Quick Navigation

- Buy-to-let remains a good investment despite rising mortgage rates.

- Northern cities like Liverpool, Manchester, Leeds, and Newcastle still offer good rental yields despite current 5% mortgage rates.

- The return on capital employed (ROCE) remains positive even with higher mortgage rates and potential rent stabilisation, making buy-to-lets resilient, especially in Northern cities.

For aspiring property investors, the question of whether buy-to-let is still a worthwhile investment opportunity is a common concern. With evolving market conditions and regulatory changes, it’s essential to assess the potential returns and associated risks before embarking on a buy-to-let venture. By examining relevant statistics and market insights, we can gain a clearer understanding of the current landscape and make informed investment decisions.

In this article, we will delve into the factors that determine the profitability of buy-to-let investments, including rental yields, capital appreciation, costs, and regulatory considerations. By exploring these aspects and examining the latest data, we aim to provide a comprehensive assessment of whether buy-to-let remains a worthwhile venture in the current market – a market in which 7-8% mortgage rates are more viable than ever before.

Is Buy to Let Worth It?

Mortgage rates are set to continue rising until the end of the year with rates of 7-8% now becoming viable. But even with rates that high, buy-to-let investing will be absolutely worth it. That’s because, as doom and gloom as 7% mortgage rates sound, we must remember three things:

- The property market is driven by supply and demand so fewer people wanting to purchase houses means lower prices. However, this will not happen immediately as the property market tends to lag a few months.

- As property investors, we are here for the long term so decreased cash flow, although a bummer, isn’t the end of the world for us.

- The unfortunate truth is that increases in mortgage payments often lead to increases in rent so it’s very likely that rent will increase by around 5-10% if mortgage rates were to rise that high – we have already seen crazy rises in rent.

Mortgage rates are currently at 5% which has already killed some buy-to-let opportunities (I’m looking at you London) but you can still lock in very good yields in Northern cities, especially the ones within the Northern Powerhouse (cities such as Liverpool, Manchester, Leeds and Newcastle). The opportunity is still there as the properties continue to deliver good rental yields.

Taking a pessimistic approach, let’s say that towards the end of 2024, the mortgage rates sit at 7.5%. Whilst that would severely hurt the cash flow of the Northern properties (not to mention properties down South whose owners would be having a horrible time indeed), it would be likely that we would see a decline in property prices. How large would this decline in prices be? It’s hard to say but predictions vary from 6% to 15% with the general consensus sitting at around the 10% mark. On top of that, any sellers would be incredibly motivated to sell their property quickly, even below the market value, as panic sets into the market with the majority of investors and homebuyers running for the hills.

To get a better understanding of how higher mortgage rates would affect buy-to-let properties, let’s look at an example – a two-bedroom semi-detached property in Liverpool, L6 4DU. The property has recently been refurbished to a great standard and has been popped on the market for us to snap up. We’ll see how the numbers stack up for this rental with interest rates at 5% and if they were to increase to 7.5%.

Our handy property value estimator tool from Lendlord tells us that this property is worth £105,000 as of right now. Because it’s a turnkey property and we can rent it out immediately, we decided to buy it for that price. A bit of research also tells us that this property would rent for around £675 – £700. Now, let’s compare the numbers:

| 5% Mortgage Rates | 7.5% Mortgage Rates | |

|---|---|---|

| Property Value | 105,000 | 89,250 |

| Total Money In The Deal | 32,500 | 27,700 |

| Monthly Rental Income | 675 | 710 |

| Mortgage Repayment | -328 | -422 |

| Landlord Insurance | -25 | -25 |

| Management Costs (10% plus VAT) | -81 | -85 |

| Monthly Profit | 241 | 178 |

| Annual Profit | 2,892 | 2,136 |

| Return on Capital Employed (ROCE) | 8.90% | 7.71% |

As you can see, if the worst-case scenario were to play out and mortgage rates reach 7.5%, the expected fall in property prices along with a 5% rise in rents would go a very long way in cushioning your ROCE (return on capital invested). Not so doom and gloom anymore is it?

Now, there’s always going to be that one doubter who assumes a scenario even worse than the above – they will ask ‘what if prices don’t fall but mortgage rates go up to 7.5%? Well, don’t worry, if that unrealistic expectation were to somehow come true, property investors in the North will still be okay. For that scenario, the ROCE would be 6.57%.

But what if that scenario occurs and you choose not to raise your rent by 5% because you want to help your tenants out? Does that kill northern properties? Nope, ROCE would still be 5.28%.

The point is that buy-to-lets will survive so if you’re scared of purchasing a buy-to-let because of what’s happening right now, you really shouldn’t be. Well, maybe if you’re purchasing one in London, you should start rethinking your decision – for that last scenario, the ROCE of a similar property in Greater London which costs £350,000 would be -0.92%, yikes. You’re far better off putting your money in a savings account.

Does this all mean that buy-to-let is a good investment? Let’s explore that next.

Is buy to let a good investment?

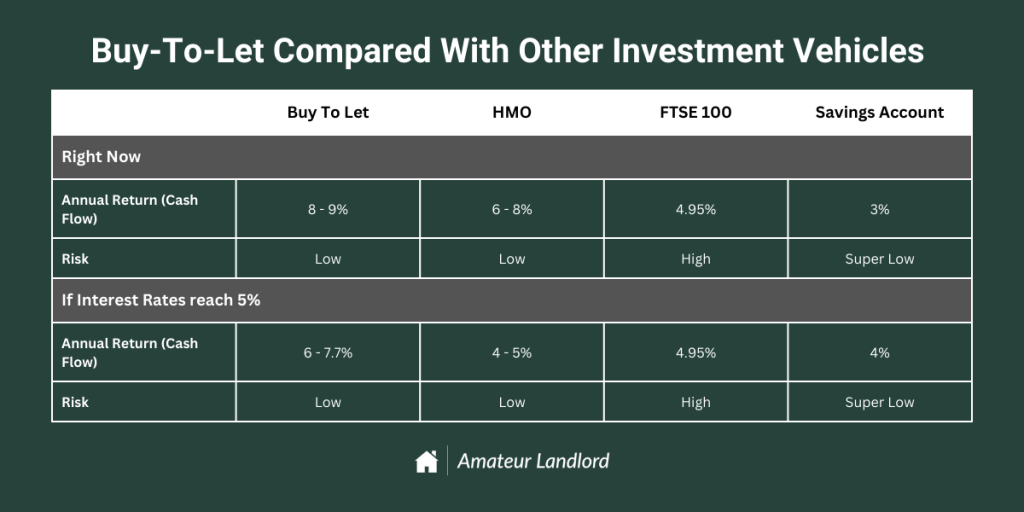

I would definitely say so – the way the market responds to raising mortgage rates cushions the effect of those higher payments. Even if property prices didn’t come down for some reason and rents wouldn’t increase by 5%, a property in the Northern Powerhouse would still likely have a ROCE of around 5-6%. While that’s not quite the same as what Northern investors are used to, it’s still far better than what properties in the South will return; not to mention that it will still be better than keeping your hard-earned cash in your bank account. But how does this compare with other property investment strategies and even other asset classes? Let’s have a look:

Buy to let properties edge out against HMO property investments (This is mostly due to the landlord being responsible for the utility bills in HMOs which are quite pricey at the moment and show no sign of coming down for a good while), they also wipe the floor with investing into a high yield index fund such at the FTSE 100 because of the risk involved. However, the savings account makes a compelling case since the risk is virtually zero.

Let’s look into these buy-to-let alternatives in more detail.

Buy-To-Let Alternatives

Let’s look at the following as alternatives to purchasing a buy-to-let property:

HMOs

A HMO will, in most cases, produce a higher return on capital invested (ROCE) than a buy-to-let property so if you want to go through the extra hustle of having upwards of 3 different tenants in your property, then this is a no-brainer for you. But before you go and start looking for HMOs, it’s important to mention that HMOs require more capital to be invested as the landlord must furnish the property to a good standard and the ongoing costs are also much higher because the landlord is responsible for paying the council tax along with the utility bills. Considering the sky-high utility bills, your ROCE will be more or less level with a buy-to-let, or it can be less in some cases.

Investing into HMOs right now is definitely worthwhile but you are very much hoping for the costs of living to come down. If you would like to learn more about HMOs, check out our comprehensive HMO guide.

FTSE 100

If you’re looking for a way to put your money into an asset and do literally nothing with it for years to come, buying an index fund such as the FTSE 100 can be a good bet. The trouble is that an index fund doesn’t produce cash flow, not even one with a dividend because most times that dividend will be invested back into the index fund. You also run the risk of the dividend changing, and considering the economic outlook, the dividend is far more likely to decrease than increase.

Whilst this is a decent alternative, I don’t think it’s better than investing in buy-to-let properties. Running with the figures we worked out earlier, a buy-to-let property would bring in a cash flow of 6 – 7.7% if interest rates were to hit 5%. That cash flow is pretty much guaranteed (unless your tenants decide to stop paying). Another upside of buy to lets over an index fund is that the property market is far less volatile than the stock market so whilst property may see a drop of 10%, the stock market may drop more than 30%.

A Savings Account

In normal circumstances, you wouldn’t ever catch me recommending a savings account as an alternative to property investment. However, if interest rates were to rise to 5%, a flexible savings account would likely offer 3.5% and a locked savings account (funds are locked for 120 days) would offer around 4.5 – 5%. Since you are protected up to £75,000, this would be an incredibly safe way to earn a decent return whilst there’s blood in the streets.

However, there’s no upside to keeping your money in a savings account. Whereas your property can, and likely will, increase in value, the cash in your savings account will not. And considering that we buy a property with a mortgage, thus leveraging our exposure, a mere 3% gain in the value of your property would result in a 12% gain on your invested capital!

The Key to Successful Investments

The Pros of buy-to-let

1) A buy-to-let property has two ways of earning a return

If you’ve read any of the guides in the ‘Property Investing basics’ series, you may accuse me of sounding like a broken record. But I will continue to shout this from the rooftops because it’s a massive benefit of investing in property – unlike other assets, property will earn you a return from both rental income and capital appreciation. This results in a far larger return on your money than investing in indexes for example – the FTSE 100 will, on average, make an annual return of 6-7%, but a good rental property will earn you a whole lot more.

For example, the property mentioned above has seen an average annual growth of 8.8% and because we are leveraging via a mortgage, that return quadruples to 35.2%! I will admit that this is an unusual amount of growth and is due to the property being located in Anfield (I got lucky when choosing the example). The average growth for Liverpool over the last 12 years has been 4.82%, which is a far more realistic number – this equates to an average return of 19.28% on the capital invested.

2) The property market is less volatile

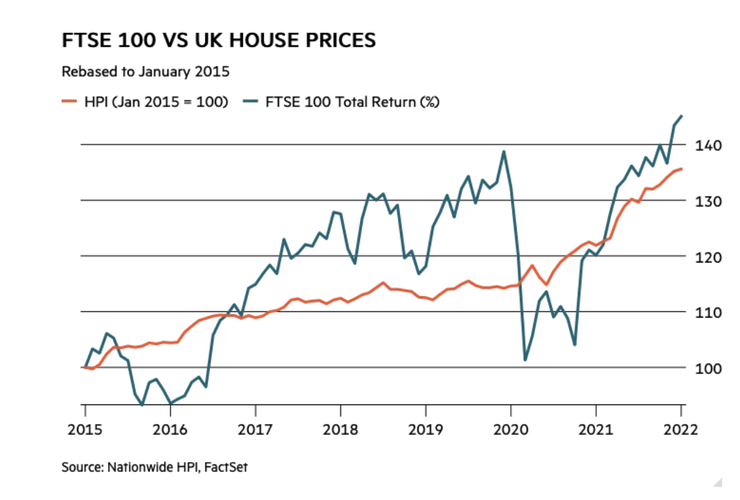

Compared to the stock market, the property market is far less volatile. Whereas the stock market can crash by more than 30%, the property market merely dips. Just look at the below chart which I have borrowed from The Investors Chronicle.

As you can see, the property market isn’t affected as much as the stock market is – compared to the FTSE 100, the UK property market barely drops making it a far safer investment. It’s also worth pointing out that the overall return is more or less the same but that doesn’t account for leverage via a mortgage so, in reality, the FTSE 100 is by far the interior asset.

The Cons of buy-to-let

1) Location is incredibly important

If you choose to invest in a bad location which sees no capital growth (guide on how to avoid picking a bad location), or you choose to invest in an area like London which is on the verge of going negative in terms of rental income, you will not benefit from the above-mentioned advantages.

It’s also commonplace for more expensive properties to get hit harder when the market turns so properties in the South may experience a larger decrease in value if the market were to turn this year.

2) If the property is void for a long time, you’re in trouble

If for whatever reason the property is void for a prolonged about of time, your positive rental return will turn into a negative one as you have no rental income coming in. On top of that, you are now responsible for paying the bills and council tax which only increases your liabilities. While this shouldn’t be an issue if your property is in good condition and in a high-demand area, it’s definitely something that needs to be considered.

Buy-to-let Capital Gains Tax

When considering the profitability of buy-to-let investments, it’s crucial to take into account the impact of capital gains tax (CGT) on your potential returns. CGT is a tax levied on the profit made from selling an asset, including investment properties. As a beginner investor, understanding how CGT works and its potential implications is essential for making informed decisions.

In the United Kingdom, the CGT rate for residential property sales is determined by your income tax bracket. As of the current tax year (2023/2024), basic rate taxpayers pay a CGT rate of 18% on property sales, while higher and additional rate taxpayers face a CGT rate of 28%. It’s important to note that these rates and thresholds are subject to change, so it’s advisable to refer to official government sources or consult with a tax professional for the most up-to-date information.

Calculating CGT involves deducting the purchase price and any allowable costs, such as legal fees and stamp duty, from the sale price. The resulting profit is then subject to the applicable CGT rate. However, it’s worth mentioning that you may be eligible for certain tax reliefs or exemptions, such as the annual tax-free allowance known as the “Annual Exempt Amount.” For the tax year 2023/2024, this amount is set at £14,500 for individuals.

Selling a buy-to-let property that has experienced significant capital appreciation can result in a substantial CGT liability. Therefore, it’s advisable to carefully evaluate the potential gains and assess the long-term viability of your investment strategy.

To navigate the complexities of CGT and maximise your returns, it’s highly recommended to consult with a qualified tax advisor or accountant who can provide tailored advice based on your specific circumstances. They can help you explore strategies to minimize CGT liabilities, such as utilising tax reliefs and allowances available to property investors.

By understanding the implications of CGT on your buy-to-let investments, you can make informed decisions and develop a comprehensive investment strategy that aligns with your financial goals.

Final Thoughts

I do believe that buy-to-lets are good investments and are most definitely still worth it. That may not be the case in every area of the UK but it’s definitely the case for Northern properties that were already benefiting from high yields. If you had or were considering buying properties in the South, you need to ensure that the numbers will still work at higher mortgage interest rates such as 7% or even 9% – stress testing is an important aspect of analysing any property investment. While I don’t think we’ll see 9% rates, it’s a good idea to make sure that even then, your investment will not become a liability.

I hope that this guide has shed some light on how the property market will withstand the likely upcoming recession and has helped you make your mind up in regards to where you should park your hard-earned cash. I should mention here that this, of course, is not financial advice and you should do your own research before investing in any asset.

Victor Sterling

Hi, my name’s Victor - I’ve been investing in property for three years now, with my preferred strategies being buy-to-let, BRR and house flips. My goal with Amateur Landlord is simple - to provide beginners with easy-to-follow resources that simply weren’t around when I started, and to offer these for free and without ads.