Quick Navigation

- House flipping involves buying a property, renovating it, and selling it for a profit. It’s not as easy as portrayed on TV shows, but it can be profitable with the right approach.

- To determine if a property is suitable for flipping, consider factors like the local ceiling price, demand in the area, potential value addition, and the amount of work needed.

- Calculate profit by using our property flip calculator.

House flipping, considered one of the most well-known property investment strategies, has gained popularity thanks to shows like ‘Under the Hammer.’ While these shows made for great Saturday morning entertainment, they unfortunately created unrealistic expectations for beginner investors interested in venturing into UK property flipping.

In reality, house flipping is not as effortless as portrayed on those shows, particularly if you’re handling all the work yourself. So, if you’re seeking an effortless method to make money from property, property flipping is not the answer (in that case, I’d suggest exploring buy-to-lets instead). However, if you’re willing to put in the effort and hard work, house flipping has the potential to deliver an impressive return on investment.

In this guide, we will delve into the house flipping basics, covering what it entails, how it works, and whether it’s a worthwhile pursuit for aspiring investors.

What Is House Flipping?

Flipping houses is a straightforward concept: you buy a house, refurb it and then sell it at a higher price, pocketing a handsome profit along the way (if all goes well). Typically, substantial work is done on the property to increase its value. This can involve adding a new kitchen, bathroom, flooring, or even extending the house.

To make the most of this strategy, it’s recommended that you look for a rundown property in dire need of renovation. You can then fix it up and sell it (similar to the Buy Refurbish Refinance strategy, but without the refinancing and renting aspect).

Note – If you’re interested in a more detailed breakdown on how to flip houses, we also have a separate guide dedicated to that topic. Feel free to check it out after finishing this one.

Now that we understand how flipping houses works, let’s move on to exploring whether property flipping is in fact profitable.

Is House Flipping Profitable?

Absolutely! House flipping can indeed be a profitable venture, but it all comes down to whether the numbers for a specific deal add up. Not every property can be flipped for a substantial profit, it all comes down to picking the right opportunities.

There are several key factors to consider when selecting the right deal. So, let’s dive into these factors in the next section. To give you a better understanding of how it works, we’ll also run through a profitable house flipping example.

Factors To Consider When Finding A Property Flipping Opportunity

Flipping houses profitably isn’t as easy as you’ve been led to believe, there’s a fine margin between a profitable house flip and one which will set you back a few thousand pounds. You need to consider the following factors when evaluating a property flipping deal:

1. What Is The Ceiling Price For The Local Area?

Each area will have a ceiling price (the maximum value that a certain type of property in that specific area can be worth). Whilst it’s possible to break through the ceiling price, it’s incredibly unlikely. The reason behind this is that if an entire road is made of the same sort of properties, those types of properties will only be worth a certain amount so adding extravagant features will not make it worth more. Think about it this way, if you have a standard spec Ford Focus from 2015, no matter how nice the paint job and how much you tune it, it will never be worth as much as a brand-new Mustang.

It’s important to figure out the ceiling price of the area the property is located in and not push above it. If the deal requires you to sell the property £20,000 above the ceiling price to make a decent amount of profit, you should pass on that deal because the likelihood of doing so will be low.

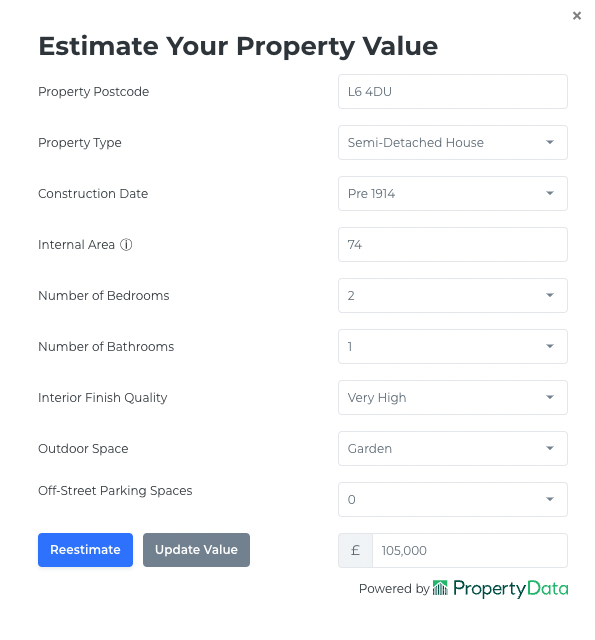

Working out the ceiling price is thankfully quite simple – go to Lendlords free deal analyser and enter the details of the property you’re looking at. Select the interior finish quality that you are aiming for (ideally high or very high) and press estimate. Lendlord will provide you with its estimate of what that specific property would be worth in that condition based on data it has gathered about other properties on that street – in my experience, Lendlord is really accurate with these estimations.

2. Is There A Strong Demand For Properties In That Area?

Another very important factor – after all, you will need demand for your property so that you can actually get it off your hands. There is nothing worse than sitting on a refurbished property for months on end because there is no demand for it, with each month’s holding expenses digging into your potential profit.

Thankfully, working out the demand for properties in a specific area is quite simple. You can either use Lendlord or work it out manually by using Rightmove:

Lendlord – Lendlord offers a postcode information tool which includes the local property demand. You are given 3 free monthly searches so use them wisely (otherwise, you may need to upgrade to the premium subscription which isn’t too expensive). It’s as simple as entering the property’s postcode and Lendlord does all the work for you. As a general rule of thumb, you want Lendlord to rate the demand as a ‘Buyer’s Market.’

Rightmove – This method is a bit more hands-on and requires a more in-depth explanation so head over to our guide on choosing investment locations if you’re interested. If using this method to gauge demand, we’re looking for a minimum of 30% of the properties listed on Rightmove to be under offer or sold. This is a good indication of there being strong demand for properties in that area.

3. How Will You Add Value To The Property?

In order to make this strategy work, there needs to be an opportunity to add value to the property. This can be done in any of the following ways:

- A refurbishment

- Adding an extra bedroom

- Adding an extension

Each of these methods will add value to the property. The method you choose to utilise really just depends on the state of the property, the ceiling price of the local area and whether you will be able to make a good amount of profit from it.

4. How Much Work Does The Property Require?

You need to know what you’re getting yourself into; there’s a massive difference between a property which requires freshening up (new kitchen & bathroom, new floors and a flick of paint) and a property which requires plastering, isolation and a new boiler as well as the touch-up. Everything will need to be taken into account when you run your numbers on the deal. It’s not possible to predict everything that may go wrong during the refurb; that’s why it’s important to have a contingency in place (20% of the total refurbishment costs is recommended for beginners).

The Key to Successful Investments

How Do I Work Out Profit From Property Flipping?

Working out the amount of profit in a property flipping deal is quite simple – you can do it manually or you can save yourself some time by using our trusty tool Lendlord – which offers a free flip analyser. Let’s walk you through the steps of working out the profit by using an example – a 2-bed semi-detached property in Liverpool, L6 4DU. This property is in severe need of modernisation – a total refurbishment, the garden needs taming and there are slight issues with dampness throughout.

Note – we are assuming that we are using cash to purchase the property. This will be the case most of the time when flipping property because it’s quite hard to get a mortgage on a run-done house. Bridging loans are also an option but to keep it simple, let’s just assume that we are buying with cash.

1. What is the purchase price?

This property was listed for £75,000. Using Lendlord, we confirmed that in its current condition, it is worth that amount. However, we do not want to offer £75,000 because we are cash buyers and thus will likely receive a discount due to being able to move much faster than mortgage buyers. Instead, we would offer 10% less than the asking price, £67,500.

2. What is it going to be worth after the refurbishment?

Using Lendlord’s free property value estimator, we can see that this property would be worth £105,000 if refurbished to a great standard.

3. How much would the refurbishment cost?

Working this out can be a bit tricky and the costs of labour will always vary but for this particular property, we know that all of the necessary works plus a 20% contingency would total £18,000. We’re not going to go over how we worked this out here because it’s a whole guide of its own – check it out here.

4. What other costs are involved?

When flipping a property, there are a bunch of other costs involved. These include:

Buying costs – Legals, surveys and stamp duty.

Cost for this example = £4,025

Holding costs – the costs involved in holding the property whilst you refurbish it and sell it – insurance, utilities, council tax etc. It’s quite common for this entire process to take around 9 months so let’s assume that’s how long it takes to flip this property.

Cost for this example = £4,050

Selling costs – Assuming that you’re not an estate agent, you will need to find one who will sell the property for you. They will often charge a 1% commission on the total sale value.

Cost for this example = £1,050

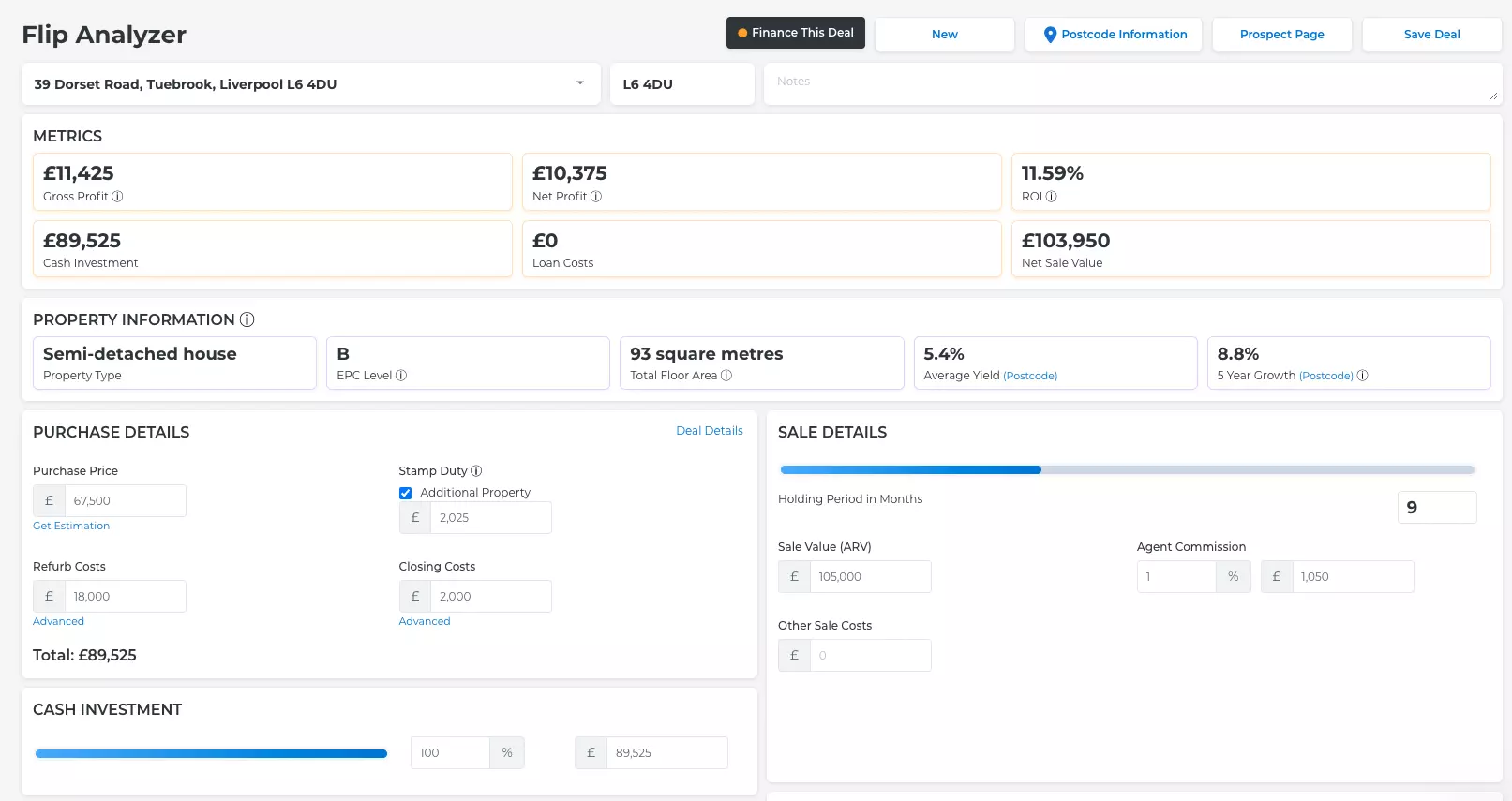

5. Throw all of these figures into the House Flip Analyser

Now that we have worked out all of the figures for this deal, let’s thrown them into Lendlord’s Flip Analyser to see whether this deal would be profitable or not, and by how much.

As you can see, this property flip would require £90,000 and would result in a net profit of £10,375. This would give us an ROI of 11.59%.

Note – this isn’t a great return considering the amount of effort necessary. You should aim for upwards of 15% when it comes to property flips.

Is House Flipping Worth It?

The short answer is yes, property flipping in the UK is definitely worth it. However, the numbers need to make sense to you and so does the strategy. For example, if your goal is to make significant returns in relatively short amounts of time, house flipping is definitely worth it, especially if you can find deals which give you an ROI of 15% and upwards. This can help you build up a larger amount of capital and for some people, it can be a good alternative to their jobs. You only need to flip two properties per year to make around £24-30k and if you take it full-time, you can definitely flip more properties than that.

However, if your goal is to be hands-off as a property investor, you may want to explore buy-to-let investing instead. You could also look into the Buy Refurbish Refinance strategy which offers the best of both worlds – you refurbish a property, remortgage it to get a large chunk of your money out and then rent it out to generate monthly cash flow. For example, the above property would make around £3,240 – £4,704 in annual profit depending on whether you self-manage or not. This equates to an ROI of 12% – 17.42%. However, it’s important to note that whilst for this particular example, the ROI for a BRR may be better, this will not always be the case – sometimes flipping the house will make you more money.

To help you make your mind up about property flipping and whether it’s the property investing strategy for you, let’s quickly look at the pros and cons of house flipping.

Is house flipping still profitable in 2024?

Yes, house flipping is still profitable in 2024. Flipping houses will always be profitable as long as you manage to find good deals which offer the opportunity to make a hefty amount of profit.

Pros of House Flipping

The ROI is usually amazing

Property flipping offers incredible returns on your investment. The worse property flip projects can bring in around 10% ROI whereas, on the other side of the scale, you could make upwards of 30% in around 9 months. There aren’t many investing strategies that could make you that sort of return.

You Could Become A Full-Time Property Flipper

I’ve known quite a few people who absolutely fell in love with property flipping and quit their job so they could pursue it full-time. A single flip could bring in around £10k-£40k in profit depending on the quality of the deal. If you were to flip properties full-time, you could quite easily complete 3-6 projects a year which would bring in around £30-240k a year.

You Can Recycle Your Funds Much Quicker

Another massive advantage of property flipping is that you can recycle your funds quickly, much quicker than if you were to invest in a buy-to-let for example. This means that you can keep reinvesting your funds in order to make more and more money.

Cons of House Flipping

It Requires A Lot Of Money

House flipping, even on the cheaper end, requires a lot of money. Not everyone will be able to find £40,000 to £80,000 that they can use on a house flipping project, and that’s for properties up North where it’s considerably cheaper.

Delays Will Hurt Your ROI

The property isn’t cash flowing so if there are any delays in either the refurb or in selling the house, you will incur monthly expenses. This will decrease your ROI and can even lead to the project resulting in a loss.

Refurbishments And Selling The Property Are Very Stressful

There are so many things that can go wrong, and likely will go wrong, when you are refurbishing a property – you will find additional problems, some of your tradespeople will be useless and you will have to buy additional materials. The same goes for selling the house, your estate agent likely won’t be a superstar and the potential buyers are definitely going to mess you around a bit. All of this makes property flipping incredibly stressful.

Final Thoughts

Property flipping is another great strategy to have in your property investing toolbox. It’s more geared towards investors who wish to make significant gains in shorter amounts of time and wish to keep recycling their money until they build up a larger pot of cash. Property flipping also offers you the opportunity to make it your full-time job which may be very appealing to some people.

If it sounds like something that appeals to you and your property goals, be sure to check out the rest of the house-flipping guides available on Amateur Landlord. I have also included an FAQ section below which answers some of the most commonly asked questions that we receive about property flipping.

Recommended Tools:

Victor Sterling

Hi, my name’s Victor - I’ve been investing in property for three years now, with my preferred strategies being buy-to-let, BRR and house flips. My goal with Amateur Landlord is simple - to provide beginners with easy-to-follow resources that simply weren’t around when I started, and to offer these for free and without ads.