- Leasehold properties grant the right to live in the property for a fixed term but not ownership of the land. Renting out such a property is dependent on the lease agreement.

- Renting a leasehold can be profitable, but it’s essential to factor in costs like ground rent and service charges. Tools like the Buy to Let ROI calculator can assist in financial calculations.

- The value of leasehold properties is affected by the remaining lease term. It’s advisable to be cautious with properties nearing 85 years on their lease.

I’m sure you’ve asked yourself, can you rent out a leasehold property? You’re not alone. There’s a lot of misunderstanding surrounding leasehold properties among landlords looking to generate income from property rental.

In this article, we’ll deliver the lowdown on this topic, clear up some of the confusion, and give you the information you need to decide if this is the right move for you.

What is a Leasehold Property?

So, what exactly is a leasehold property? Simply put, when you buy a leasehold property, you’re buying the right to live in a property for a fixed term, but not the land it sits on. This is a common arrangement for flats and apartments, but it can also apply to houses. The land is owned by the freeholder or ‘landlord’ and you will have to pay annual ‘ground rent’. It’s a unique kind of property ownership with its own set of rules and specifics.

Renting Out Your Leasehold Property

It’s essential to understand that, as a leaseholder, your freedom to do what you want with the property can be restricted. You have the right to occupy and use the property. But can you rent out a leasehold property? Well, it depends on your lease. Some lease agreements expressly forbid subletting, while others require permission from the freeholder. Prior to planning to rent out your leasehold property, I highly recommend getting familiar with the specific terms of your lease.

Financial Considerations when Renting a Leasehold Property

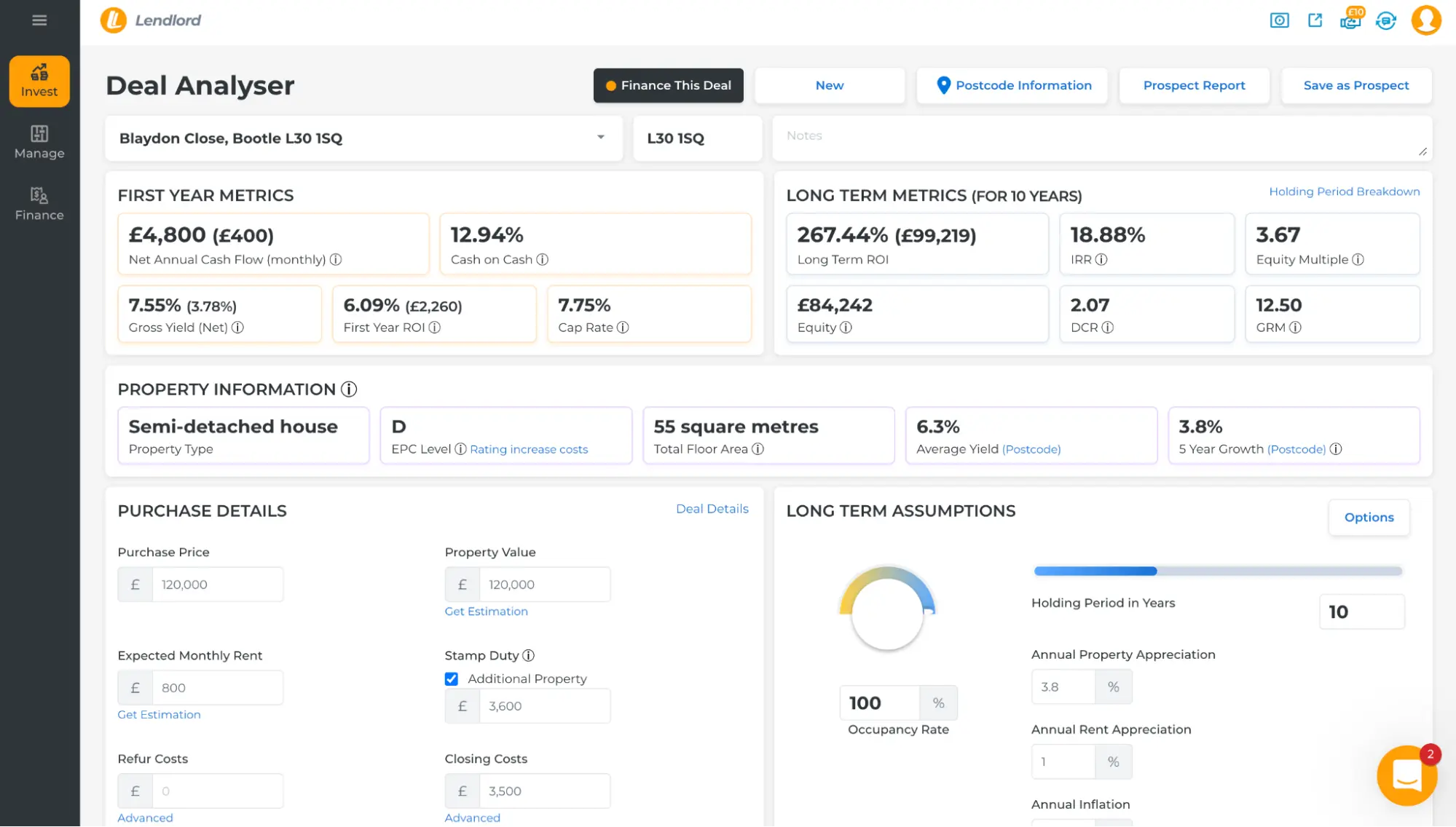

If your lease agreement allows subletting, renting out your leasehold property can be a great way to generate an income stream. But, it’s crucial to do the numbers here. Your ground rent and service charge need to be factored into your calculations, to ensure that the rent you’re charging will cover these costs and still bring you a profit. To help with this, you can use our Buy to Let ROI calculator.

Remember, every leasehold is unique and it’s essential to take the particular details of your agreement into account. Size up your potential ROI, understanding that market fluctuations can impact rental yields.

Leasehold Property as A Buy-to-let Investment

At this stage, you might be wondering about the potential of a leasehold property as a buy-to-let investment. Well, this can be both advantageous and challenging. On the bright side, leasehold properties, particularly flats and apartments in prime locations, can fetch high rental yields. For example, a two-bed apartment in Liverpool city centre can fetch a rental yield of 9.5%.

The downside? The fact that leasehold properties come with expiration dates. The length of the remaining lease can significantly affect your property’s value and mortgage options. Therefore, it’s essential to balance your potential rental income against the remaining lease term. To help you out, we have a great tool: the buy to let deal analyser.

As a general rule of thumb, approach leases shorter than 100 years with great caution and completely avoid ones with less than 85 years left. The property will begin to decrease in value at this point as potential buyers will take into account the cost of renewing the lease.

The Key to Successful Investments

Best Financing Options for Leasehold Rental Properties

In my early years as a property owner, I found bridging finance incredibly useful when I spotted a great deal and had to move quickly.

In a nutshell, bridging finance is a short-term loan, usually with a high-interest rate, that can be used to ‘bridge’ the gap between buying the property and securing a more regular form of financing. It’s particularly useful when you’ve found a good deal and don’t have the cash on hand to snap it up right away. If you want to know more about the ins and outs of bridging finance, check out Bridging Finance on our site.

However, bridging finance is not a one-size-fits-all solution, and it’s not the only one out there. Depending on your situation, a professional mortgage broker may be able to help you source a buy to let mortgage specifically tailored to leasehold properties.

The importance of having an experienced Buy to Let Mortgage Broker by your side can’t be overstated. They have the experience, connections, and, most importantly, the know-how to guide you to the best resources in the market.

Is it Worth Renting Out a Leasehold Property?

After examining the ins and outs of leasehold properties, are they worth renting out? Well, it mostly boils down to the specifics of your lease and the potential profitability of your property. As always in property investment, a detailed and diligent analysis is key to success.

While leasehold properties can be a sound investment, generating robust rental yields in urban areas, they come with their specific set of challenges – from negotiating with freeholders to considering the lease term in your financial calculations.

So, while it’s certainly not impossible, whether you decide to rent out a leasehold property is a decision that requires careful inspection and analysis. Clearly understanding your lease, the potential rental market, and nailing down your financials – all of these are key to making a solid decision.

Final Thoughts

When considering leasehold properties for rental, several pivotal points come to the fore:

- Know Your Lease: Always be clear about your lease’s terms. Restrictions or conditions on subletting can make or break your rental plans.

- Count the Costs: While leaseholds can be profitable, costs like ground rent and service charges must be factored in. Utilise tools like our Buy to Let ROI calculator for clarity.

- Mind the Lease Term: Shorter leases can impact property value. Approach properties nearing the 85-year mark with caution.

- Tap into Expertise: Consulting a seasoned Buy to Let Mortgage Broker can provide invaluable insights on financing options tailored to leasehold properties.

In a nutshell, leasehold properties offer unique opportunities but come with their complexities. With thorough research, informed financial decisions, and the right guidance, they can be a viable investment avenue. Remember, in property investment, the focus should be on capital appreciation and selecting prime locations.

Victor Sterling

Hi, my name’s Victor - I’ve been investing in property for three years now, with my preferred strategies being buy-to-let, BRR and house flips. My goal with Amateur Landlord is simple - to provide beginners with easy-to-follow resources that simply weren’t around when I started, and to offer these for free and without ads.