Buy to Let Mortgage Broker York

Are you in York and need a dependable buy-to-let mortgage broker? You’re in the right place! Our service has got you covered for all your property investment needs.

With a quick 3-minute questionnaire, you’ll find tailored buy-to-let mortgage options that match your investment goals. Whether you’re a newbie or an experienced investor, our tool makes your mortgage journey easy and straightforward.

Why Use a Buy-to-Let Mortgage Broker?

Navigating York’s bustling buy-to-let mortgage market can be a tricky and time-consuming task. But with a mortgage broker, you can sidestep the hassle and access top-notch rates.

Here’s why a mortgage broker is a smart choice:

– Exclusive Opportunities: Brokers have access to exclusive mortgage deals that you won’t find at your local bank.

– Market Know-How: Brokers are experts in the mortgage market, providing tailored advice for your unique investment needs.

– Time-Saving: Brokers handle the heavy lifting, comparing various mortgage options, saving you precious time. Our process is so quick that it’ll only take you 3 minutes!

The Benefits of Using Our Brokerage Service

Navigating the buy-to-let mortgage landscape can feel overwhelming, especially when you’re aiming to align your investment goals with today’s economic rates. But don’t worry, our brokerage service is designed to simplify the process.

With just a brief 3-minute form, you’ll gain access to a range of mortgages tailored to your property and investment objectives. It’s as easy as that!

Why Get a Buy-to-Let Mortgage in York?

Growth Past 5 Years

+24.48%

Rental Yield

4.25%

Popular areas for investment

Acomb, Heslington & Heworth

Average Price

£407,194

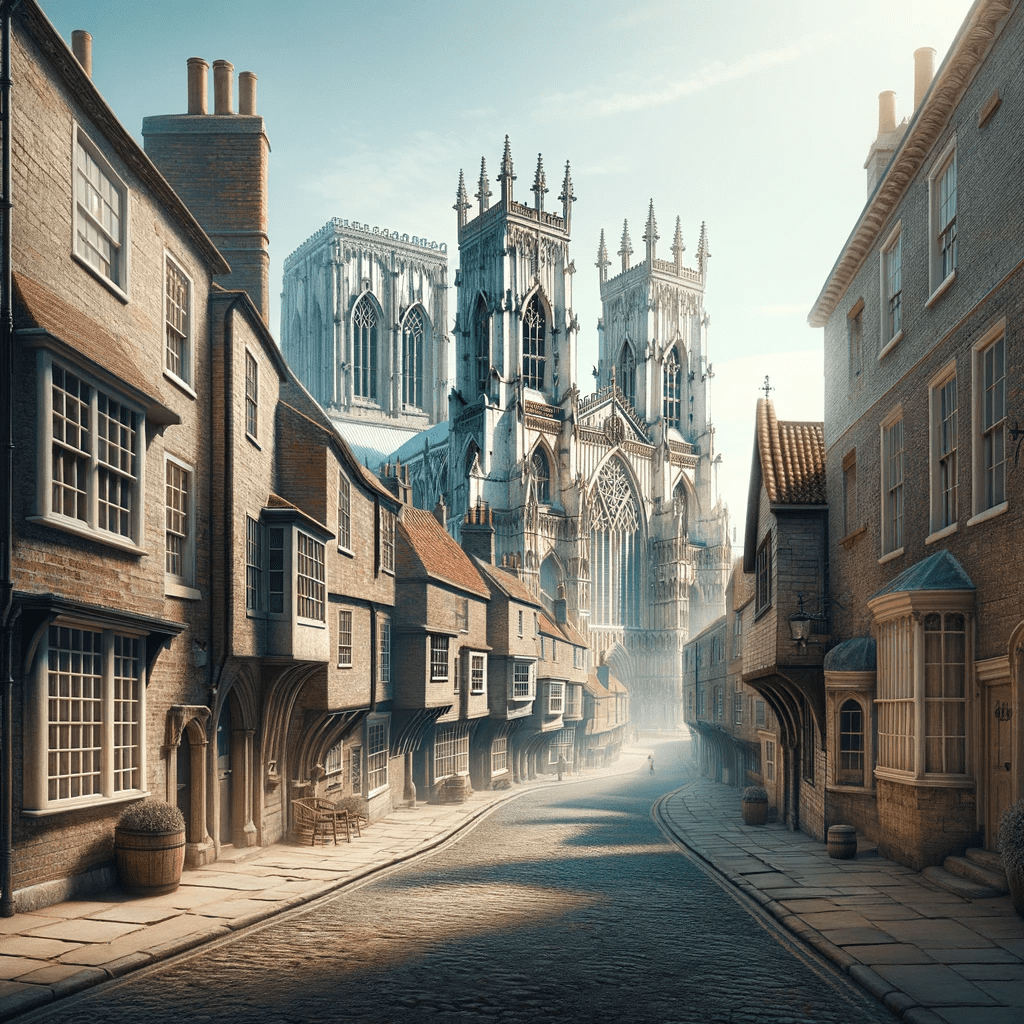

York’s strong economy is underpinned by sectors such as tourism, education, and health, contributing to a robust rental market. The city’s property market is particularly attractive, with a blend of historic and modern properties that appeal to a diverse range of tenants.

Residential areas like Bishopthorpe and Fulford are popular for their appealing settings and proximity to the city centre, making them ideal for investment. York’s quality of life, enhanced by its numerous green spaces and rich cultural heritage, is a significant draw for families and professionals.

Additionally, the city’s excellent transport connections, including its well-serviced railway station, enhance its appeal to commuters. With its historical charm, strong economy, and diverse property market,

York presents a compelling case for property investment, offering the potential for both rental income and capital appreciation.

How to Find the Best Buy to Let Mortgages?

Discovering the perfect buy-to-let mortgage is now a simple and streamlined process:

1) Let’s Begin: Start by filling out a concise questionnaire to help us understand your property investment goals and property details.

2) Tailored Mortgage Options: Our advanced system uses your responses to create a list of mortgage choices perfectly suited to your unique needs.

3) Take Your Time: Evaluate the mortgage options we’ve tailored for you, ensuring they align seamlessly with your investment strategy.

4) Easy Initial Application: Submit a non-binding ‘soft application’ to your chosen lender, without any impact on your credit score.

5. Expert Guidance Awaits: Anticipate a swift response from the lender, who will be prepared to discuss your application in detail, providing guidance every step of the way.

Our Buy to Let Mortgage Broker

Join a community of smart property investors who are already enjoying the benefits of competitive rates and a hassle-free application process. Simply complete our questionnaire to uncover the most competitive buy-to-let mortgage rates currently available in York.

Areas we serve: