Quick Navigation

- The Buy Refurbish Refinance strategy is an investment approach where properties in need of modernisation are purchased, refurbished, and then refinanced at a higher valuation, allowing investors to pull out a significant portion of their initial investment while also commanding a higher rent due to the refurbishments.

- The BRRRR method (buy, refurbish, refinance, rent, repeat) is similar to the BRR strategy, with the addition of renting the property out and repeating the process.

The buy refurbish refinance strategy, also known as the BRR method, is undeniably one of the most popular approaches to property investing in the UK, and it happens to be my personal favourite too. This strategy combines the advantages of buy-to-let investments while turbocharging your potential returns by reducing the total invested amount after the refinance and increasing your monthly rental income.

If you’re new to this strategy, don’t worry. Understanding the buy refurbish refinance method shouldn’t be too challenging, especially if you already have a grasp of the basics of buy-to-let. If you’re not familiar with this topic, I recommend taking a look at our beginner’s buy-to-let guides first.

In this article, we will delve into what the BRR method entails, how it operates, showcase an example of a property using the BRR approach, and explore variations of the strategy, including the BRRRR method.

What Is Buy Refurbish Refinance (BRR)?

The buy refurb refinance strategy is an property investment approach, involving the purchase of a property that requires some upgrading or renovation. After the refurbishments have been made, you would refinance at a higher valuation to pull a large chunk of your invested funds out of the deal. An additional bonus of this is that because the property is newly refurbished, you can demand a higher rent.

What is the BRRRR method?

The BRRRR method, which stands for buy refurbish refinance rent and repeat, is exactly the same as the buy refurbish finance method, it entails renovating a property, refinancing it for a higher value and then renting it out. The only difference is that the acronym is longer due to the inclusion of the rent and repeat steps. This is widely regarded as an American term whereas in the UK, we prefer to refer to it simply as BRR.

How does Buy Refurbish Refinance work?

I’ve broken down the BRR strategy into a step-by-step process to make it even simpler to understand:

1. Find a property which needs modernisation

While it may appear straightforward, and to a certain extent it is, the first step is to locate a property in need of modernisation. This is a property that is still habitable, with functioning utilities such as running water, a working boiler, and electricity. However, it is outdated and demands some effort to bring it in line with modern standards.

2. Run the numbers

The most important step of any property investment is conducting property research to make sure that you are happy with the returns provided by the property you are looking at. For a BRR property, this gets a little bit complicated so I’ve put together a spreadsheet to help you visualise the numbers – this can be found further down in the guide, in our BRR property example.

Estimating the refurbishment cost can be challenging initially, but with more practice, your estimates will become more accurate. Based on my experience, a complete refurbishment of a 3-bedroom property in the northern region typically ranges from £15,000 to £20,000.

However, if you have ample free time and possess multiple trade skills, the refurbishment cost could be reduced to approximately £6,000 to £8,000 by doing the work yourself. It is crucial to note that you should only undertake the work yourself if you have the necessary experience or are willing to invest time in learning.

3. Purchase the property

The property purchasing process is quite complex so I won’t go into it here but I would recommend checking out our guide on it. What’s important to note in this guide is that because we will be purchasing with a mortgage, we will likely have to pay the actual value of the property and the process will be longer than buying with cash. After you manage to purchase a property in need of modernisation, we can move on to the next step – the refurb.

4. Refurbishing the property

The refurbishment phase of the BRR strategy is often considered the most stressful yet crucial for achieving a fantastic return on investment. The refurb should focus more on interior touch-ups rather than any structural changes (unless they are necessary). Key tasks would involve kitchen and bathroom replacements, installation of new flooring throughout the property, and repainting the walls in a clean white colour.

It’s important to strike a balance and avoid going overboard with luxurious features such as real wooden floors or extravagant marble bathtubs.

How much will a refurb cost?

The cost of the refurbishment will vary depending on where the property is – for example, as mentioned earlier, a refurb in Liverpool may cost you £15,000 but the same type of refurb in London would set you back £30,000. Assuming that the majority of beginner investors are looking to purchase outside of London, specifically in the North, the below figures should give you a decent idea of the refurb costs involved. They are for a two-bed property in Liverpool that was refurbished in 2024:

-

- Skips and Rip out = £850

-

- Exterior doors = £1,300

-

- Plastering = £1,000

-

- Interior doors = £900

-

- Painting = £1,600

-

- Flooring = £900

-

- Kitchen and Install = £2,900

-

- Bathroom and Install = £2,200

-

- Other general costs = £520

-

- Contingency fund (20%) = £2,400

Total Refurb Costs = £14,600

How to add the most value to your property?

The best ways to add value to your BRR property are most often the basics of refurbishments such as adding a new kitchen and bathroom. Other methods that are rarely mentioned are adding a deck in the back garden or installing high-quality radiators and light fittings – these methods are very cheap compared to adding a new bathroom or kitchen and can add a few per cent extra to the property’s value. For the most part, these are the best ways to add value to your property:

- Convert the garage or attic to a bedroom = +15%

- New flooring and paint = +10%

- New kitchen = +8%

- New bathroom = +8%

- Garden decking = +7%

- Add a driveway = +5%

- Paint the exterior = +2%

- Add high quality fittings = +2%

5. Rent the property out

Some people may prefer to wait 6 months after purchasing the property to refinance it and then rent it out – they argue that having a tenant inside your property may decrease its value because they may leave it a mess or wear the property’s ‘fresh look’. To some degree, this is true but personally, I prefer to get the property cash flowing as soon as possible. This also gives me the opportunity to make sure everything is working correctly before the valuer comes around.

Renting the property out is quite simple as long as you opt for a lettings agent – I would highly recommend this as there are a lot of legal papers involved as well as the tenant screening process being very time-consuming. I would much rather pay the letting agent a month’s worth of rent than conduct all the viewings myself, screen all potential tenants and stress about getting all of the legal papers right.

6. And finally, refinance the property

For those of you who don’t know what refinancing is, otherwise known as remortgaging, it’s simply getting a new mortgage at a higher value and using that loan to pay off the old mortgage – a nice bonus being that you are very often left with a good chunk of cash after you pay back the old loan.

What’s key to note here is that many people think the lender will tell you what the property is valued at – that’s not the case. You tell the lender what you think the property is worth and they will come around to assess the property, either agreeing with your estimation or disagreeing with it. It’s always better to give them your optimistic estimation as they will never give you more than what you value the property at but they will definitely down-value it if they think that your value estimation is too high.

On the topic of down-valuations, if you are unhappy with the valuation you receive, there’s no obligation for you to go with that lender. You can simply go get another valuation.

Tip – Make the valuer’s life easier by providing them with your own ‘valuation pack’ – one which includes local comparables, a list of all the changes made to the property along with dates, and before & after pictures.

BRR Property Example

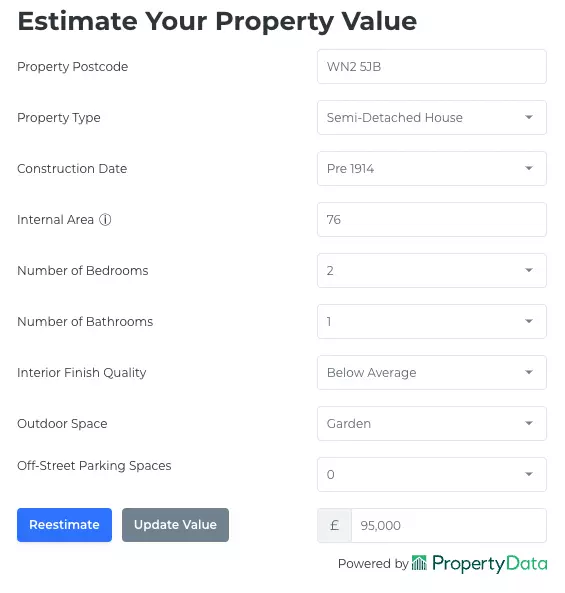

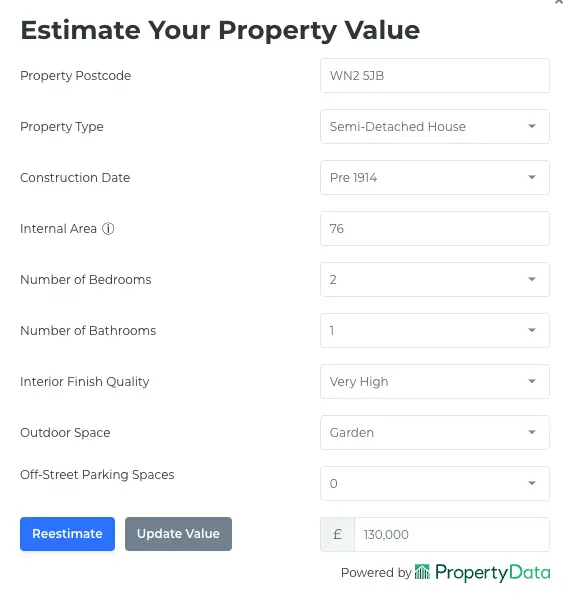

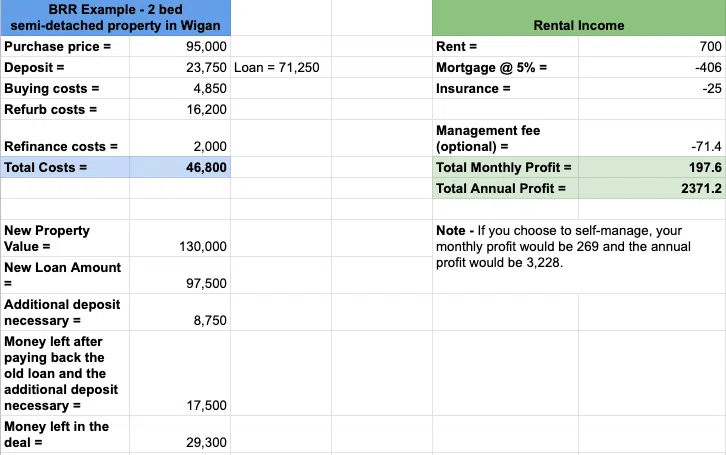

Let’s now go over a BRR example to help you really understand what this process would look like. As our example, we’ll be looking at a 2-bed semi-detached property in Wigan, WN2 5JB. The property needs an interior ‘touch up’ as well as some work on the front of the property – new exterior paint and some gardening.

First off, let’s find out what this property is currently worth and how much it would be worth after the refurb. If you’ve read a few of our guides, you probably know what I’m going to say, as always, let’s turn to our old pal Lendlord and use their free property value estimator.

As you can see, Lendlord tells us that this property is currently worth around £95,000 and after the refurbishment, it would be worth £130,000. Now that we have those figures in mind, we flick through the listing on Rightmove to see what work needs to be done. Like I said before it’s mostly touch-up stuff, nothing too serious.

For this property, the total refurbishment costs would be £16,200.

The very last thing we would need to work out is how much rent we could charge and what the mortgage repayments would be.

Working out how much rent to charge is as simple as going over to Rightmove and searching for rental properties in that postcode or within ¼ mile. Find comparable properties and see how much they are charging. For this property, I found that £700 per month would be viable. Whereas, the mortgage repayments would be £406 per month at 5% rates.

Now that we have everything we need to know, we can work out what our return would look like for this property:

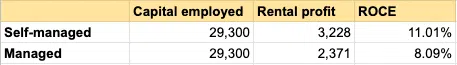

Whilst that may not seem like the greatest ROCE (return on capital invested) for the amount of work that goes into a BRR property, it’s worth considering if we were to purchase this property and rent it out as a buy-to-let, the ROCE would only be 6.08% to 8.39%. So it’s pretty clear that investing in this property using the BRR strategy has increased the ROCE a good amount.

For another example, you can look at our property investing strategies guide – the BRR property example there has a ROCE of 12.82 % to 16.25%.

Pros & Cons of BRR

Pros of Buy Refurbish Refinance

- By utilising the BRR method, you are increasing your returns as can be seen in the example above.

- Because you can pull out a large chunk of your invested capital when refinancing, you can recycle it to purchase more rental properties.

- After the refinance, you are left with a high-quality property which demands higher rent and attracts better tenants.

- Tenant turnover is low.

- You benefit from the combination of great rental income and asset appreciation.

Cons of Buy Refurbish Refinance

- BRR is far more expensive than a simple buy-to-let property because you need to pay for the refurbishment as well as the additional costs involved in refinancing the property.

- If the property is ever void, you are responsible for paying the utilities and council tax.

- The process of refurbishing a property is incredibly stressful as anything that can go wrong probably will. You could limit the stress by hiring a good project manager.

- There’s a risk that your property may get down-valued (the lender values it less than what you think it’s valued at). This may severely hurt your ROCE.

Is buy refurbish refinance (BRR) a risky strategy?

Any investment will carry some sort of risk with it which is why it’s so important to conduct thorough due diligence on the property you will undertake as a project and ensure that you have accounted for any possible surprises in the refurbishment – for beginner investors, it’s recommended that you have a contingency fund of around 20% meaning you inflate your entire estimated refurb costs by 20% to take into account these unforeseen circumstances. We’d also recommend paying for an RICS property survey – these check for any major issues with the property. Taking these steps will help you minimise the risks involved in a BRR project.

Final Thoughts

In my opinion, the buy refurbish refinance strategy stands as one of the top-notch property investment strategies available. The reason behind its excellence lies in the fact that it not only enhances your rental income significantly after refinancing the property, but it also allows you to retrieve a substantial portion of your initial investment. This aspect makes it considerably easier for you to acquire another rental property or even embark on another BRR project. By leveraging this strategy, you can effectively multiply your investment opportunities and continue expanding your property portfolio.

If you’re ready to kickstart your property investing journey by looking for your own BRR opportunity, I would strongly recommend signing up to Lendlord – It’s a fantastic free tool which has really helped me optimise my property due diligence process. Other great tools include Streetcheck and Property Data.

Recommended Guides:

Recommended Tools:

Victor Sterling

Hi, my name’s Victor - I’ve been investing in property for three years now, with my preferred strategies being buy-to-let, BRR and house flips. My goal with Amateur Landlord is simple - to provide beginners with easy-to-follow resources that simply weren’t around when I started, and to offer these for free and without ads.