Quick Navigation

- Choosing the right location for property investment is the single most vital aspect in determining your success.

- Set investment criteria based on your goals; consider factors like population growth, previous growth, and transport links when evaluating a city for investment.

- Assess the suitability of a specific postcode by examining factors like local amenities, public transport, school quality, demographics, and demand for properties.

Choosing a location in which you will invest is a crucial step in your property investment journey. But with so many factors to consider, it can feel overwhelming. That’s why we’ve created this comprehensive guide to help you navigate the world of property research and identify those prime locations that offer the best potential for growth and profitability.

Whether you’re a beginner or a seasoned investor, this guide will provide valuable insights and practical tips to uncover those hidden gems and ensure your property investments flourish. So, let’s dive in and discover how to identify the ideal property investment location.

What Are Your Criteria?

First off, you need to ask yourself what your criteria are – do you want an area which has a long track record of growth but won’t achieve the best growth rates in the future or do you want an area which hasn’t grown much in the past but is likely to experience explosive growth soon?

Your criteria will be largely determined by what your goals are. For example, my property investing goals are to buy at least one buy-to-let property every year and reinvest all my profits into more properties. I want to be as hands-off as possible so that I can focus on other things in life, such as running this website. Therefore, I choose to invest in areas which I know will continue to grow but likely won’t be ranked as areas where property values grew the most that year.

This is what you should consider when setting your city criteria:

- What is the population? You need to have at least 300,000 people living there.

- Is the population increasing? This is a great sign of demand for this area.

- Does the area have scope to grow?

- Has it experienced growth in the past? How much per year?

- How easy is it to get to other cities? Look at the transport links for both cars and trains.

The above considerations should have helped you create some sort of criteria for your perfect property investment area. Now, let’s walk through researching the area.

How To Research A Property Investing Area

When researching an area for property investment, it’s best to break it down into city-wide research (choosing which city to invest in) and postcode research – researching the local area around a certain property. Let’s begin with city research.

Is This City A Good Place To Invest Into?

Because I believe that almost every major city in the UK will experience growth, I keep this research quite simple:

1. What’s the population?

I would only pay attention to cities which have a population of at least 300,000. To find this out, simply google the city name followed by the word ‘population’.

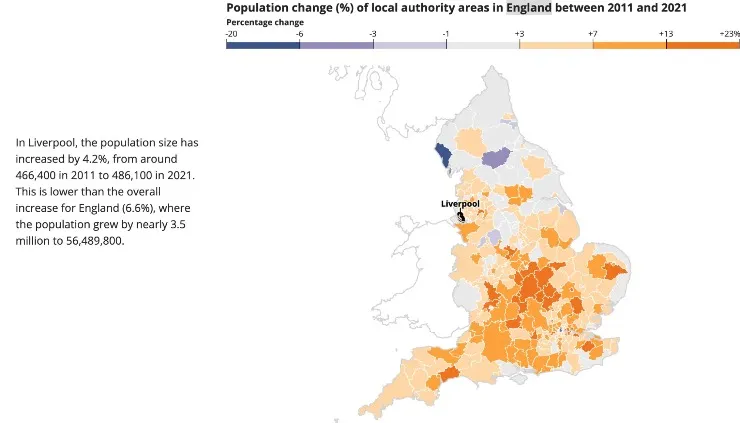

2. Is the population growing?

A growing population shows that people are moving into the area. In other words, there is a demand for property in that area. You can find out whether an area has seen population growth by looking at the national census – simply select the area you are looking for and scroll down to see how much it has grown in the past 10 years.

3. Has the area seen previous growth?

An area that has seen previous growth is quite attractive to property investors and homeowners alike. To check whether your area has experienced growth in the past, search for it on the UK House Price Index.

4. Does the area have scope to grow?

Are there any new developments planned for the near future and is the local council pumping money into the city? To find this out, look at the local SHLAA (Strategic Housing Land Availability Assessment) and search for development plans on Google. If you are visiting the area and you see a lot of cranes everywhere, that’s another great sign.

Local newspapers are another great source of news about developments in the area.

5. Does it have great connections to other cities?

Does the area have great transport links to other major cities and how long does it take to get to London? To answer these questions, just use Google Maps. You should be looking for motorways that lead directly into nearby cities and ideally straight to London too. Also, have a look at whether you can take a direct train from that city to others around the UK.

The Key to Successful Investments

Are You Investing In A Good Street?

Investing in a great city is a good start but finding a great postcode in a great city deserves a round of applause. Here’s how I would go about researching the postcode for a property I’m interested in:

1. Would you want to live there?

When choosing potential investment locations, it’s essential to set realistic expectations. Remember, no area is perfect, and you may come across a few messy bins or neglected properties here and there.

To gain a better feel for the area, take advantage of tools like Google Maps to explore the surroundings. Put yourself in the shoes of a resident and ask whether you would be comfortable living there. Does the neighbourhood look appealing, or do you notice sofas scattered outside every other house?

If it’s a place you wouldn’t choose to live in personally, it’s best to avoid purchasing an investment property there. However, keep in mind that the images on Google Maps may not reflect the current state of the area. If the pictures appear dated and the neighbourhood seems rough, there’s a good chance it has undergone significant changes since then. Stay open-minded and gather up-to-date information to make a well-informed decision about the location.

2. Are there local amenities?

Again, use Google maps to see which shops are close by. It’s always good to have a few corner shops around in case you run out of bread or milk. Just make sure they’re not literally next door to the property, those types of houses are hard to get mortgages on.

3. Good public transport?

Are there bus stops or train stations nearby? How easily could you get to the city centre from there?

4. How good are the nearby schools?

Chances are that a family will move into your property. People will want to send their children to a good school so it’s vital that there are primary and secondary schools, as well as colleges in the local area which have an Ofsted rating of good or outstanding. To find this information, I recommend using Lendlord’s property analysis tools (this will come in handy with the later steps too).

5. What’s the demographic of the area?

You want the local demographics to be around the national average if not better. Avoid locations that fall behind the national average in all areas. The best tools to find all of this out are Lendlord’s postcode tool (found in the deal analyser), Property Data and StreetCheck.

The demographics that you should be looking at are:

Unemployment rate

National average = 3.7%

This is the percentage of the population who can work but are currently unemployed.

Crime rates

National average = 75.88 per 1,000 people

This is the number of reported crimes per 1,000 people. Quite obviously, the less the better.

Social grade

This refers to the occupation of the people living in that area. The social grades include higher managerial positions, supervisory/professional positions, skilled manual workers and semi-skilled/unskilled manual workers.

It’s recommended that you avoid areas which have a prominent social grade of DE (semi-skilled/unskilled workers) because people in this category are far less likely to be in a strong financial position – this may pose a risk to you receiving your monthly rent. We’d recommend using StreetCheck for this.

Tenure type

National average = 25% owned outright, 25% owned with a mortgage, 25% privately rented and 25% social housing.

Housing tenure refers to the arrangements under which the household is occupied. For example, if the tenant rented the property from a private landlord, the tenure type would be ‘privately rented’.

Areas with over 30% of the housing tenure listed as owned show us a strong demand for property in that area. A large amount of privately rented property is also a good sign. It mostly comes down to avoiding areas which have larger than usual amounts of social housing.

6. Is there a demand for this area?

The tenure type should help you answer this question – if over 30% of the property on this street is owner-occupied and the rest is mostly privately rented, it’s a great indication that this postcode is sought after. To confirm this, you can do a simple calculation:

- Head over to Rightmove and search for properties to buy in that postcode, and write down the number of available properties. If there aren’t any, try widening the radius to ¼ mile and at most ½ mile. Be sure to exclude any retirement homes and other irrelevant property types.

- Head over to the filter bar and select ‘Include under offer, sold STC’, and then take note of the number of properties that show up.

- Divide the first number by the second (then multiply by 100) to get a percentage of how many properties in that postcode are still available. This should give you a good idea of how much demand there is for properties in that area. As a general rule of thumb, if less than 30% of listed properties are still available, this signals a strong buyer’s demand.

7. Is there rental demand?

The process for working out the rental demand for a postcode is very similar:

- Again, head over to Rightmove or Zoopla. Search for rental properties in your chosen postcode and note down the number of available rentals.

- Next, go into the search filters and select ‘Include Let Agreed’. This will include properties that were recently listed but have since been rented to a tenant.

- Divide the first number by the second number and multiply by 100 to get a percentage of how many rentals are still available. Much like the above process, this will give you a good idea of how high the demand for rental properties in that postcode is – anything under 40% is a great indication of strong rental demand.

Final Thoughts

By utilising the checklist provided above, you can steer clear of underwhelming locations that lack the potential for significant capital growth in the foreseeable future. Instead, focusing on good investment property locations characterised by thriving populations, substantial investments in city centres, and excellent transportation links.

Investing in such locations holds the key to maximising your investment returns. And to further enhance your success, be sure to explore our other property research guides and our top rated property investment tools, which will save you valuable time.

Victor Sterling

Hi, my name’s Victor - I’ve been investing in property for three years now, with my preferred strategies being buy-to-let, BRR and house flips. My goal with Amateur Landlord is simple - to provide beginners with easy-to-follow resources that simply weren’t around when I started, and to offer these for free and without ads.