Quick Navigation

- Property remains a good investment choice due to its potential for significant returns through both rental income and capital appreciation.

- Using Liverpool as a case study, the average annual gain for a rental bought via a BTL mortgage, combining rental income and capital appreciation is 33.45%.

- Historical data shows property prices doubling every decade.

Is property still a good investment in 2024? It’s a question on the minds of many prospective investors considering whether or not they should park their money in these assets. As the world evolves and economic landscapes change, it’s important to assess the current state of the property market and determine whether it remains a viable avenue for wealth creation.

With property being a staple of investment strategies for generations, it’s essential to understand how it stands amidst today’s economic climate. Whether you’re a first-time investor or seeking to expand your existing portfolio, this guide will equip you with the knowledge and analysis needed to evaluate the potential of property as an investment avenue in 2024.

So, let’s dive in and uncover the opportunities, challenges, and considerations that come with investing in property. By the end of this blog post, you’ll have a clearer understanding of whether property holds its position as a solid investment choice in the ever-changing landscape of the market.

Is Property a Good Investment?

Property is hands down one of the most popular investment options out there. And there’s a darn good reason why people flock to property investment – it offers incredible returns and a low-risk profile that’s hard to beat.

Now, here’s the thing that the naysayers often overlook: investing in property opens up not one, but two avenues for making money. You’ve got the rental income, which starts flowing into your pockets pretty darn quickly. But the real secret sauce of property investment lies in capital appreciation. When you consider both rental income and capital appreciation, it becomes pretty hard to find a reason why you wouldn’t want to invest in property. And we haven’t even touched on the fact that you can leverage your property investment by using a mortgage.

But hold on a minute, my friend. I can sense your curiosity piquing. You want to see some real-life results, don’t you? Well, let’s dive into a quick example of an investment property and compare its performance with other investment options. Trust me, the numbers will speak for themselves!

So buckle up, my fellow investors. It’s time to explore the exciting world of property investments and discover why it’s a smart move that can set you up for financial success. Let’s dive in and crunch those numbers together!

UK Investment Property Example

In our ‘what is an investment property and how does it work’ guide, we looked at the example of a two-bed terraced property in Liverpool, L14. For an in-depth breakdown, I’d recommend popping over to that guide quickly, after which you should return here. In this article, we’re just going to focus on the numbers:

| Capital Invested | Annual Profit | ROCE (Return on capital employed) | |

|---|---|---|---|

| Managed Property | £33,750 | £1,932 | 5.72% |

| Self-Managed Property | £33,750 | £2,940 | 8.71% |

Depending on whether you choose to manage the property yourself or you hire a management company, you’re going to make a return of 5.72 to 8.71%.

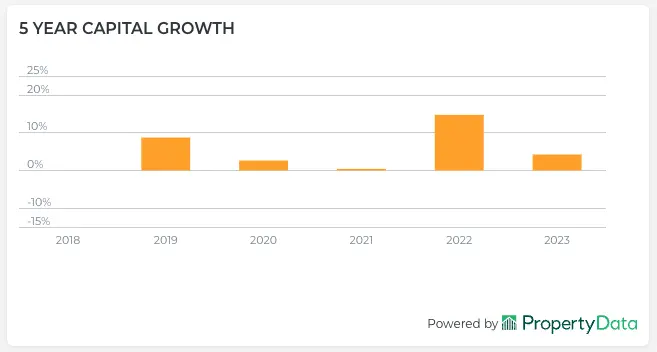

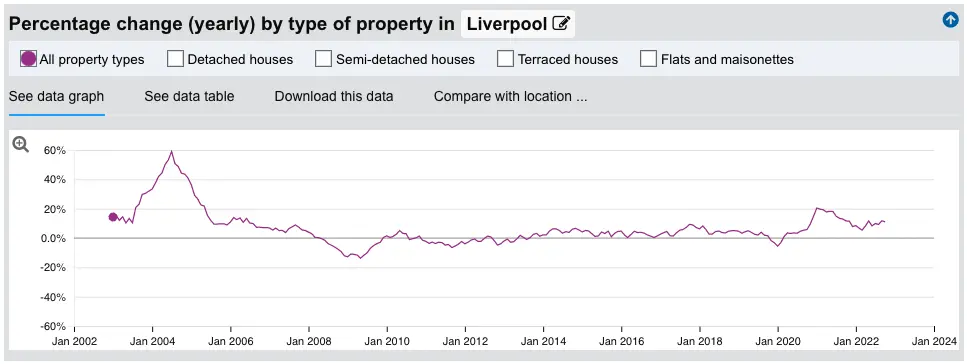

Now, let’s look at the historical capital appreciation for the local area and for Liverpool. Yes, historical data is not a predictor of future returns but it’s the best data we have plus we would do the same for any other investment vehicle we’d consider. We’re going to use two tools for this – Lendlord to check the local capital growth and the UK House Price Index to check the growth for Liverpool.

Using Lendlord’s postcode information tool, we find that this postcode has seen an average growth of 6.12% per year. Now, let’s check what the past 20 years have looked like for Liverpool.

Having added up all of the yearly % changes for the past 20 years and then divided by 20, we end up at an average annual gain of 6.69%.

This is where it gets really good – because we most likely bought the property with a buy to let mortgage (25% deposit), it means that the capital appreciation that we see on our invested amount is actually leveraged 4 times. All of a sudden, that 6.69% annual average gain becomes a 26.76% gain!

Combining the rental income and average annual capital appreciation of the property gives us an average annual gain of 33.45%.

As you can see, focusing on just rental income when evaluating whether property investment is worth it is pretty stupid. This example also proves one of my initial statements – what other investment vehicle can match these results?

To really hit this point home, lets compare property investment with other investment vehicles.

The Key to Successful Investments

Property Investment vs Alternatives

If not property, where else could you park your hard-earned cash? The most popular options are:

- Stock Indexes – the S&P 500 offers the highest annual returns.

- High Yield Saving Accounts – the highest rate for unlimited deposits is 3.5% but has a 90 day notice period – offered by Mansfield BS.

- One-Year Fixed Savings – SmartSave offers the highest rate at 4.26% if locked for a year.

But how do these compare?

| Investment Property (Liverpool Example) | Stock Indexes (S&P 500) | High Yield Savings Account | One-Year Fixed Savings | |

|---|---|---|---|---|

| Cash Flow Return | 5.72 – 8.71% | n/a | 3.5% | 4.26% |

| Average Annual Capital Appreciation | 26.76% If purchased with a mortgage | 10.7% | n/a | n/a |

| Risk Level | Low | High | Super Low | Super Low |

There simply isn’t anything else that comes close to property. Although a case could be made for investing in stock indexes if you weren’t bothered to go through the property purchasing and managing processes. Having said that, a potential extra 16% annually for jumping through some hoops is definitely worth it, at least for me.

Why Is UK Property Such A Good Investment?

The UK property market benefits from multiple factors that are responsible for driving its rather brilliant performance:

Supply & Demand

The UK has a chronic issue which only gets worser by the year – there is an ever-growing undersupply of property. This is largely down to UK developers not being able to keep up with demand, planning for new builds being notrousily hard to get and a little thing called ‘the green belt’ – land surrounding the UK’s largest cities that is protected and thus, cannot be built on.

Combine this with growing demand for both, rentals and properties to purchase, especially in cities, and you have yourself a perfect storm for increasing property prices.

UK House Price Growth

Ever since the first Domesday Book survey was ordered in 1085 (a detailed survey and valuation of UK land and property), property prices have doubled, on average, every 10 years – a trend that has continued into the 21st century although It does show signs of slowing down. Between 2003 and 2013, there was only a 34.35% increase, whereas between 2013 and 2024, there was a 78.87% increase.

Looking forward into the future, Savills estimates that in the next 3 years, property prices will further grow by 7.5% – London is estimated to stagnate and only see 3% growth whereas Northern areas such as the North East are estimated to lead the pack by growing 10%.

Annual Rental Increases

Most landlords will insert annual rental increases into their tenant contracts, raising rents in line with inflation – typically between 2 and 5%.

Whilst it may not seem like a large increase, it adds up and most importantly increases your profits. For example, if your rent is set at £700 per month, a 5% increase would result in £420 of addition profit the following year.

Rental Demand Is Increasing

The reason for this is two-fold:

- As property prices increase, people’s wages do not, making their dream of one day owning a house harder to achieve. Since they can’t afford to buy their homes, they will rent for longer.

- People are interested in living luxurious lifestyles – eating out often, buying/leasing nicer cars than they can afford and buying designer clothing. All of this leaves them with less money and no option but to continue renting.

Going back to our previous point on there being an undersupply of property, what do you think will happen to rental prices if more people want to rent? Yes, that’s correct, they’ll go up even higher!

UK Property Investment Pros

- You earn a rental income and your property appreciates in value (if you chose your location well).

- There’s an opportunity to add value to your investment by refurbishing the property.

- The property market is far less volatile than the stock market. For example, between 2015 and 2022, the S&P 500 has seen two 30% drops whereas the UK property market only saw drops of 2-3% in that time.

UK Property Investment Cons

- Location is an important factor in your property investment. If you don’t do your research and end of investing in a location that doesn’t have a strong demand, you likely won’t see such a good return on your investment.

- If your property is void (meaning that no one is living there), you will have to pay all the associated costs such as the council tax and utilities bills, not to mention the mortgage. This will dig into your rental income, thus harming your returns.

Is It A Good Time To Invest In Property?

2024 is likely going to be a rough year for the property market as interest rates are likely to increase further, driving mortgage rates up. This will naturally decrease demand for property from both home-owners and property investors. Decreased demand, even with the UKs under-supply of property, will lead to a drop in prices. By how much? Nobody really knows but predictions vary from 6% to 15%.

As any investor should know, when prices drop we get our cash out. A drop in property prices can be viewed as a nice discount off any property investments we wish to make – one that can be negotiated down a few percent more as there will be less interest in any property you are going for.

All of this makes 2024 a great time to invest in property, at least in my opinion. If you’re a long-term property investor, you shouldn’t be too concerned about the current state of the property market, instead, you should focus on getting the best possible deal you can – there will always be great deals in any market.

Final Thoughts

If you were wondering whether property investment is a good idea, I hope that I have helped you make your mind up by walking you through an example of a property investment and by comparing a buy-to-let property with alternative investments. I’d also recommend reading our article on whether buy to let is worth it in 2024 – it dives deeper into the topic and showcases how your property investment would perform if mortgage rates were to hit 7-8%.

Recommended Tools:

Victor Sterling

Hi, my name’s Victor - I’ve been investing in property for three years now, with my preferred strategies being buy-to-let, BRR and house flips. My goal with Amateur Landlord is simple - to provide beginners with easy-to-follow resources that simply weren’t around when I started, and to offer these for free and without ads.