Quick Navigation

- Property investment involves buying properties like houses, apartments, or commercial buildings to generate financial returns via rental income and capital growth.

- Different types of investment properties include residential, student housing, commercial, and mixed-use, with residential being the most popular for buy-to-let investors in the UK.

Many people have misconceptions about property investment and how it works. Contrary to the belief that “property only goes up,” the real estate market fluctuates like any other market. Additionally, it’s a misconception that all properties across the country follow the same trajectory. Location plays a crucial role in a property’s growth potential, and areas lacking development and demand may not see an increase in value.

Understanding these fundamentals is vital, which is why we’ve created this guide. We’ll explore what constitutes an investment property, its workings, and provide guidance on investing in your first real estate investment in the UK.

What Is Property Investment?

Property investment involves investing in various types of properties, such as houses, apartments, or other buildings, with the primary goal of generating a financial return. While residential buy-to-let properties are commonly associated with investment properties, there are other types as well, including hotels, holiday lets, and commercial properties leased to businesses.

Regardless of the property type, you can generate returns through two primary avenues. The first is rental income, where tenants, whether residential, professional, or business owners, pay monthly rent for occupying your property. The second avenue is capital growth, which refers to an increase in the property’s value due to factors like rising demand or limited supply (as seen in the UK). By combining rental income and capital growth, property investors have the potential to achieve profitable returns on their investments.

Types of Investment Properties

As touched on above, there are many different types of investment properties. Here’s a summary of what these are:

1. Residential Property

Residential properties are rented out to tenants who wish to live in your property. These can take the form of houses, apartments, and if it’s your thing, even boat houses.

2. Student Housing

Student investment properties share similarities with residential properties, but their tenants are students. Renting to students has gained popularity among UK landlords due to various advantages, including exemption from council tax.

While it’s possible to rent a regular house or apartment to students, student investment properties typically take the form of purpose-built student accommodation. These properties consist of individual rooms with shared kitchens and communal living areas.

3. Commercial Property

Commercial investment properties are rented out to businesses that wish to use your property as an office or a store. These can take the form of stores, offices, warehouses or even garages. Whilst these types of properties will generate rental income, when it comes to capital growth and selling the property, it becomes more complex.

4. Mixed-use Property

Mixed-use investment properties are ones which are both residential and commercial. The most common example would be a three-storey building with a storefront at the bottom and two residential flats above. The landlord would generate rental income from both the business renting out the store and the tenants living in the above flats.

Top Tip – Mortgage brokers dislike properties above stores (even more so if it’s a restaurant) so getting a mortgage on them may be difficult.

The Key to Successful Investments

How Does Property Investment Work?

Okay, now that we have a good understanding of what investment properties are, it’s time to look into how it all works. We shall focus on residential investment properties because they are the most common and likely what the majority of you are interested in. Residential investment properties work like this:

- You purchase a residential property under a buy-to-let mortgage. These require a 25% deposit and are most often interest-only mortgages, meaning that you don’t pay off the mortgage, just the interest. For those of you wondering why on earth you would do that, it’s because we are prioritising cash flow. You’re welcome to go for a repayment mortgage but it will eat into your profits.

- After you have purchased the property, you will find a tenant to rent it out to. This should be quite easy if you’ve picked a good area.

- The tenant will pay you monthly, and with the exception of the odd repair or phone call, you’ll sit at home with your feet up, collecting rent every single month. Happy days.

- If you ever choose to, you can sell the property to realise your capital gains (assuming that it does rise in value).

Investment Property Example

Let’s look at an example of a residential investment property – a two-bed terraced house in Liverpool. Why Liverpool? Because it’s a personal favourite of mine, it ticks all of the boxes for what I would want to see in an area before I invest in it and it’s attainable for beginners wanting to get into property. Let’s dive into this property to see how it would all work and what kinds of returns you could expect.

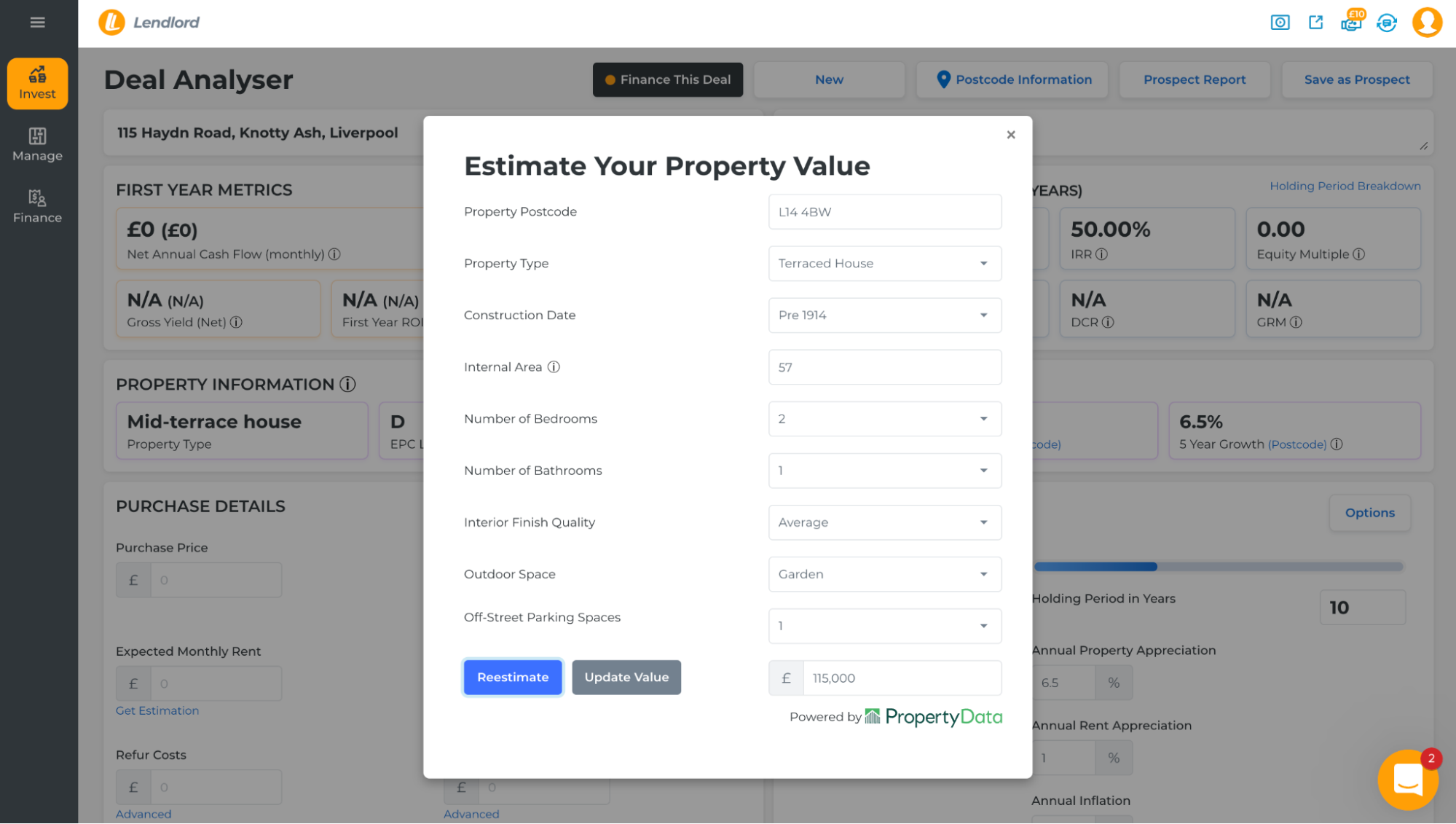

This is your bog standard 2-bed terraced house in Liverpool, L14. It’s in pretty good condition and could be rented out immediately. Having used Lendlord’s deal analyser, we can see that this property is worth £115,000 so let’s assume that you bought it for that figure on a buy-to-let mortgage which required a 25% deposit, which equates to £28,750. Let’s slap on another £5,000 to pay for stamp duty, legal costs and paying a mortgage broker. This brings the total money in the deal to £33,750.

On a side note, Lendlord is a brilliant free tool which I highly recommend for analysing properties. Among other things, it gives you very accurate property value estimations (In many cases, it’s more accurate than my own estimations).

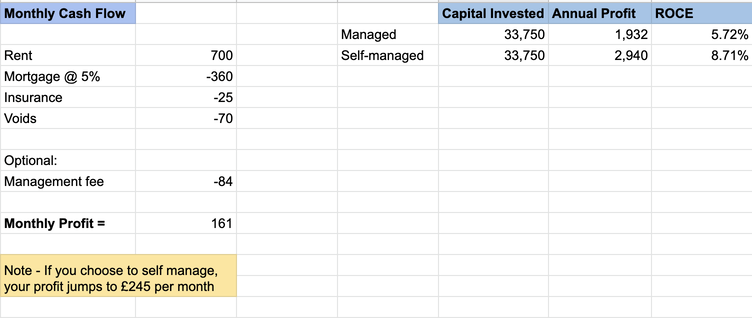

Further research shows us that a property like this will likely rent for around £700-725 per month. However, this isn’t all straight profit. You will have monthly costs such as the mortgage, insurance and you may have to pay a management company if you choose to have it managed. I know that this may all sound very complicated to any beginner reading this but rest assured it will start to make more sense as you continue through our guides, by the end of which, you will know all of this like the back of your hand.

The figures for this property break down like this:

ROCE stands for Return on Capital Employed – it is calculated by dividing your annual profit by the amount of capital you have invested in the deal.

As you can see, you would make 5.72% to 8.71% annually on this rental property – this is a fantastic return considering that interest rates are currently so high. A lot of properties in London are currently cash flow flat or negative if their mortgages were taken out at current values, so 5 to almost 9% is an amazing return.

Can Property Investment Make You Rich?

Can property investment make you rich quickly? No. Can it make you rich really really slowly? Absolutely.

A well-picked property in a developing area is a fantastic investment, one which will beat out every other asset out there on a consistent basis. That’s because your rental income isn’t the only form of return you receive. As we mentioned at the start, the price of your property will also grow and because you are using a mortgage with a 25% deposit, your actual returns from the appreciation of the property are leveraged four times.

For example, if that property value were to grow by 4% each year (which is a very reasonable growth figure considering that between 2010 and 2024, property prices in Liverpool have on average grown by 4.82% annually according to the UK House Price Index), your return on the capital you invested would be four times that, a whopping 16%.

Considering capital growth and rental income, the property we mentioned earlier would have an average return of 21.72 to 24.71%. Of course, it won’t always hit that figure as many unforeseen events can occur that may harm that return.

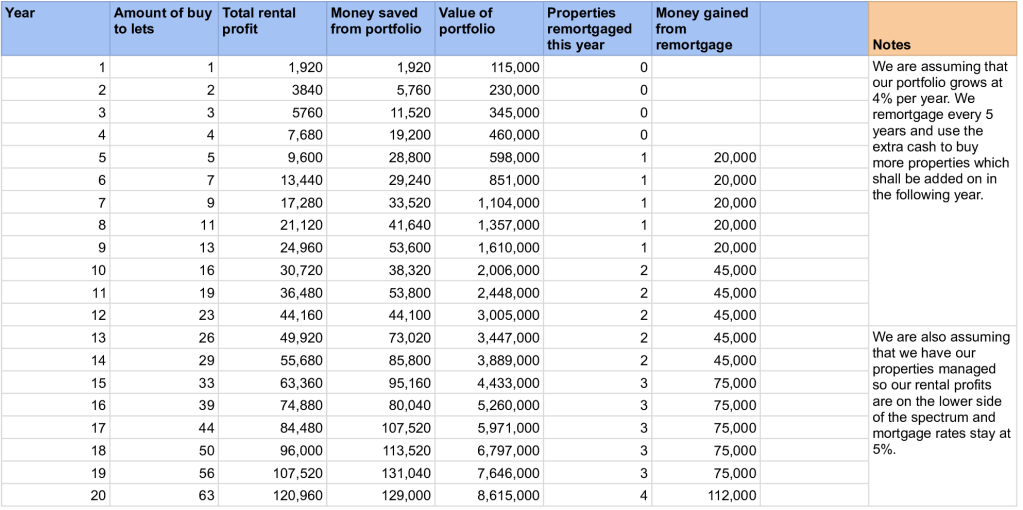

Let’s look at the larger picture to show you just how powerful that sort of return can be. Let’s assume that you utilise the simplest and easiest property investing strategy out there – purchase one buy-to-let every year (ones similar to the above example) and reinvest all rental profits (we would typically remortgage every 5 years too and use the profits to buy even more property). As you become more advanced, you will need to consider a lot more when running forecasts like these but for now, let’s keep it simple.

Let’s take a look at the below spreadsheet (you better love spreadsheets because as a soon-to-be property investor, they will become your best friend):

Whilst this isn’t pinpoint accurate, it provides you with a very good idea of what a simple real estate investment strategy can do for you. If you buy one rental property per year and reinvest all profits from rental income and remortgages, by year 10, you will own 16 properties with a portfolio valued at over £2 million… wow. You could stop there and receive £30,720 in rental profit every year or you could keep on going and become a property tycoon.

How To Start Investing In UK Property?

Now that you know what investment property is and how it works, you’re probably ready to go in all guns blazing, especially after looking at that spreadsheet. But how exactly do you go about investing in property? Let’s jump into the common questions that beginners often ask:

How Much Do I Need For An Investment Property?

This depends on the strategy you intend to use (property investment strategy guide) and where you intend to buy. If you want to buy a simple buy-to-let like the one we looked at, you will need about £33,000. You may need a little less if you were to invest in a slightly worse, but by no means bad, area of Liverpool like Bootle. A ready-to-rent property here will cost you around £90,000. To cover the deposit and other buying costs, you would need around £28,000. However, if you want to invest in London where the same sort of property will cost £350,000 – £400,000, you will require around £104,500 – £121,000.

How Do You Successfully Invest In Property?

1. Location is key

Choosing a good location is at the heart of what makes a successful property investment. You want to focus on areas that have growing populations, are being developed, have great transport links and have good job prospects. You don’t want to invest in a small town where there are no jobs, transport is utter rubbish and the first thing people say when you ask them about it is “I want to leave”.

Have a look at our ‘how to choose good investment property locations‘ guide to learn more about picking the best locations.

2. You don’t want to overpay

Because a property is listed on Rightmove for £120,000, that doesn’t mean it’s worth that sort of money. Do your own research and come up with your own estimate of its worth. As I stated before, Lendlord’s deal analyser is fantastic for this and it’s free. You will find yourself often outbid by eager homebuyers willing to pay a 20% premium and that’s all right because their motivations are purely emotional whereas yours, as a property investor, are purely financial. If the numbers don’t work, don’t buy the property.

I have heard many stories of people being stuck in negative equity (this is when the house is worth less than the mortgage amount so the owner will lose money if they sell it) because they overpaid back in 2007 and the price of the property has never come back up to where it was before. That’s a position you want to avoid at all costs so I’ll say it again, don’t overpay.

3. Do strict tenant searches

Your investment property is like your baby, be wary of whom you give it to. Just like you would research a nanny and would want to see good reviews, you want to do thorough searches on your tenants. You want to know for sure that they have a stable income, a sufficient amount of money saved, and have no previous charges against them. It’s always a good idea to call up the previous landlord to see whether they were good tenants or a massive pain in the backside.

This may seem a bit excessive but there is nothing, and I mean nothing, worse than being stuck with a tenant who trashes your property and doesn’t pay you rent. Removing a tenant like this from your property is one of the most stressful things that can happen to a person. It takes months if not up to a year sometimes and the law is heavily in favour of the tenant. Take my word for it, and be very strict with who you rent to.

Final Thoughts

Property investment offers a world of opportunities for individuals seeking financial growth and wealth accumulation. By understanding the fundamentals of property investment, such as different strategies, risk assessment, and due diligence, you can make informed decisions to maximise your returns.

Remember that property investment is a long-term game, requiring patience and careful planning. It’s crucial to stay updated with market trends, leverage technology and tools for property analysis, and seek professional advice when needed.

As you embark on your property investment journey, remain focused, adaptable, and proactive. With dedication and the right knowledge, you can navigate the property market and build a successful portfolio that brings you both consistent income and potential capital appreciation.

Victor Sterling

Hi, my name’s Victor - I’ve been investing in property for three years now, with my preferred strategies being buy-to-let, BRR and house flips. My goal with Amateur Landlord is simple - to provide beginners with easy-to-follow resources that simply weren’t around when I started, and to offer these for free and without ads.