Quick Navigation

- Effective negotiation skills can save house buyers a lot of money, especially in uncertain times when sellers are eager to close deals.

- Before making an offer, it’s essential to accurately value the property, either by comparing similar properties or using tools like Lendlord. Generally, starting with an offer 5-10% below the property’s worth is recommended.

- Successful property price negotiation involves being well-prepared, understanding the seller’s situation, justifying your offer, taking a strategic approach to counteroffers, and being willing to walk away if necessary.

Being able to negotiate house prices effectively is by far one of the best skills for house buyers to possess – not only will it help you to shave off thousands from the purchase price, but it’s also a skillset that can be applied to other areas of life.

What’s more, it’s a skill that can yield fantastic results right now. We live in slightly confusing times in which we’re half expecting a recession that doesn’t seem to want to arrive. All this is keeping sellers on edge and making them want to sell their property as fast as possible. This is great news for you because they’re more likely to accept below-the-market offers.

In this guide, we’re going to look at how to negotiate property prices effectively, starting with how to correctly value the property, how much you should offer on it and lastly provide you with a handful of tips for successfully negotiating the price of a property.

How to Value the Property?

Before you even think about contacting the estate agent, you need to research the property and value it – you may be shocked to know that those pesky estate agents often add a few per cent to the asking price meaning that it’s not a reliable valuation of the property. Luckily, doing your own valuation isn’t too hard; you can do it in either of two ways:

- Find comparable properties – on Rightmove or Zoopla, you can look at nearby properties that have recently sold. Simply find a few that are exactly the same as the property that you are looking at (same number of bedrooms, layout, square footage etc). This will give you a good idea of how much the property would be worth.

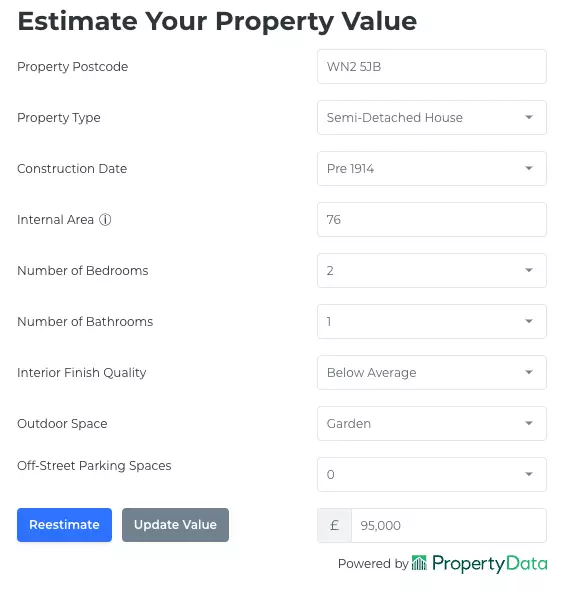

- Use a property valuation tool – this is our preferred method as it’s quicker and often more reliable (even if you prefer the first method, you can double-check your numbers with this tool). Our recommended tool is Lendlord as it’s free and easy to use. Once you sign up, head over to the ‘Invest’ tab and then to the rental analyser. Here you’ll be able to find the property valuation tool. It looks like so:

If you’d like to find out more about Lendlord and our other recommended property analysis tools, we have a handy breakdown linked above in the site menu.

How Much Should You Offer on a House?

There’s a lot of varying advice out there regarding how much you should offer on a house, and frankly, It all depends on how fast you want to get a deal accepted and how serious you are about getting the best deal possible.

In general, I’d recommend making an offer that is around 5-10% lower than what the property is currently worth according to your research – this opens you up to the possibility of getting a slight discount and also allows for some wiggle room when negotiations begin. If, however, you’re willing to play hardball and risk having the door slammed in your face, you can begin by making an offer that’s 20% lower than the property’s value. If you’re a cash buyer, you may be able to regularly make offers that are 20% lower and have them accepted, especially if the vendor requires a quick sale.

Having said that, because you start with a below the market offer, doesn’t mean that you should only be willing to pay a reduced price – there is nothing wrong with agreeing on a market value sale price. After all, it’s only fair and it’s the easiest way to get your offer accepted.

The Key to Successful Investments

Tips for Negotiating House Prices

There isn’t a specific strategy that you should use for negotiating house prices as every situation will be different, and ultimately it comes down to your interpersonal skills and your understanding of the vendor’s situation. Having that in mind, we have listed some tips for how to negotiate property prices successfully:

1. Get everything ready

Don’t be an ill-prepared buyer as that will make you look like an amateur and nobody wants to deal with those. Before you even begin looking for properties, get a mortgage in principle ready, find a solicitor and gather all of the necessary documents. When chatting to the vendor, be sure to mention that you already have everything in place and ready to go – this will speak volumes for how serious of a buyer you are and it will be something that you can lean on during negotiations.

2. Understand why they’re selling the house

Are they selling their property due to a divorce or relationship breakdown? Or perhaps they’re desperate to downsize in order to save on living costs? Seek to gain a better understanding of why the vendor is opting to sell their house. There are two key benefits to this:

1) It’s an opportunity to build rapport with them and sympathise with their situation.

2) This will give you a good idea of how desperate they are to sell, whether they need to move fast and if they’re willing to accept a lower price; every bit of information is valuable when it comes to negotiating the property price.

3. Justify your offer

Provide a brief explanation behind your offer so that the vendor understands why it’s lower than their asking price. Be it that comparable properties are cheaper, the boiler or electrics need updating or whatever other reason it may be. Most people are perfectly logical individuals so they should understand.

4. Try to meet halfway (but still closer to you)

Most negotiations go like this – you will increase your offer and the seller will decrease theirs until you meet in the middle. This is a sound tactic and often results in agreeing on a price that works for both of you. But if you want to get the best deal possible, make them move two steps for every step you take, this will help you to get the best deal possible whilst also keeping the seller happy. How do you achieve this? Simply take more time to increase your offer and chew it over, the vendor will likely lower there’s a tad bit more if they feel that you may walk away.

5. Never alter your offer in the same conversation

As soon as you alter your offer within the same conversation, you’ll lose the high ground immediately. It’s better to play it cool and ask whether you can get back to them after running your numbers. Make it clear that you’re doubtful about an increased offer but you’ll check your numbers again just to be sure. Then give it a few hours and call them back with a revised offer or the same offer if you do not wish to improve upon it.

6. Ask this question

A brilliant question to ask is “What’s the lowest you could accept and still be happy with?” The trick here is to ask and let them think. As soon as they state a number that’s lower than the asking price, you’ll be in a better position than they are throughout the negotiations. Also, there’s a chance that they may quote you a figure that you’re perfectly happy with from the get-go.

7. Don’t set your heart on the house

You cannot let emotions get the better of you. Remember that there are thousands of other properties just like the one you’re looking at, which will be coming onto the market in the coming months so there’s no rush to get an offer accepted as soon as possible. Stay calm and collected, be friendly and more than anything, just be willing to walk away if the deal doesn’t work for you.

8. Be willing to walk away

If the vendor isn’t willing to budge and you cannot pay what they’re asking for, the easiest way to get them to think twice is to genuinely be willing to walk away from the deal.

Final Thoughts

If you follow the advice laid out in this guide, you’ll give yourself a better shot at successfully negotiating the price of a property and hopefully manage to shave off thousands from the initial asking price.

Victor Sterling

Hi, my name’s Victor - I’ve been investing in property for three years now, with my preferred strategies being buy-to-let, BRR and house flips. My goal with Amateur Landlord is simple - to provide beginners with easy-to-follow resources that simply weren’t around when I started, and to offer these for free and without ads.