Buy to Let Mortgage Broker Chester

Begin your property investment journey in Chester the right way by using our buy-to-let mortgage broker. This service is your key to uncovering the best mortgage rates, which could save you thousands over time.

All it takes is 3 minutes to fill out our easy questionnaire. This quick step will open the door to a variety of buy-to-let mortgage options, each customised to align with your specific property investment objectives.

What Does a Buy-to-Let Mortgage Broker Do?

A mortgage broker acts as a navigational compass in the vast sea of mortgage options, guiding you towards the best buy-to-let mortgages. They play a crucial role in reducing costs, simplifying paperwork, and saving you a significant amount of time. In essence, a buy-to-let mortgage broker is instrumental in helping you find the most competitive interest rates and the products that best fit your property investment strategy.

Using Our BTL Mortgage Broker offers several advantages:

1. Access to a Wealth of Options

Our brokerage tool is your portal to the best products in the market. With a network that includes 45 lenders, we provide you with VIP access to exceptional mortgage options.

2. Deals That Benefit You

The focus here is on securing great deals. Lendlord, our partner, excels at obtaining competitive interest rates and attractive mortgage terms. This is not just about cost savings; it’s about enhancing the profitability of your buy-to-let investment.

3. Customisation to Your Needs

We understand that your investment journey is distinct. That’s why we tailor the mortgage to fit your specific needs and situation perfectly.

4. Efficient and Hassle-Free Process

Gone are the days of lengthy forms and long waits. Lendlord has revolutionised the application process, making it quick and effortless. Just fill in a form, complete a short questionnaire, and you’ll receive a list of options curated for you.

5. Stress-Free Experience

We know your time is valuable and better spent on bigger investment decisions. Our process is designed to be seamless and straightforward, eliminating unnecessary hassles and giving you more time to concentrate on your property investment’s broader aspects.

Why invest in Chester?

Growth Past 5 Years

+27.89%

Rental Yield

5.9%

Popular areas for investment

Blacon, Upton, and Hoole

Average Price

£327,629

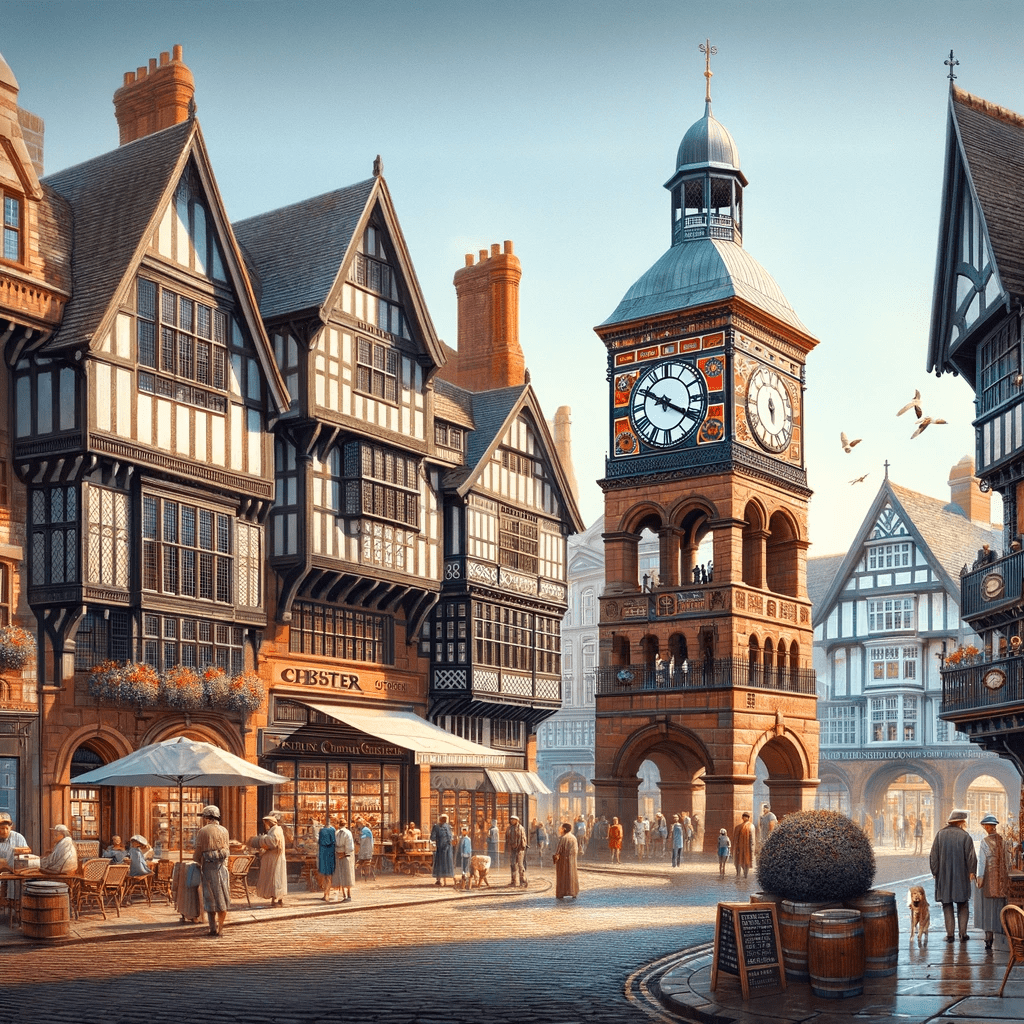

Chester, renowned for its rich Roman heritage and charming mediaeval architecture, offers a unique buy-to-let investment opportunity. The city’s vibrant economy is bolstered by sectors like tourism, retail, and financial services.

Chester’s property prices, while reflecting its desirability, offer value for investors, particularly in comparison to larger metropolitan areas. The city attracts a diverse range of residents and visitors, from tourists drawn to historical sites like the Chester Roman Walls and Chester Cathedral to students attending the University of Chester.

Residential areas such as Hoole and Boughton are popular for their character and proximity to the city centre, making them prime locations for investment. Chester’s high quality of life, marked by excellent shopping, dining, and cultural events, along with its green spaces and riverfront, adds to its residential appeal.

The city’s strong transport links, including its railway station and access to major road networks, make it convenient for commuters. With its blend of historical allure, economic stability, and strategic location, Chester stands out as a promising location for property investors looking for a balance of rental income and capital appreciation.

Finding the Best Buy to Let Mortgages in Chester

To successfully navigate the complex world of mortgages, having an expert by your side is crucial. Our brokerage service is designed to simplify this journey for you. Here’s the process:

1. Starting with the Basics

Begin by filling in the questionnaire form above. This is your chance to provide essential details about your property investment goals and the specific property you’re considering.

2. Tailoring to Your Needs

After you submit the questionnaire, our sophisticated system gets to work. It carefully evaluates your responses to match you with mortgage products that align with your unique investment scenario. The focus here is on personalisation, ensuring that the options you receive are the perfect fit for your needs.

3. Compare and Contrast

Now, the exciting part begins – examining your options. Look at factors like interest rates, loan terms, and repayment structures. This step is vital for choosing a mortgage that not only meets your requirements but also supports your long-term investment strategy.

4. Soft Application

When you’ve identified the right mortgage for your goals, it’s time to take action. Submit a ‘soft application’, which allows you to proceed without affecting your credit score.

5. Personalised Final Touch

Once your application is submitted, the lender will take over. They will contact you to discuss the finer details of your application, ensuring everything is tailored to your situation.

Access Marketing Leading Rates

Choosing a Buy to Let Mortgage Broker in Chester can greatly enhance the efficiency and profitability of your mortgage process.

We handle the heavy lifting – sifting through mortgage options, identifying the best deals, steering clear of pitfalls, and ultimately saving you time, money, and stress.

As an investor, this frees you up to concentrate on what matters most: acquiring profitable properties and building a successful portfolio.

Areas we serve: