Quick Navigation

- Buy To Let: Single-let residential houses are purchased with a buy-to-let mortgage and rented out. Notable for its simplicity.

- Buy Refurbish Refinance (BRR): This involves buying a run-down property, refurbishing it to increase its value, then refinancing to pull out money, and renting it out.

- House of Multiple Occupancy (HMO): Properties rented out per room to multiple tenants. Generates higher cash flow than standard buy-to-lets but requires higher investment.

- Property Flipping: A short term strategy where you purchase a run-down property, fix it up and sell it for a hefty profit.

When you first dive into the world of property investing, you may find yourself swarmed with all the different investment strategies available to you. I remember when I was in that exact position, I would be dead-set on investing in buy-to-lets and then get a bad case of the shiny penny syndrome and jump to higher yielding strategies such as HMOs, then I would change my mind again and focus on B.R.R, only to jump to property flipping a few weeks later.

It’s essential that you don’t follow in my footsteps and jump around like that – you simply won’t get anywhere. You need to have a half-decent idea of which property investment strategy matches your goals so that you know where to focus your time. That’s why we’re putting this guide together, to present you with a concise overview of all the best property investment strategies. For each strategy, we will explain what it is and how it works, its pros and cons, and provide you with an example including the potential returns.

Once you have a better idea of which property investment strategy you would like to utilise, be sure to check out our in-depth guides on each one, where we teach you everything you will ever need to know about that specific strategy.

Buy To Let

Buy-to-let is the most popular property investment strategy in the UK. When people talk about buy-to-let properties, they are often referring to single-let residential houses – these are properties that are let out to single tenants, families or groups of friends.

How it works is pretty straightforward – you would purchase a property under a buy-to-let mortgage, find a tenant who wants to rent your house/apartment out (this should be pretty easy since there is high demand for rental properties) and rent it to them. From that point on, it’s as close to passive income as you can possibly get within property investment. Apart from the odd phone call here and there about the boiler not working or a small leak, you’ll just be sitting at home collecting rent.

Buy-to-Let Example

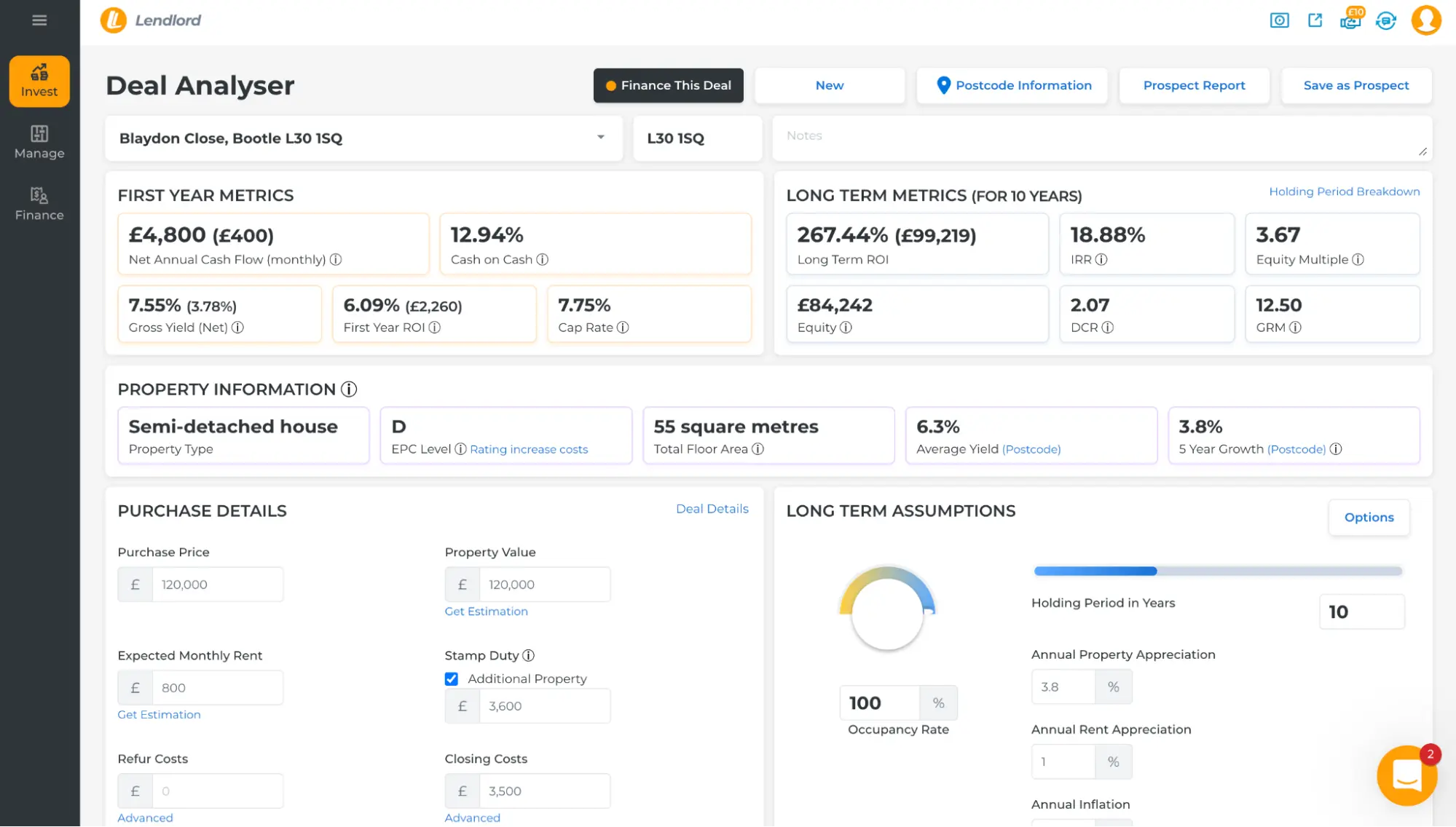

Let’s look at the below example of a buy-to-let property – a 3-bed semi-detached house in Liverpool, L30.

According to Lendlords free property value estimator (found in the deal analyser) this house, in its great condition, is worth around £120-125k.

Let’s say that you purchase this property for £120,000 (this being made up of a £30,000 deposit and a £90,000 mortgage), your all-in cost for this investment would be around £37,100 – the additional £7,100 being due to stamp duty, legal costs, surveys and such – view our complete buying an investment property guide.

Having done some quick research, I can see that this property would rent out for around £800-850 per month, with the interest-only mortgage costing around £375 (at a rate of 5%). Let’s slap those numbers into Lendlord’s deal analyser to see what kind of return on investment we could get.

As you can see, your monthly cash flow would be £400 for this property (assuming that you self-manage, if you instead use a management company, your monthly cash flow would be £320 and £3,840 annually), leaving you with a net annual cash flow of £4,800. This equates to a return of 12.93% every year. Pretty darn good if you ask me – definitely beats investing in the FTSE which, on average, returns 6.47%.

Not to mention that properties in this postcode have grown by 3.8% each year! This adds another 15.2% to your estimated annual return (quadrupled due to you buying via a mortgage). The combination of both, rental income and capital appreciation, makes this rental property strategy a simple and effective way to utilise your money.

Buy To Let Pros

- Investing in single-tenancy buy-to-lets is the simplest property investing strategy.

- It’s the least time-consuming.

- Huge rental demand means you’ll be able to get your property tenanted very quickly, limiting void periods.

- Tenant turnover is low as typically tenants will live in your property for many years.

- You benefit from a great rental Income as well as the capital appreciation of your asset.

Buy To Let Cons

- If the property is ever void (meaning there are no tenants), you will have to pay the bills.

- These are considered long-term investments which are intended to be held for years, if not decades. If you are looking for a quicker way to make significant short-term gains, this may not be the strategy for you.

If the buy-to-let property investing strategy sounds like something you wish to pursue, check out our buy to let guides for beginners including articles on the following topics:

The Key to Successful Investments

Buy Refurbish Refinance (BRR)

Let’s kick off by saying that BRR and BRRRR, or any other such variations, all refer to the same exact thing except that the second abbreviation adds rent and repeat to the name. Now that we have that crystal clear, what is buy refurbish refinance?

Think of BRR as an add-on to the buy-to-let strategy – you are purchasing a property which is run down and in need of a refurbishment before you can rent it out; or, if you prefer a lighter job, you can purchase a property which is unmodernised but could theoretically be rented out. Either way, refurbing the property will increase its value which will allow you to refinance and pull some of your money out of the deal – leaving you with a brand-new property that can be rented out for more, and you will have a smaller amount of cash in the deal resulting in a greater return on your investment.

Once again, how it works is pretty simple:

1) You find a property in need of a refurb and one which offers an opportunity to refinance at a far higher value.

2) You purchase the property.

3) You get a team of tradespeople together to fix it up.

4) A few months later, after the refurb is complete, you rent out the property to get it cash flowing.

5) You then refinance the property at a higher value, pulling a good amount of money out of the deal.

6) From this point on, it’s exactly like a buy-to-let property – you sit on your couch and watch the rent come in; albeit, with a repair here and there.

BRR Example

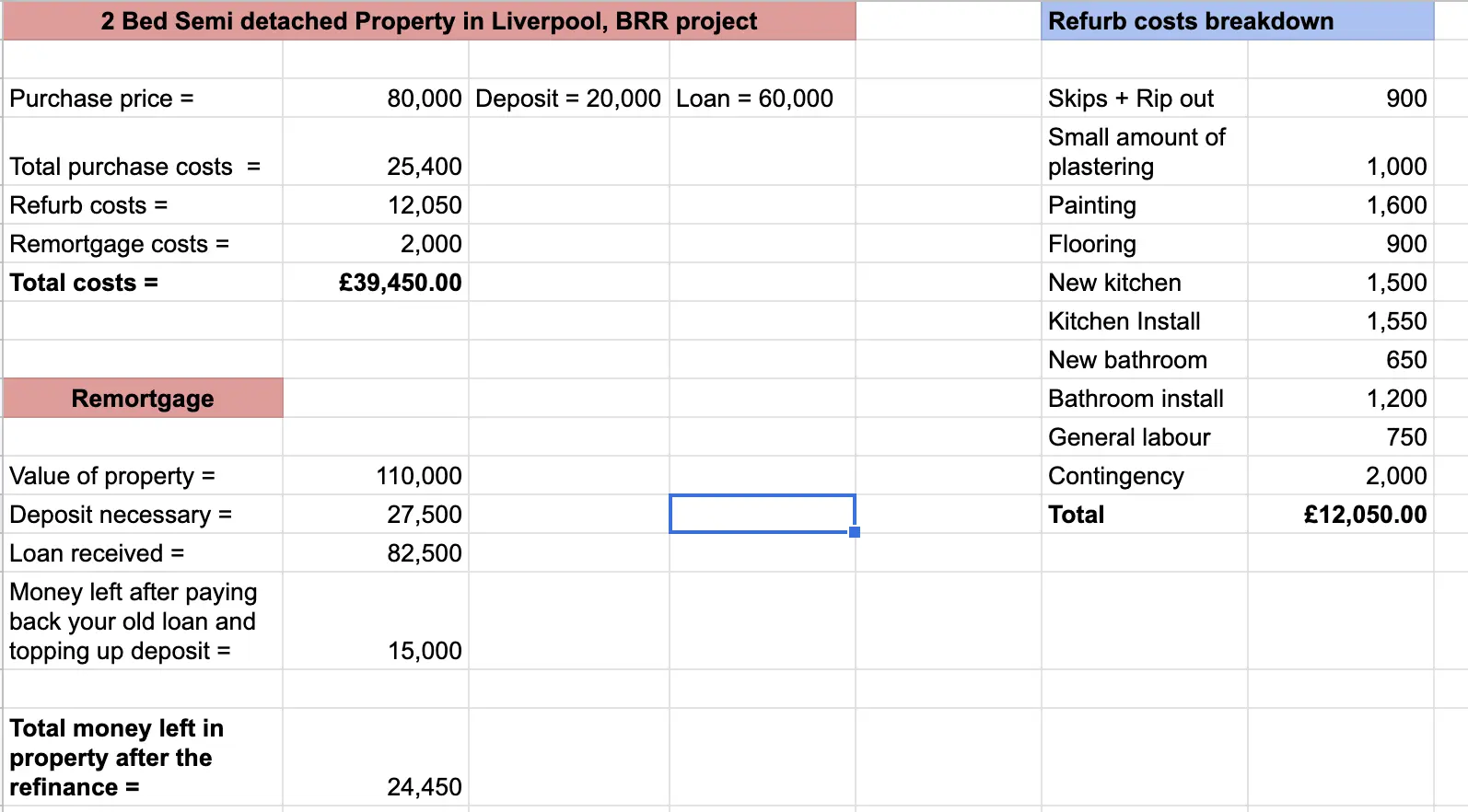

Let’s go back to Liverpool to find a BRR example. This time, we’re looking at a 2-bed semi-detached house in need of some modernisation. This property is located at CH44.

Our trusty friend Lendlord tells us that in its current unmodernised state, this 2-bed is worth £80-85k. However, if we were to refurbish this house to a great standard, it would be worth £110k and would rent out for around £700-£725 a month. This offers us a good window of opportunity.

Let’s look at the below spreadsheet where we dive into the overall costs of this BRR investment, as well as how much a typical refurbishment would cost. We also look at how much money you would have left in the deal after the refinance/remortgage.

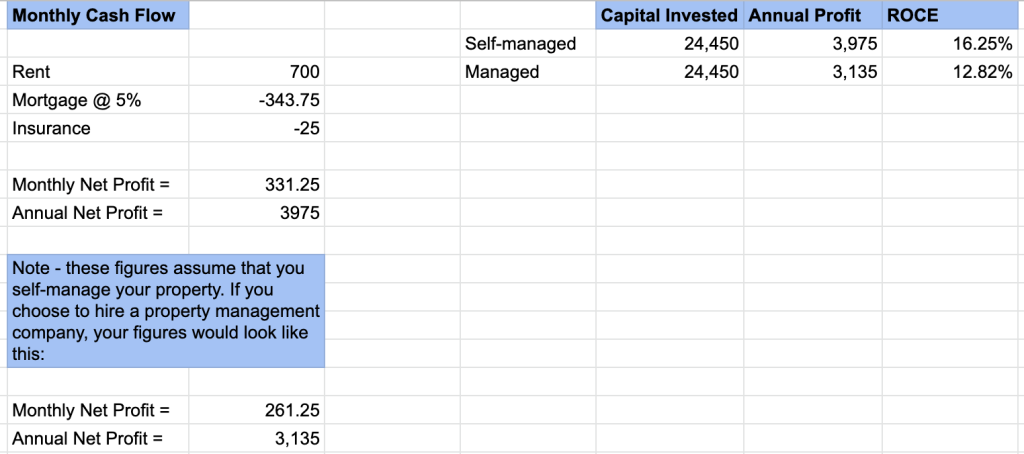

As you can see, although the initial cost of the investment was higher due to the refurb costing £12,000, after we remortgaged the property, we received £15,000 back. This left us with only £24,450 of our original cash in the deal (we have also added £7,500 in equity to the deal). Not only do we now have a property which is worth more and will rent out for more, but we have less money left in the deal than if we just left the property as it was.

But what does the annual return look like on this property after we refurbished it and remortgaged?

You would be looking at a ROCE (return on capital invested) of between 12.82 and 16.25%, depending on whether you choose to self-manage or use a management company. Either way, an incredible return.

BRR Pros

- You end up with a far better return due to having a higher quality property which will rent out for more and you’ll have less money left in the deal.

- Because you are pulling money out, you can recycle it and invest it into another property.

- As with single buy-to-lets, the tenant turnover is low.

- This is a great combination of long-term rewards and short-term rewards. You pull out a good chunk of money from the deal, receive rental income and your property appreciates in value over the long term.

BRR Cons

- You will need to cough up more money initially to pay for the refurbishment and refinancing costs.

- Whilst the property is void, you will have to pay the bills and council tax.

- The refurbishment process is often stressful as things go wrong and the project is delayed.

- There is a risk of down valuation (this is when the mortgage lenders value the property lower than what it is actually worth).

If you would like to learn more about BRR, check out our comprehensive buy refurbish refinance guide.

House of Multiple Occupancy (HMO)

HMOs are properties which have multiple tenants. Each room is rented separately to a different tenant, with the property having communal areas such as bathrooms, the kitchen and living rooms. In higher-quality HMOs, each room may come fitted with an en-suite.

The beauty of HMOs is that they will bring in more cash flow than a standard buy-to-let investment property. Each room will often be rented out at a premium because you will have to provide more than just the property. In HMOs, it is expected that you furnish the entire house and you, as the landlord, pay for the utilities – the electricity, water, gas, council tax etc.

This may turn a lot of people off, but it’s worth mentioning that even after you pay for the furniture and the monthly utilities, the cash flow from an HMO will still be higher than that of a similar property rented out as a single let (although that may not be the case in 2024 as the price of utilises has rocketed up).

Let’s look at an example:

HMO Example

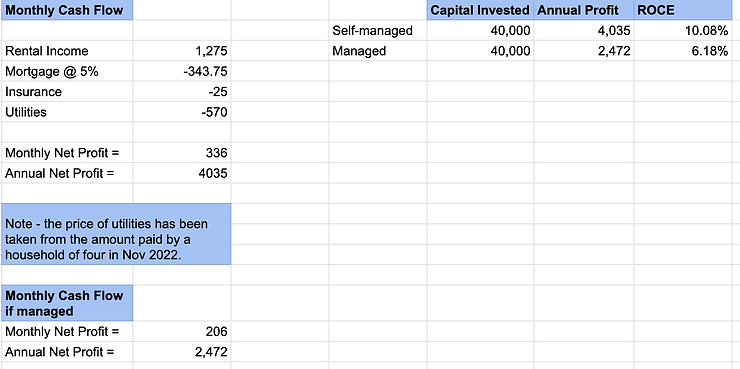

Let’s go back to the 3-bed semi-detached property that we used as an example for single residency buy-to-lets. The important metrics to remember are that it was worth £120,000 and resulted in a monthly cash flow of £400 (self-managed).

If we were to rent out that property as an HMO, we could fetch around £425 a month for each room. This would result in a gross rental income of £1,275 (around £375 – £425 more than if we rented it out as a single let). Okay so more gross income, but what about the extra expenses? Let’s have a look at our spreadsheets:

We rounded up the capital invested to £40,000 to account for the purchase of furniture for the entire property.

As you can see, the HMO produces a ROCE of 6.18 – 10.08%. This is pretty much on par with just renting the property out – this is due to the current costs of utilities. If the price of utilities was £200 lower, your ROCE would be 12.18 – 16.08%. Whilst this may not be an attractive property investment strategy right now, it is definitely one to consider when the prices of utilities come back down.

HMO Pros

- You benefit from a greatly increased ROCE.

- It’s rare that you will ever have a completely void property.

- As with the other examples, you benefit from monthly cash flow and capital appreciation.

HMO Cons

- The price of utilities can have a detrimental effect on that ROCE as can be seen in our example.

- It’s a lot more work to manage multiple occupants than just a single tenant. They will often call you to resolve any issues the arise between themselves.

Property Flipping

Property flipping is essentially undertaking a BRR project but instead of renting it out, you sell it for profit. This is a great property investing strategy for those who wish to make large sums of money in a relatively short amount of time – It’s common for flips to take around 9 months. Whilst the refurb only takes a few months, selling the property is a very lengthy process in the UK.

Another key difference with property flipping is that you shouldn’t utilise a mortgage. Mortgages are meant to be long-term financial products so if a lender sees that you keep on taking mortgages out, only to pay them back early 9 months later, it’s likely that they will blacklist you. What makes this worse, is that lenders tend to share information so being black-listed with one lender may exclude you from mortgage products with other lenders too.

If you intend to flip a property, you will instead have to buy it in cash. Don’t worry though, this has some advantages to it:

-

- You’ll be able to secure a much better deal if you buy in cash as it’s common for cash buyers to receive heavy discounts.

- You can utilise a bridging loan if you don’t have enough cash for the purchase.

Property Flipping Example

For this example, we’re going to keep it simple and use cash to purchase the property. It’s worth mentioning that bridging loans are a fantastic way to get the cash but they do require a fair amount of explanation so if that interests you, check out our bridging loan guide.

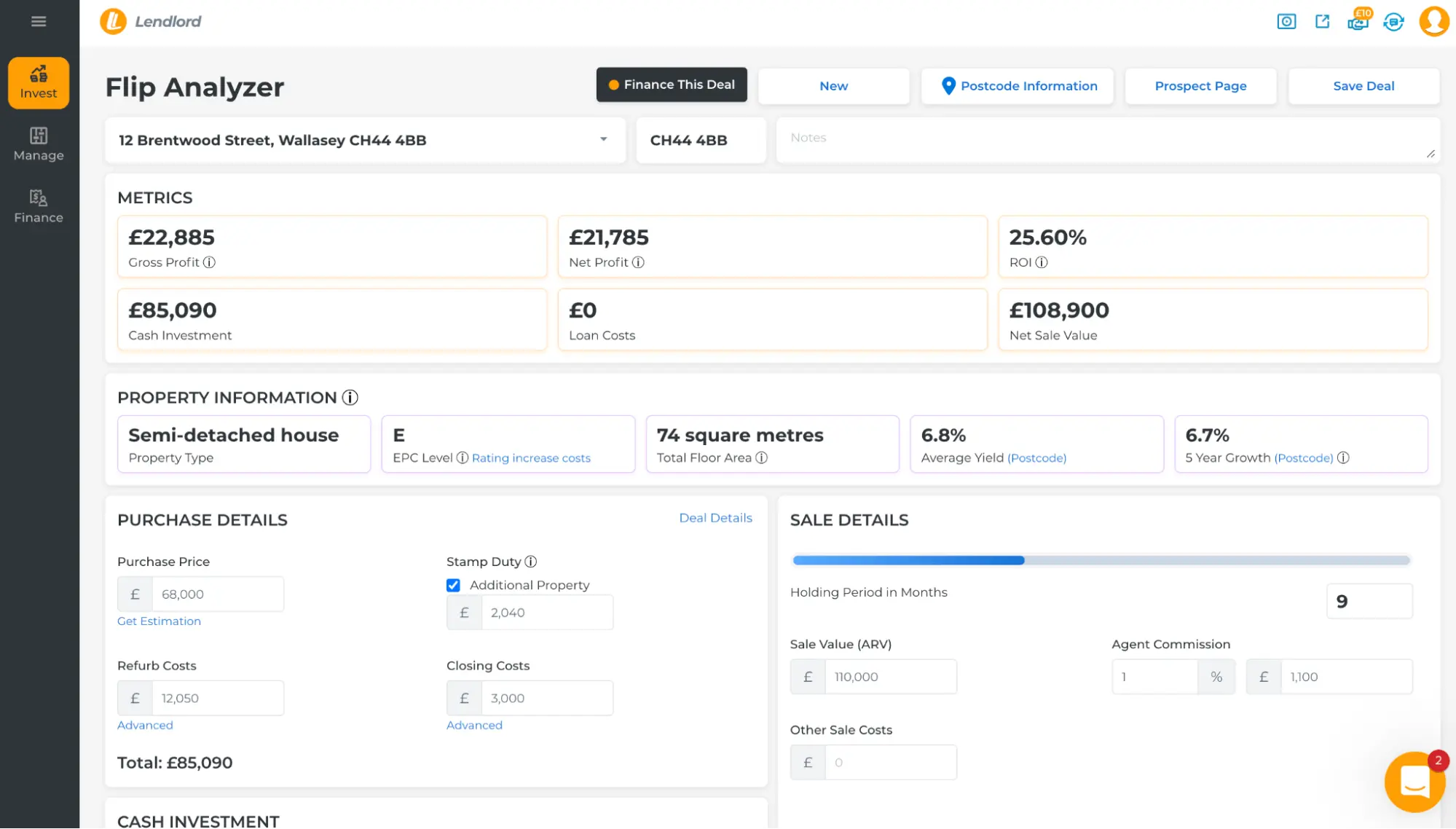

Let’s use the 2 bed in CH44 4BB as our example (the property used as the BRR example). Because we are buying in cash, let’s assume that we secure a 15% discount and purchase it for £68,000. All the other costs remain the same and it takes 9 months to flip this property. Now, let’s turn to our good friend Lendlord and use their free property flip analyser:

As you can see, taking into account holding costs for those 9 months and a 1% agent commission, you will end up with a hefty profit of £21,885. This equates to an ROI (return on investment) of 25.60%. That’s just shy of 4 times what investing in the FTSE 100 could get you on average per year.

Property Flipping Pros

- The right property can earn you a fantastic ROI in under a year, making property flipping one of the best property strategies, great for short-term investors or for building up funds.

- You can secure a great discount by purchasing with cash.

Property Flipping Cons

- This strategy will require a lot more money than the previous ones.

- The longer it takes to sell the property, the more expenses will be involved, reducing your ROI.

Does property flipping sound like something you would like to do? Read our fully comprehensive guide on how to flip a house. We’d also recommend checking out our guide on what is property flipping for a more in-depth breakdown of this strategy.

What Is The Best Property Strategy?

It all depends on what your goals are. If you want a simple, tried-and-tested, method of investing in property, one which requires the least amount of effort, single residency buy to lets are your best bet. Whilst they may not deliver the best return out of all the strategies mentioned, they still blow any other financial asset class out of the water.

On the other hand, if you want a short-term strategy to build up your funds, you may be drawn to property flipping. In around 9 months, sometimes less, you will generate upwards of a 20% ROI. Repeat the process a few times and you’re sitting on a very hefty amount. However, this strategy is far more involved and definitely a lot more stressful.

Then there’s the individual who wants the best of both worlds – I would recommend the BRR strategy to them. Not only do you benefit from a greater rental ROCE, but you also have the opportunity to recycle your funds. This allows you to reinvest much quicker than if you just had to wait until you had enough saved for another property.

Final Thoughts

In this guide, we covered the best property investing strategies out there in enough detail to give you a good idea of which strategy matches your goals and personality. If you’re a complete beginner, I hope that this gives you a bit of clarity as to how you wish to invest in this market. Be sure to follow along with this series of ‘Property Investing Basics’ to learn the fundamentals of property investing.

Recommended Tools / Finance:

Victor Sterling

Hi, my name’s Victor - I’ve been investing in property for three years now, with my preferred strategies being buy-to-let, BRR and house flips. My goal with Amateur Landlord is simple - to provide beginners with easy-to-follow resources that simply weren’t around when I started, and to offer these for free and without ads.