Quick Navigation

- Property due diligence involves thorough research to assess a property’s potential for profitability and value appreciation.

- To conduct due diligence, you can use our tools to determine the property’s actual worth, estimate renovation costs, calculate your investment requirements, assess potential rental income, and consider monthly operating costs.

- The article provides a detailed example of property due diligence for a 3-bedroom terraced property in Liverpool.

Think of property due diligence as your secret weapon for making smart investment decisions and avoiding potential pitfalls. So whether you’re eyeing that charming fixer-upper or considering a rental property, this guide will equip you with the knowledge and tools to thoroughly research and analyse your potential investments.

In this article, we’ll break down what property due diligence is all about, why it’s crucial for your success, and most importantly, how you can conduct it like a pro.

What Is Property Due Diligence?

Property due diligence is a vital step in the investment process, where you thoroughly research a specific property and its surrounding area to assess its potential as a profitable investment. It involves gathering as much information as possible about the property, focusing on its potential for value appreciation and generating monthly cash flow.

When it comes to investing in property, conducting due diligence is absolutely crucial. We’re talking about a significant investment here, so it’s essential to feel confident and well-informed about your decision. By dedicating time and effort to conducting thorough due diligence, you can gain the necessary insights to evaluate the property’s viability and make informed investment choices.

Remember, knowledge is power when it comes to property investment. So buckle up, as we walk you through analysing a property investment.

How To Do Due Diligence On A Property?

Conducting property research, isn’t as hard as you may think. Especially if you have a checklist and the correct property investment analysis tools to help you to do it quickly. Luckily for you, I’m about to provide you with both so let’s jump straight into how to do property due diligence step by step:

1. How Much Is The Property Worth?

Most people assume that the asking price is what the property is actually worth but that’s not always true – sellers will try to be cheeky and list their properties for a premium. In fact, properties are on average listed for a premium of 6%. Thankfully, working out the actual value of a property is fairly simple – we can either manually find comparable properties to see how much they are worth or we could use a tool called Lendlord to do all the hard work for us.

Lendlord is a free tool that offers a variety of different analysers and calculators; for our purpose, we’re going over to the Rental Deal Analyser and clicking on ‘Get Estimation’ button – it’s just below the box labelled property value. Enter all of the property’s details including the interior quality and press ‘Estimate’. This will give you a very good estimate of what the property is worth.

2. How Much Work Does The Property Require?

If you’re looking at a turnkey property, not much work will be required. You might just want to give the place a slight touch-up by painting the walls and giving it a deep clean. If it’s a buy refurbish refinance property thought, you will need to estimate the costs of the refurbishment – I recommend reading our guides on BRR to learn how to do this. The figures I provided there can be used to estimate your refurbishment cost.

3. How Much Would You Need To Invest?

Now that you know how much the property is worth and how much work it will require (including the refurbishment cost if there is one), you can begin to run the numbers. To start off, let’s calculate how much money you would need to put into this deal:

- How much deposit do you need? Usually 25% for a buy-to-let property.

- How much will the stamp duty be? Use this calculator.

- What will the refurbishment cost?

- What closing costs are involved? This includes the cost of a solicitor, mortgage costs, surveys and brokers. View our full breakdown of the costs involved in purchasing a property.

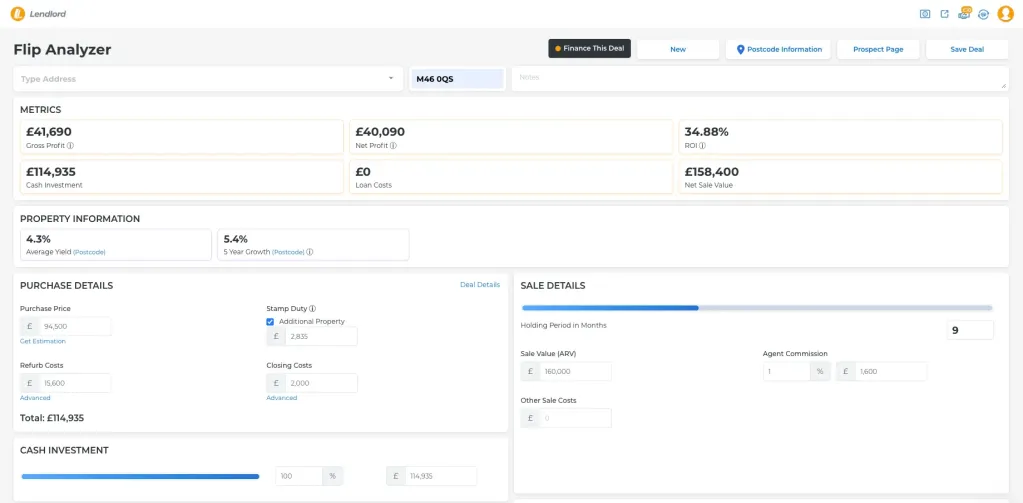

After you’ve worked all of that out, pop all of the information into Lendlord’s deal analyser (pictured above).

The Key to Successful Investments

4. What Would The Rental Income Be?

The next step would be to work out the potential rental income for that property. This is another simple task – search for rental properties in the same postcode on Rightmove or Zoopla, if nothing comes up, try widening your search area to ¼ miles and ½ miles if there’s still nothing there. Remember to include properties that are ‘let agreed’ – you can check this box in the filters tab. Now just find a comparable property, one which is ideally the same as your property (or what your property will look like after you’re done with it) – it has the same amount of rooms, has or doesn’t have a garden and driveway, same interior finish and similar square footage.

Once you find one, see how much they are charging, your property will likely rent out for the same amount. Pop this amount into the deal analyser too.

5. Monthly Operating Costs

Unfortunately, we will have monthly expenses associated with the property – mortgage payments, insurance and a managing agent fee if you choose to have your property managed. Be sure to take these costs into account. For the most part, landlord insurance will be £25 per month and a managing agents fee is 10% (plus VAT) of your monthly rent. To work out your mortgage payments, use this calculator. Then, enter all of this into the deal analyser.

6. Calculate Your ROI

Since we’ve been entering all of this information into Lendlord’s deal analyser, we should now have the ROI in front of us. This figure will give you a good idea of whether the property you’re looking at is a good investment or not. Whether the ROI is good or not comes down to your criteria. Personally, I would only consider investment properties which give me an ROI of at least 7%.

Property Due Diligence Example

Let’s work through a property due diligence example to really wrap our heads around it. Below we’ll look at a 3-bed terraced property in Liverpool that I recently had my eyes on.

How Much Is it Worth?

There weren’t too many comparables to work with for this example (I guess people aren’t selling their houses here – a good sign surely). However, I was able to find one property from Oct 2022 that was in a similar condition. It sold for £103,000.

Jumping over to Lendlord and running a postcode analysis (Here is how to find the full address of any property), I can see that in 2023 the prices in that postcode have risen by 6.2% to date. Since the comparable was sold towards the end of 2022, I can simply increase it’s price by 6.2% to arrive at a likely market value for this property – £109,386.

How Much Work Does It Require?

This house is in average condition (some parts are actually nice but others are quite unmodernised). The bathroom looks fairly new and could just use a few minor touches but everything else needs to be ripped out and replaced. If I were to do this refurbishment myself I could probably get away with spending around £7,000. However, if you’re not handy with tools or you’re just not bothered to do it yourself, hiring tradespeople would almost double this to around the £12-14k mark.

How Much Would I Need to Invest?

Deposit (25%) = £27,500

Stamp Duty = £3,300

Buying Costs = £3,000

Refurbishment = £12,000

Total Investment Necessary = £45,800

This may seem like a lot but it’s key to remember that this will likely be a BRR project where we would refinance at the end and get a good chunk of that money out of the deal. In this case, a likely end value with be around £137,000. So, after the refinance, we would have £32,300 left in this deal if we bought at market value.

How Much Rent Could I Charge?

This postcode is quite popular with landlords so it was easy to find properties to let. A similar 3 bed house in great condition on the street was recently let out for £825. It’s fair to assume that we could fetch the same amount.

Monthly Operating Costs

Assuming that our interest only mortgage rate would be around 5% and that we opted to self-manage the property, this is how our monthly costs would look:

Mortgage Repayments = £450

Insurance = £30

10% set aside for maintenance = £80

Total Monthly Profit = £315

Calculating the ROI

Multiplying the above figure by 12 gives us an annual rental profit of £3,780. After the refinance, this would give us a rental ROI of 11.7%. Considering the current interest rates, that’s amazing!

It gets better – the average capital growth for this postcode is 4.4% which translates to a 17.6% return for us (because we’ve leveraged with a mortgage). Bringing our total expected ROI to 29.3%.

Final Thoughts

Property due diligence is a fundamental process that may seem daunting at first, but with practice, it becomes second nature. To get the hang of it, I highly recommend honing your skills by randomly selecting a few properties on popular platforms like Rightmove or Zoopla and analysing them. Remember, it’s not just about the property itself; the location plays a crucial role too. So, be sure to conduct thorough research on the area as well.

Now, if you’ve stumbled upon this guide and find yourself unsure about which property investment strategy to pursue, fear not! We’ve got you covered. Take a look at our comprehensive guide on the best property investment strategies. In that guide, we delve into each strategy, comparing their pros and cons. It’s a fantastic resource to help you make an informed decision.

If you already have a solid grasp of these strategies and aspire to become an expert in the field, we’ve got advanced sections dedicated to each property investing strategy. We believe in empowering you with the knowledge and insights needed to excel in your investment journey.

Victor Sterling

Hi, my name’s Victor - I’ve been investing in property for three years now, with my preferred strategies being buy-to-let, BRR and house flips. My goal with Amateur Landlord is simple - to provide beginners with easy-to-follow resources that simply weren’t around when I started, and to offer these for free and without ads.