above – it’s free and only takes a few minutes.

Areas we serve: