Quick Navigation

- The process involves selecting the right area, property type, and profit goals, then searching for opportunities, analysing deals, financing the purchase, refurbishing, and finally selling the property.

- An example of flipping a 2-bed end-of-terrace property in Bolton is provided, highlighting the importance of thorough research and profit calculations.

A lot of people assume that learning how to make money by flipping houses is going to be dead easy, likely due to the popularity of house flipping shows which make it look like any idiot with some spare time and cash can flip a property.

Even when potential property investors take the step to educate themselves by reading property flipping guides, they’re often faced with simplistic guides and made-up examples which don’t really go into much depth. That’s why I’ve decided to write this guide on how to flip houses in the UK. It’s a fully comprehensive guide on everything a potential property flipper would need to know. Not only are we going to cover how to flip houses but also how much money you would need, the tax involved when flipping houses, and we will also provide a real example of how we would flip a property.

Without further ado, let’s jump straight into this property flipping guide.

How Much Money Do You Need To Flip A Property?

We’re going to start off with this question because it’s very important to consider and can save you a bunch of time – we don’t want you wasting your time with a property investing strategy which doesn’t work for you and your available funds.

Flipping property is definitely one of the more expensive property investment strategies because you will rarely be able to get a mortgage on a run-down property in need of modernisation. This means that you will either have to purchase the house with cash or with a bridging loan. This isn’t exactly the end of the world though, as you will likely to able to secure a 10-15% discount on the property due to being a cash buyer.

If you are buying property up North in Liverpool for example, you will likely require around £80,000 at the very least if you were to buy using cash (this includes money for purchasing the property and refurbishing it). However, if you wanted to use a bridging loan instead, you would require around £35,000 to £40,000. If this sounds like an amount you would be able to cough up, property flipping is definitely a viable option for you. However, if it is unrealistic for you, you may want to consider a property investing strategy such as buy-to-let which requires far less capital.

Now that we have that out of the way, let’s jump into how to flip houses in the uk.

How To Flip Houses?

If you are a complete beginner to house flipping, I would first recommend that you check out our guide on what house flipping is and whether it’s worth it. Once you have a good understanding of the basics of house flipping, return here and make yourself a nice cup of tea because learning how to flip houses may get a little bit complex. I have broken the process down into steps in order to make it easier to follow:

1. What area are you going to focus on?

Before you start looking at properties, you need to have a good idea of which areas you want to focus on – it’s no good looking at random areas of the UK. We have guides on conducting property research so I won’t go into too much detail here but it essentially all boils down to finding areas which are:

- Close enough to you so that you can travel there or you have a team of labourers and project managers in that location who can sort everything out for you.

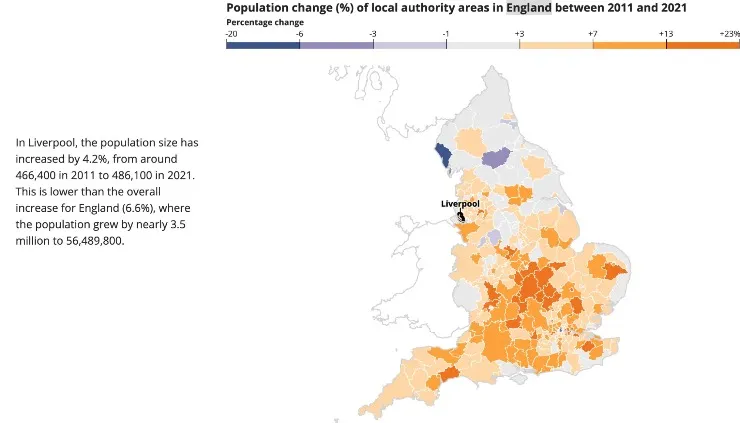

- There’s a strong demand for property in that area. When it comes to figuring out demand on a city scale, the easiest way is to look at the population growth of that city. The logic here is that the UK has a housing shortage, with demand for property far outstripping the supply of property, so if a city is experiencing population growth, the demand for property will surely increase. Pretty solid logic if you ask me. To find out if an area has seen population growth, go to the latest UK Census and select the area you are looking for. You will be presented with the population growth figures for the last 10 years. For example, Liverpool’s population has grown by 4.2% which signals to me that people clearly want to move to Liverpool and there is a growing demand for property there.

2. What type of property are you going to focus on?

Now that you know which area you will be focusing on, you need to figure out what type of property you want to flip. This may seem like an unimportant step as you’re probably thinking that you just want to flip anything that will make you money but it’s important to only focus on certain types of property so that you know exactly what you’re looking for. For example, you may only want to focus on houses that have gardens and off-street parking. This mostly depends on personal preference and what you think will work for you.

You also need to ask yourself whether you want to consider flats and if so, what kind of flats – ground floor, flats on the 5th floor etc. As a beginner, I wouldn’t consider undertaking any flat-flipping projects because they tend to be much harder and there are a lot of complexities to consider. It’s best to stick to flipping houses.

3. How much profit do you want to make?

Okay, so now you know where you want to buy and what type of property you want to buy. The next step would be to set yourself some criteria in regard to how much profit you want to make. As I explained in the ‘What is property flipping and is it worth it?’ guide, property flipping is only worth it if the numbers make sense to you. Some people may be happy with an 11% return on their house flip whereas others may only consider opportunities which provide them with a 20% return or more. Again, this is all about personal preference but I would advise you to weigh up what other options you may have available.

4. Start looking for opportunities

At this point, you should have a very good idea of what kind of opportunity you are looking for and can start searching for those opportunities. Here’s a list of where you can look:

- Rightmove

- Zoopla

- OnTheMarket

- Gumtree

- Property sourcers – they will find and secure the deal for you in exchange for a fee (fees range from £2000 all the way up to £10,000)

- Lendlord

- Newspaper Ads

- Local lettings agents

- Direct-to-vendor marketing

5. Deal analysis

When you find properties which look like they could be a good flipping opportunity, you need to conduct some property research. Once again, we have comprehensive step-by-step guides on conducting property research so I won’t go too in-depth with this explanation. It boils down to the following:

- Does the property offer an opportunity to add value to it? How much would it cost?

- Can you make a profit from this deal?

- Are there local amenities?

- Are there good transport links? A bus stop and train station nearby? Good access to the centre of the city as well as neighbouring cities?

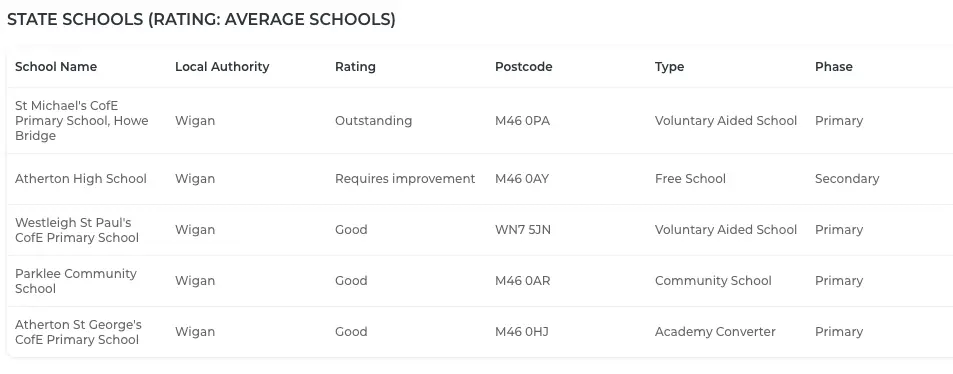

- Does the area have high-quality schools nearby? Ideally, they should have an Ofsted rating of outstanding.

- Are there parks nearby? (This one is not necessary but if you think that your target buyer is a family, a nice park nearby would be a benefit).

- Is the crime rate low?

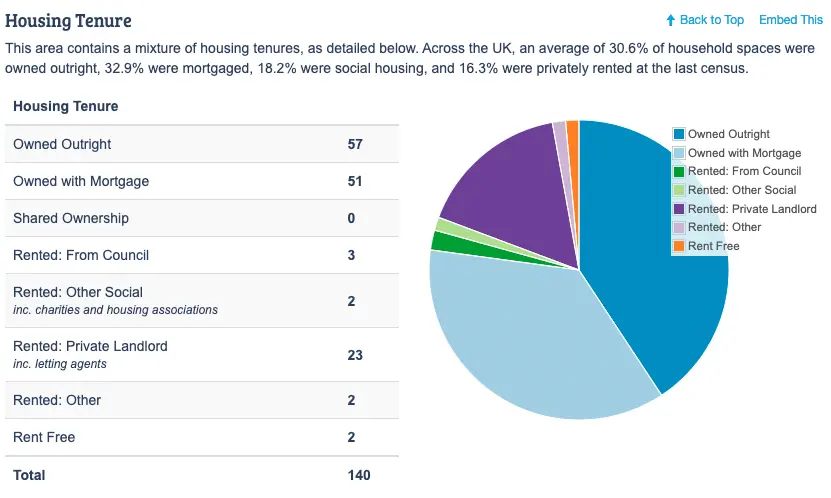

- Are the majority of the houses on that street owner-occupied or privately rented? At the very least, 30% of the houses should be owner-occupied.

This may seem like a daunting amount of research to do but don’t worry, we have property analysis tools such as Lendlord and Property data at our disposal which help us do all of this research a lot faster. I would definitely recommend using these tools; doing all of this research manually would take hours for a single property, and it’s likely that you will be analysing a few a day. These tools are free or quite inexpensive.

Once you find a deal that you would like to make an offer on, you can move on to the next step.

The Key to Successful Investments

6. Financing your house flip

There are several financing options available to fund your house flip, including:

- Mortgages: Traditional mortgages can be used to finance a portion of the property purchase cost. This option is suitable for investors who meet the eligibility criteria and have a good credit history.

- Buying with Cash: If you have sufficient funds, purchasing a property outright with cash eliminates the need for financing and associated interest costs.

- Bridging Loan: You may opt for a bridging loan so that you can purchase the property with cash. These short-term loans will often give you 70% LTV but they do have steep interest rates.

- Private Investors: Seeking investment from private individuals or companies can provide additional funds. This option may involve sharing profits or providing equity in the project.

- Crowdfunding Platforms: Crowdfunding platforms allow you to raise funds from multiple investors who contribute smaller amounts. These platforms often offer convenient online tools for managing the fundraising process.

Deciding on which financing method you should opt for will largely come down to your specific scenario, how much capital you have available and how fast you need to move. If you would like to leverage and can afford to take your time getting a mortgage arranged, financing with a mortgage would be the best path for you. However, if you need to purchase the property with cash and have promised to move quickly, you might wish to explore other options such as bridging loans or seeking funds from private investors.

7. Pull the trigger

When you find a deal which meets all of your criteria, you’re ready to make an offer. It’s as simple as calling up the agent, arranging a viewing and assuming that everything about the property is as expected, you can make your offer. Then you just wait to see if it’s accepted. Finger’s crossed, it will be.

8. Refurbish the house

If your offer got accepted, happy days, you now have to go through the rather annoying and lengthy process of actually purchasing the house. But after that’s done and you have the keys in your hands, you can get the dream team together and begin refurbishing the house.

9. Sell the property

After you’re finished with the refurbishment, you will be ready to sell the property. Find a good estate agent (ideally one who has been recommended to you by several people – either friends and family or fellow property investors). The process of selling a house can be lengthy and a lot of things can go wrong so it’s important to have an estate agent who is competent and able to sell the house not only quickly but to people who aren’t messing about.

House Flipping Example

I’m well aware that for any beginner out that, that explanation of how property flipping works may have just flown over your head so let’s look at an example of how it would actually work. For this example, we will be looking at a 2-bed end-of-terrace property in Bolton, M46 0QS. We have already researched the area and have decided that Bolton is a good area to invest in because it has great connections to the city of Manchester and will likely grow as property in Manchester gets more expensive, forcing people to move outwards. We have also set ourselves the goal of making an ROI of at least 15%. Knowing that, let’s jump into this example:

1. We need to analyse this deal to make sure that it meets our criteria

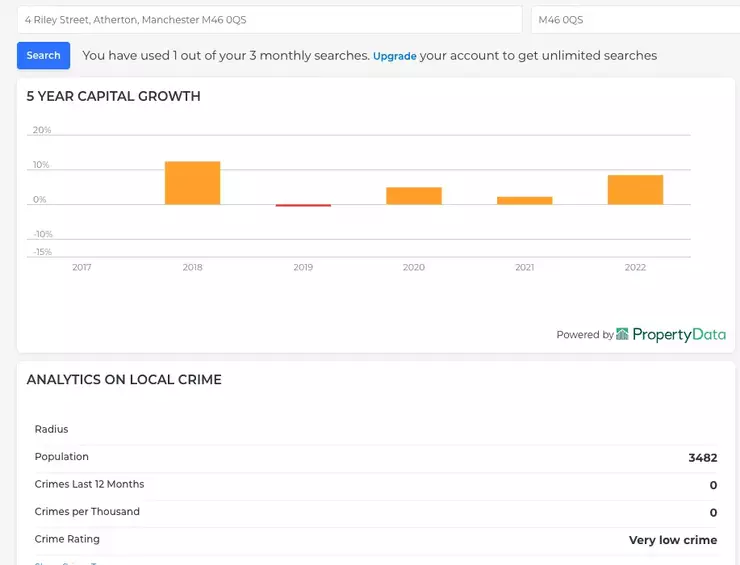

We can see that this property is quite run down and is in need of a total refurbishment. There are slight signs of dampness but nothing too serious. To check that it meets our postcode criteria, we use Lendlord’s free postcode information tool – which can be found in the deal analyser.

As you can see, this postcode has experienced a good amount of growth over the past 5 years, it has a very low crime rate and there are some good schooling options. We also conducted some further research using Property Data, Streetcheck and Google Maps to find that the rest of our criteria were also met – a standout finding being that 108 out of the 140 properties in this postcode are either owned outright or owned with a mortgage. This shows us that the demand for properties here is incredibly high.

2. What’s the current price and the end value

We now know that the property is located in a good area and there is a lot of demand for properties here. It’s time to work out the property’s current value as well as its end value – how much it would be worth after we have refurbished it. This is incredibly easy to work out, we just use Lendlord’s Property Value Estimator. I find that its estimations are spot on and it’s really simple to learn so I highly recommend it. For this example, we were given the following figures:

Current value = £105,000

End value = £160,000

Now that we have that information, we can move on to the next step.

3. Calculate the profit potential

It’s now time to figure out whether flipping this property would give us our desired 15% ROI.

Note – For a step-by-step breakdown of how to calculate the profit potential for a flip, refer to this guide. It talks you through which metrics are necessary in order to calculate the potential profit.

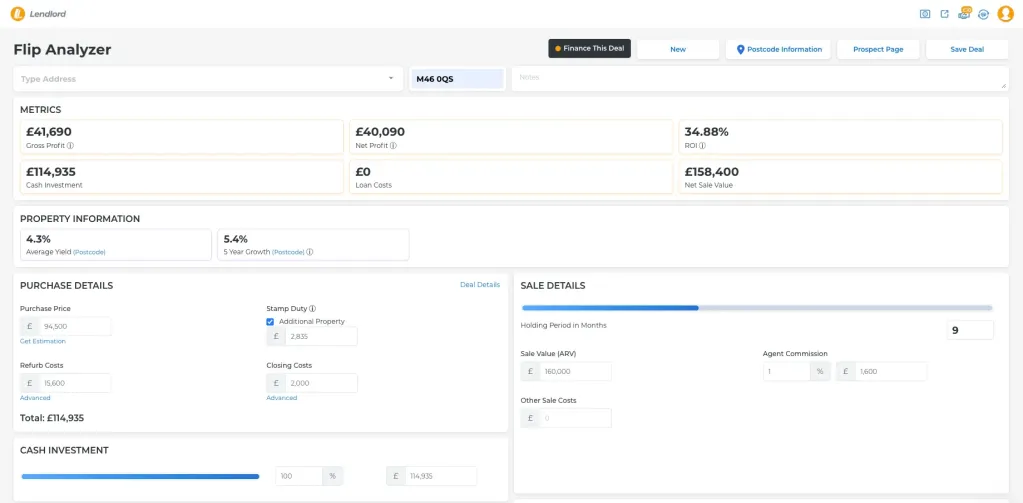

Essentially, you just need to know all of the costs associated with the purchase of the property and then you pop those figures into Lendlord’s flip analyser. For this example, I have already worked out all of the costs associated with buying this property. I’m assuming that we’re buying with cash because it’s easier to understand and the ROI would be similar if we were to purchase via a bridging loan anyways.

Purchase price = £94,500 (because we are a cash buyer, we managed to secure a 10% discount)

Purchase costs = £5,835

Refurb costs = £15,600

Monthly holding costs = £375

Agent commission = £1,700

Time taken to flip the property = 9 months

We now simply pop these figures into the flip analyser:

The profit potential for flipping this property is £40,090 which equates to an ROI of 34.88%. This is a fantastic return on investment and definitely meets our profit criteria.

4. Make an offer, refurbish it and sell it

Since the property meets all of our criteria, we make an offer of £94,500 and it is accepted. We then proceed with the purchasing process, the refurbishment and eventually we sell the property. If everything goes to plan, we should be £40,000 richer after selling this property.

Tax On Flipping Houses UK

The last topic to talk about is everyone’s favourite – tax. If you are purchasing the property as an investment, you will have to pay capital gains tax on any profits made from house flipping. However, if you decide to flip your residential property, a.k.a the house you live in, you’ll be pleased to hear that there is no capital gains tax on residential property.

Final Thoughts

Congratulations on reaching the final stages of your house-flipping journey! Throughout this blog post, we’ve covered the essential steps and considerations for successfully flipping a house in the UK market. By following a systematic approach and staying informed, you can increase your chances of a profitable flip.

Best of luck with your future house-flipping endeavours in the UK market. If you would like to learn more about the art of property flipping, consider checking out the rest of our house flipping guides.

Recommended Tools:

Victor Sterling

Hi, my name’s Victor - I’ve been investing in property for three years now, with my preferred strategies being buy-to-let, BRR and house flips. My goal with Amateur Landlord is simple - to provide beginners with easy-to-follow resources that simply weren’t around when I started, and to offer these for free and without ads.