Quick Navigation

- Buying a second property to rent out differs with requirements like a larger deposit and specialised buy-to-let mortgages.

- Despite differences, buying a second house to rent out can yield excellent returns, primarily from capital appreciation.

Buying a second property to rent out is one of the most popular ways in which people choose to invest their hard-earned money in the UK – in fact, according to the English Housing Survey, 19% of all households in the UK are privately rented. Contrary to what most people will think, the majority of the landlords who own these properties aren’t massive corporations, they’re people like you and me.

If you’d like to jump on the bandwagon and buy a second property to rent, you need to be aware of the many differences between buying a residential home and buying a rental property.

Differences Between Buying a Residential and Rental Property

Whilst the majority of the house buying process will be exactly the same for a rental property as it was for your residential home, especially the work you’ll do with your solicitor, there are quite a few aspects that differ. Let’s look into what these are.

1. Mortgages

By far the biggest difference is the sort of mortgage that is required. For a buy-to-let rental property, you will require a specialist buy-to-let mortgage – these are different from normal residential mortgages in the following ways:

- The Deposit – whereas residential mortgages only require a minimum of a 5% deposit (although it’s recommended that you deposit at least 10%), buy-to-let mortgages require a 25% deposit. This is because a rental property is seen as more risky to lenders, thus they require you to have a larger stake in it before they lend you the rest.

- Repayment Method – Most residential mortgages are repayment ones, meaning that you will pay off the initial loan amount month by month on top of the interest charges. On the other hand, buy-to-let mortgages are often interest-only – this means that you only pay the interest of the loan, and you do not pay the initial loan back. Important to note here is that there are repayment buy-to-let mortgages available but most property investors will opt against them in favour of maximising their cash flow and just letting inflation eat away at the initial mortgage amount.

- Criteria – On top of needing to have the deposit money, buy-to-let mortgage lenders will also want you to earn at least £25,000 and already own your home. These should be the easiest criteria to meet, along with having a good credit score of course. A slightly harder criteria, made worse by the interest rate rises this year, is the rental coverage – this is simply how many times your property’s rental income can cover the interest-only mortgage if the rate was 5.5% (although some lenders are now pushing this to 7%). Most lenders will want to see a rental coverage of at least 125% but more commonly 150%. For example, if your interest-only mortgage payments would be £500 at 5.5%, your rent would need to be at least £625 (for 125% rental coverage) or £750 for a 150% rental coverage.

- Mortgage Rate – As mentioned earlier, rental properties are considered higher risk to lenders, so they will require a larger deposit and offer a higher interest rate. For example, whilst the interest rate for a residential property would be 4.47% (for a 5-year fixed deal), a buy-to-let mortgage for the same property would have an interest rate of 4.69%.

If you’re looking for a buy-to-let mortgage, we’d highly recommend Lendlord – they offer a free online mortgage broker service in which they help you find the best mortgage product for your specific circumstances.

2. Stamp Duty Tax

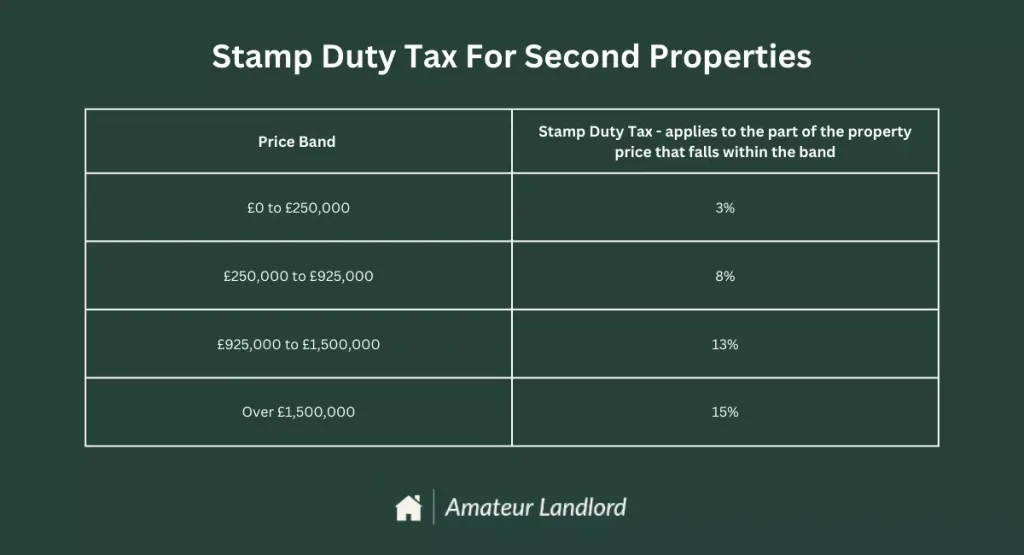

Unfortunately, when buying a second property or investment property you will have to pay an additional 3% in stamp duty tax. As of June 2024, the stamp duty rates are:

The rates are banded so you will pay 3% on the first £250,000 of your property, 8% on anything between £250,000 and £925,000 and so on.

3. Legal Requirements

What many people fail to understand is that when you rent out your property to a tenant, there is a legal relationship created between the two parties. You as the landlord have legal responsibilities that you must uphold or face being charged with a criminal offence.

For the most part, these obligations include the upkeep of the property, ensuring that it’s in a habitable condition and free from any health or fire hazards, as well as ensuring that your tenants have been provided with all the correct paperwork and been made aware of where their deposit is being stored.

For a detailed breakdown of your responsibilities as a landlord, I’d recommend heading over to Gov.uk and reading their guide on renting out your property.

The Key to Successful Investments

Is It Worth Buying a Second House To Rent Out?

Buying a second house to rent out is definitely worth it as it can deliver exceptional returns on your invested capital, but it’s not going to be passive income. There is quite a bit of upfront work required when purchasing the property and then finding a tenant. After that, your input will be minimal but you should still expect a phone call or two from either your tenant or property manager once in a while.

The return you can expect to see on your investment will vary greatly depending on which property investing strategy you choose to utilise. Assuming that you opt for the lowest effort strategy available, purchasing turnkey buy to let properties (one’s that are ready to rent out immediately or sometimes already come with a tenant), you should expect to make an average return of 15-20% from the combination of rental income and capital appreciation of the property (this will, of course, depend greatly on the location and the quality of the deal). To see a breakdown of a real turnkey property investment, check out our article about turnkey property investments.

Rental vs Serviced Accommodation (a.k.a holiday homes)

With serviced accommodation (providing holiday homes and short term rental properties on platforms such as Airbnb) being a very popular property investing strategy right now, it’s only right to compare it with boring buy-to-let investments.

In general, serviced accommodation will blow buy-to-let investments out of the water when it comes to income. However, there are two key factors to consider before you get excited about the income potential.

- Time Input – buy to let properties are low effort, or at least as low effort as a property investment can be, and thus they are the cornerstone of many landlords’ portfolios as they allow them to reap the benefits of such investments but also enjoy their free time. Serviced accommodation does not offer the same luxuries – it’s likely the most time consuming strategy you could opt for! If you choose to manage everything yourself, you will have to list the property, manage your bookings, clean the property (likely twice or three times a week) and make any necessary repairs to it. There is also an increased risk of tenant issues, mostly because of the volume of tenants but also because you cannot screen your tenants beforehand. As someone who has dabbled in serviced accommodation before, I can say that this is alike to having a part time job. Even if you choose to outsource everything, your workload will only change from doing chores to chasing after people to ensure that they have done the chores correctly.

- Future regulation – the rise of serviced accommodation has only worsened the UK housing crisis as more landlords take their properties off the rental market and instead pop them on Airbnb. This is one of the driving factors behind the large rental increases that we have experienced over the past few years; and as such, there is a lot of talk about regulating this industry. This could mean that the number of holiday homes in each council will be limited and you will have to seek permission before listing such a property.

If you want to maximise your income and are more than happy to sacrifice your evenings in order to clean and manage bookings, serviced accommodation could be a great option for you. However, if you would prefer to take the easier but lower yielding route, buy to let is definitely the way forward.

Pros and Cons Of Buying a Second Property

To further help you decide whether you want to purchase a second house to rent out, I’ve summarised the pros and cons below:

Pros

- A rental property in a good location beats out any other investment vehicle; even with the laziest of strategies, you can make a great return from the rental income and capital appreciation of the property.

- The UK has a property shortage which shows no signs of being resolved with the government likely to cut down on house building, according to the Guardian. Demand will continue to outstrip supply which only means one thing for prices in the long term, they’re likely to go up.

Cons

- The additional 3% surcharge on stamp duty tax for second properties can be quite hefty, especially if you’re buying in the South East of England where the average property price is £404,200 (according to the UK house price index).

- Becoming a landlord/property investor can be quite difficult at first so it’s highly recommended that you take the time to learn more about property investing and your chosen strategy. You do not have to pay for courses, free resources such as this website exist to help you learn about property investment without splashing your cash.

Final Thoughts

All-in-all, whilst buying a second house to rent out is quite different from purchasing a residential property for you to live in, it’s definitely worthwhile as the potential return on your investment is great. It’s important to consider the potential capital appreciation of the property when deciding whether you wish to invest in a second house – many people solely focus on the rental income, forgetting that capital appreciation is the real reason why property investment in the UK is so wonderful.

Recommended Tools:

Victor Sterling

Hi, my name’s Victor - I’ve been investing in property for three years now, with my preferred strategies being buy-to-let, BRR and house flips. My goal with Amateur Landlord is simple - to provide beginners with easy-to-follow resources that simply weren’t around when I started, and to offer these for free and without ads.