- A leasehold property is owned for a predetermined time before rights revert to the freeholder. Such properties often involve annual ground rent and service charges.

- Leasehold properties, like flats in major cities, can offer higher rental yields than houses. However, potential returns might be reduced by maintenance costs and other leasehold-related expenses.

- Whether leasehold properties are a good investment depends on individual risk tolerance, portfolio strategy, and understanding of leasehold intricacies. Proper evaluation using tools can aid in making informed decisions.

Fellow property investors, allow me to pose a question that I have pondered over many times: “Are leasehold properties a good investment?” Its answer, like most things in property, is not a simple one. You see, I’ve experienced the ownership of leaseholds firsthand and, believe me, it is a terrain full of various pros and cons.

Leasehold Properties Explained

To put it simply, a leasehold property is one you own for a set time before the ownership rights revert back to the freeholder. Now, this may sound straightforward on paper, but it often comes with a lot of nuances.

For instance, leasehold properties typically require the owner, (that’s us investors), to pay annual ground rents, and service charges – all these costs can add up. However, leaseholds usually cost less than freeholds upfront, so there is less capital tied into the purchase.

Leasehold Properties as an Investment

From an investment perspective, I’ve seen leasehold properties provide great returns if managed correctly. For instance, in big cities, flats (which are typically leasehold) can offer a higher yield than houses. For example, a two-bed apartment in Liverpool city centre offers a 9.5% rental yield whereas a two-bed house in the same area offers a 7% rental yield.

Note – Liverpool offers some great rental yields in general; some of the highest in the UK.

However, these returns can be offset by the aforementioned costs of maintaining the property. While I’ve experienced prosperity with these types of properties, I’ve also had to juggle my finances to meet unexpected costs related to the leasehold’s upkeep.

Financial Aspects of Leasehold Properties

Now, for us to objectively decide if a leasehold property is a good investment, we must delve into the hard numbers. I’ve found it instrumental to use tools such as our buy to let ROI calculator to analyse potential returns. I’ve had properties that seemed like a steal upfront, but after adding service charges and other costs, the yield ended up being significantly lower than a freehold property. It just goes to show, a higher upfront investment might save you financial troubles down the line.

Evaluating Leasehold Properties for Investment

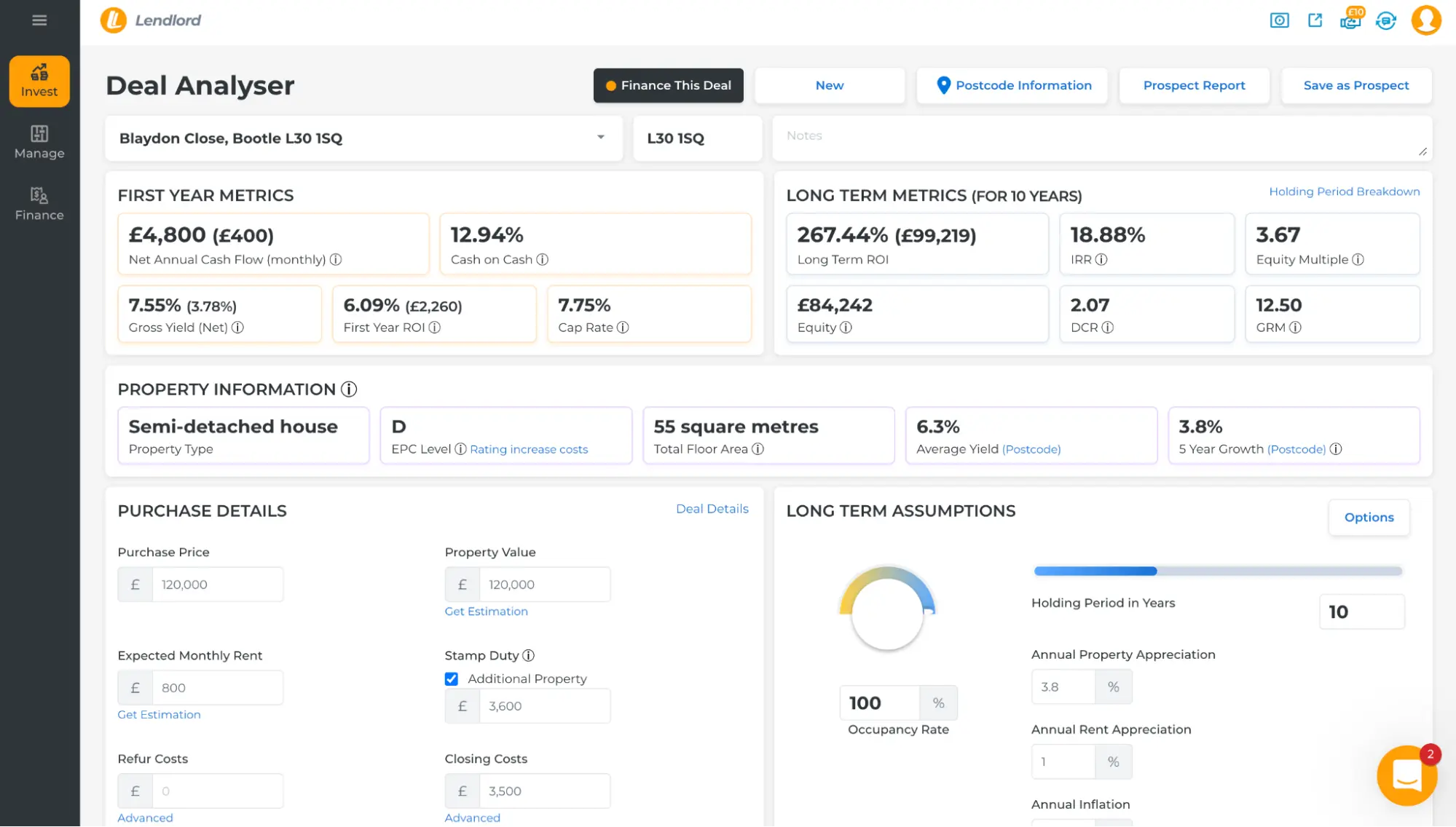

The key to determining if a leasehold is a good investment, in my experience, lies in thorough evaluation. Just like I would with any other kind of property, I make sure to critically analyse every aspect when considering leasehold properties. Our resident buy to let deal analyser tool has made this process much more streamlined for me.

By factoring in the purchase price, expected rent, ground rent, service charge and lease term, I can get a more accurate picture of a property’s profitability. What I particularly like about this tool is that it generates a comprehensive overview of return on investment, cash flow and internal rate of return (an important metric that is often not spoken about).

Remember, a tool like this can only guide us; there can still be unexpected developments, so always set aside funds for potential costs down the line.

The Key to Successful Investments

The Role of a Buy to Let Mortgage Broker

Securing the most advantageous rates for a leasehold investment can be a daunting task. Especially when the market is as volatile as we’ve seen in recent years. In such scenarios, the value of a good buy to let mortgage broker truly shines.

During my early investment years, I experienced first-hand how a competent broker can make the process smoother. For instance, my mortgage broker found me a great deal for my third property that I wouldn’t have come across on my own. This resulted in significant savings on my monthly repayments.

Are Leasehold Properties a Good Investment?

Now, having walked through my thoughts and experiences, it’s time to answer: “Are leasehold properties a good investment?” The answer, unfortunately, isn’t a simple yes or no. There are occasions where leasehold properties might provide a higher ROI as compared to other property types, as demonstrated by the Liverpool example mentioned above.

However, the additional charges and potential uncertainty of owning a leasehold might not be palatable for every investor. Therefore, this decision comes down to individual risk tolerance, your portfolio strategy and, importantly, your ability to navigate the intricacies of leasehold properties. Always remember to evaluate each leasehold property using our tools.

Final Thoughts

As we wrap up our discussion, let’s take a moment to revisit the important question we started off with: “Are leasehold properties a good investment?” The answer, as we’ve discovered, largely depends on a variety of factors. These include the terms of the lease, ongoing costs, the local property market, and one’s individual risk tolerance and investment strategy.

I found that the use of handy tools like the buy to let deal analyser and the buy to let ROI calculator, as well as advice from a competent buy to let mortgage broker, can truly help in assessing a property’s profitability. And while leaseholds can bring their own set of challenges, they also present unique opportunities for high returns in specific situations.

Armed with this knowledge, I hope that you can now better navigate the domain of leasehold properties. Remember, the journey of property investing is not a sprint but a marathon. It requires thorough research, patience and, of course, the willingness to learn from both success and mistakes.

Victor Sterling

Hi, my name’s Victor - I’ve been investing in property for three years now, with my preferred strategies being buy-to-let, BRR and house flips. My goal with Amateur Landlord is simple - to provide beginners with easy-to-follow resources that simply weren’t around when I started, and to offer these for free and without ads.